Prices

July 25, 2024

HR futures: Shifting risk profiles, emerging opportunities

Written by John Medich

Summer is here, and a familiar sentiment has hit the hot-rolled coil (HRC) futures market. Prices continue to decline in both the spot market and the futures market, with expectations of sub-$800 prices for the remainder of the year.

While market sentiment may cast a wave of “doom and gloom,” some notable changing dynamics will likely shape the market for the rest of the year. Instead of focusing on predictive questions like “What price are we going to?” or “When will the market turn around?”, we take a different approach. We focus on probabilistic distributions and how different key factors shift where the market is skewed, both up and down.

Below, we focus on how supply, demand, and market factors that have skewed futures markets in recent months, as well as how risks are skewed for the remainder of the year.

Supply: waning downside risks and market stabilization

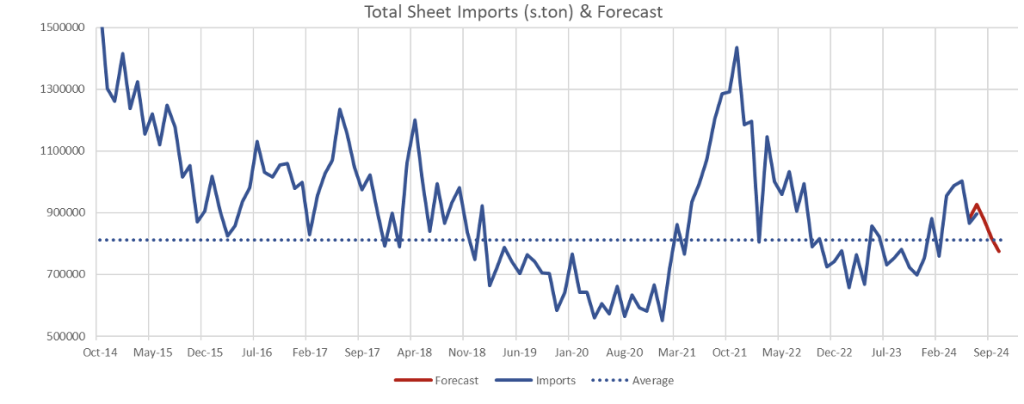

During the first half of the year, we observed steady increases in imported materials, with May seeing the highest levels since June 2022. This rise was driven by significant margins between the US and global markets, leading to two major effects. First, mills lost domestic demand to cheaper foreign alternatives. Second, as more material entered the market, an already high inventory situation was exacerbated, resulting in an oversupply issue. These supply factors have aggressively skewed the risk to the downside thus far in 2024.

However, the problem may indeed present the solution. OEMs with abundant inventory are less likely to order foreign material with significant lead times as we head into August. Additionally, global price differentials are no longer competitive for marginal buyers. Consequently, we forecast a significant decline in imported sheet material over the next several months. Historically, the market reacts to the expectation of reduced foreign material with increased prices well before the material arrives. The anticipated shortfall in imports from September onward introduces a significant upside risk for fourth-quarter HRC futures.

Demand: Historical trends and the skewed risk profile for Q4

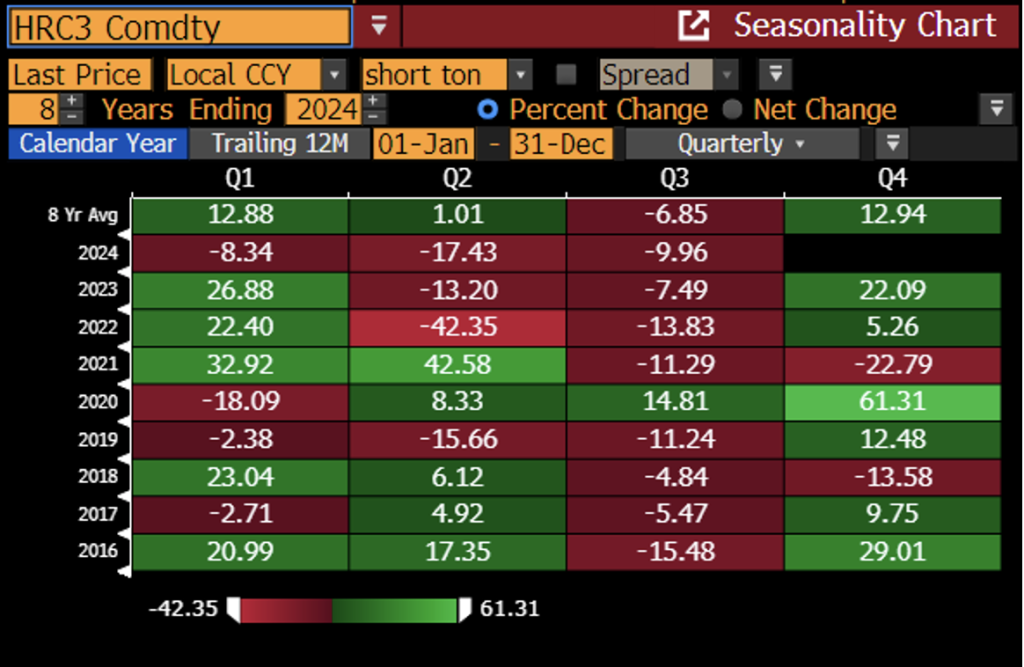

While cycles in HRC have become more volatile in recent years, historical trends can still provide insights into future risk. HRC futures have declined during the third quarter in seven of the past eight years and are on track for another down year in 2024. This downturn is largely due to the typical summer slowdown in manufacturing, which results in built-up inventories, as well as a regular slowdown in housing and construction activity. Recent data has disappointed to the downside here.

However, the probabilistic risks shift significantly for the fourth quarter. Historically, futures performed the strongest in the fourth quarter, rallying by an average of 12.94%. The market has only declined in the fourth quarter in 2021 and 2018. In those years, the market experienced downturns following significant rallies that peaked at over $920 in June 2018 and over $1,850 in August 2021. With September futures trading at $678 today, the current market conditions feel notably different from those previous outliers.

This historical performance, combined with current market conditions, underscores a significantly skewed risk to the upside in the fourth quarter. The current setup suggests a higher likelihood of a turnaround rally, contrasting with the downside risks observed in the third quarter.

Ferrous markets: Moving from overbought HRC to converging spreads

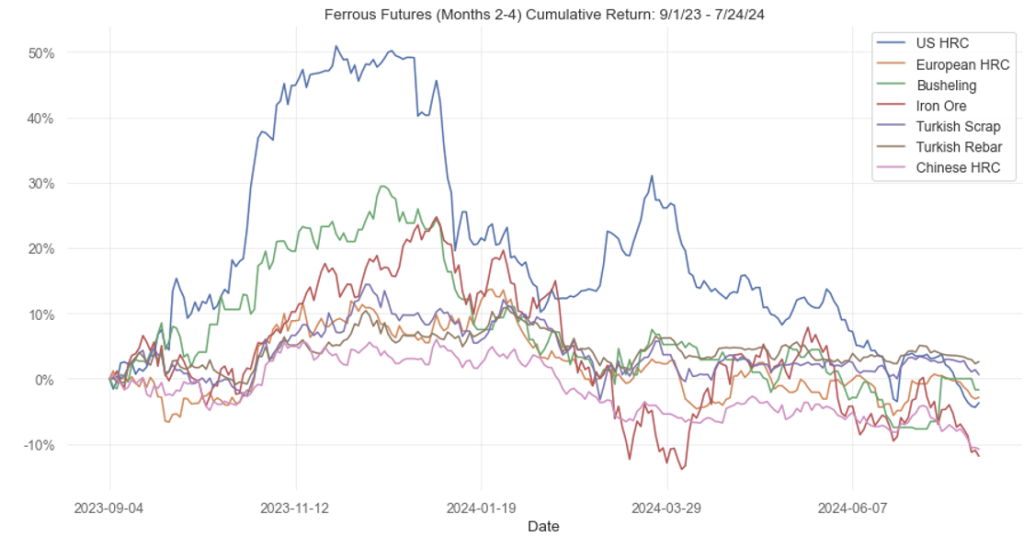

Last year, HRC futures outperformed all other products in the ferrous complex, surging by over 50% from September through December. However, earlier this year, HRC futures experienced a sharp rally that did not extend to the rest of the complex, creating a significant “overbought” condition. This situation left substantial room for prices to decline as speculators sought the “best sale” in a falling market.

The current market dynamics reflect a skewed risk profile. Amidst relatively low-cost materials, both BOF and EAF mills have enjoyed robust profit margins, leading to a natural tendency to sell HRC futures relative to other ferrous products. This created negative pressures on the HRC market, paired with the healthy profit margins enjoyed by domestic mills. These factors contributed to the bearish trading activity that has persisted for several months.

Yet, these dynamics are now unwinding. The HRC curve has fallen back to the rest of the ferrous complex, with spreads over scrap and European HRC futures at some of their tightest levels in years. This trend is consistent with activity in the physical market, where BOF and EAF mills are experiencing tight profit margins for the first time in 2024. This changing dynamic can be seen as either a negative signal for raw materials or a positive one for finished steel. Regardless, the downward pressures from the overall ferrous markets have come to an end.

The shifting risk profiles in HRC futures signal an exciting transition. With stabilizing supply dynamics and potential for a fourth-quarter rally, the market is poised for renewed opportunities. The easing of bearish pressures and tightening spreads suggest that downside risks are moderating, setting the stage for a pivotal few months ahead.

Disclaimer: The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Flack Global Metals or Flack Capital Markets should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.