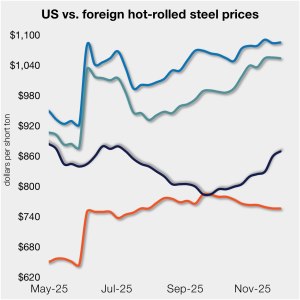

Spread between US HR prices and imports narrows

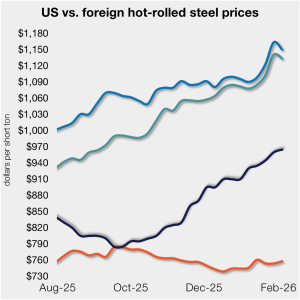

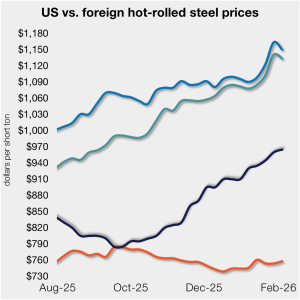

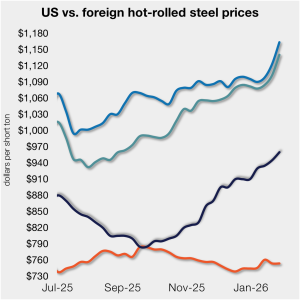

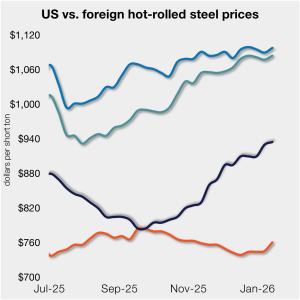

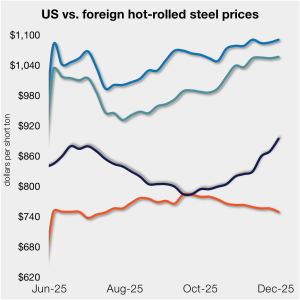

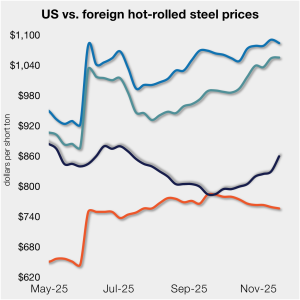

The price gap between US hot-rolled coil and landed offshore product narrowed this week, as price movements stateside and abroad diverged.

The price gap between US hot-rolled coil and landed offshore product narrowed this week, as price movements stateside and abroad diverged.

November apparent steel supply declined 9% or 772,000 short tons (st) from October to 7.61 million st, the lowest measure recorded since February 2021

US rebar and wire rod prices rose month on month (m/m) alongside continued scrap increases, while merchant bar and structurals were unchanged.

Steel imports remain weak in November and December according to recently released final US Commerce Department data. Many of the sheet and plate products we follow slipped to multi-year lows.

The US Department of Commerce has found that certain steel pipe rolled in Oman using Chinese hot-rolled coil is illegally circumventing anti-dumping and countervailing duties (AD/CVDs).

A coalition of US steel industry CEOs has formally urged President Trump to maintain—and fully enforce—current Section 232 tariffs on steel and steel‑containing goods.

The price gap between US hot-rolled coil and landed offshore product inched higher, even as prices stateside and abroad mostly moved in tandem vs. last week.

Lower finished steel imports continued to support US domestic prices this month. HR coil prices are up more than $40 per metric ton (mt) month-on-month (m/m) due to higher seasonal demand in January and tightening domestic supply.

The plate market’s swell of optimistic sentiment marking the start of 2026 dissipated this week.

The price gap between US hot-rolled coil (HR) and landed offshore product has been relatively flat to begin the year.

US steel imports have fallen sharply under the new 50% Section 232 tariff regime. Jerry Richardson, general director of CSN LLC, discussed on an SMU Community Chat this week how the market is now structurally tighter and more volatile than at any point in the past decade.

The amount of finished steel that entered the US market contracted from September to October, driven primarily by slowing domestic mill shipments, according to SMU’s analysis of Department of Commerce and American Iron and Steel Institute (AISI) data

SMU's steel market chatter this week.

According to recently released final US Commerce Department data, US steel imports rebounded 11% month on month (m/m) in October 2025 after falling to a multi-year low one month earlier. The latest license figures suggest imports eased back by 3% in November and by another 2% in December, with trade again nearing historical lows.

Steel plate market participants think increasing spot prices and growing order volumes could stick around. That’s two encouraging signs for the year ahead, they said. Oregon Steel Mills, SSAB, and Nucor all increased base prices for plate products by $40 per short ton (st) in the final weeks of December. SMU data also indicates that mills […]

The US Department of Commerce has officially published the anti-dumping and countervailing duty orders on corrosion-resistant steel sheet imports, the final step in the trade case originally filed more than a year ago. At the same time, Commerce also revealed it is allowing some CORE imports into the country without paying the AD or CVDs.

Editor’s note This is an opinion column. The views in this article are those of an experienced trade attorney on issues of relevance to the steel market. They do not necessarily reflect those of SMU. We welcome you to share your thoughts as well at smu@crugroup.com. As we close out 2025, my best wishes to all […]

The price gap between stateside hot band and landed offshore product continues to narrow, inching closer toward parity. The premium is now, on average, at its lowest level since July.

Apparent steel supply rose to 8.64 million short tons in September, driven primarily by higher domestic mill shipments despite a sharp drop in finished imports.

In our opinion, it is striking that for all the bold talk about establishing a "common external tariff" — or "Fortress North America" — the solutions being proposed fail to live up to their promises. As we have commented recently, USMCA certainly needs a rethink. But we have serious concerns about Canadian and Mexican proposals that suggest common trade policies that are, as we see it, more illusory than effective.

According to recently finalized US Commerce Department data, US steel imports tumbled to a near five-year low in September

The price gap between stateside hot band and landed offshore product continues to narrow toward parity, now at its lowest level in five months.

We can be grateful for some things. One is the regional agreement between the US, Canada, and Mexico that is currently undergoing review. A decision is expected by July 2026 on whether to extend the agreement, which is set to expire in 2036, for another 16 years (to 2052). Three days of hearings just concluded with comments of five minutes’ duration from more than 50 witnesses.

Earlier this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to tariffs, imports, and evolving market events.

The price gap between stateside hot band and landed offshore product has inched closer to parity, now at its lowest level since the summer.

The price gap between stateside hot band and landed offshore product tightened further this week, as the average price for domestic hot-rolled was $10/st higher w/w.

US steel imports declined considerably in September and October, with trade falling to reduced levels not seen in nearly five years.

The price gap between stateside hot band and landed offshore product shrank week over week (w/w).

Sheet prices are in the middle of one of their most sustained rallies since the first quarter, and this time in the absence of any tariff or trade policy shocks.

The whole world waits for the Supreme Court to rule on the validity of President Trump’s International Emergency Economic Powers Act (IEEPA) tariffs. Meanwhile, the ground is shifting. Just this past week, the president changed the direction of tariff policy. He belatedly concluded that taxes on imports of products that we don’t make in the United States are inflationary