CRU: US, Mexico longs prices continue to rise while Brazil demand lags

US rebar and wire rod prices rose month on month (m/m) alongside continued scrap increases, while merchant bar and structurals were unchanged.

US rebar and wire rod prices rose month on month (m/m) alongside continued scrap increases, while merchant bar and structurals were unchanged.

Sheet market participants said conditions this week were more stable than in past weeks, but they remain cautiously optimistic overall.

U.S. Steel plans to restart Battery #13 at its Clairton Coke Works on Feb. 5. Battery #13 was one of the batteries hot idled since a lethal explosion at Clairton on Aug. 11, 2025.

Flat-rolled steel prices inched upward again this week as mixed demand appeared to be offset by limited supplies.

This news item was first published by CRU. To learn about CRU’s global commodities research and analysis services, visit www.crugroup.com. Canada’s Algoma Steel signed a binding Memorandum of Understanding (MoU) with Hanwha Ocean to support Canada’s submarine program and Algoma’s diversification strategy. A new structural steel beam mill may result. Financial support, subject to conditions being […]

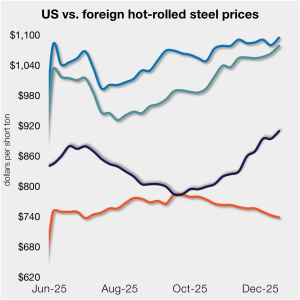

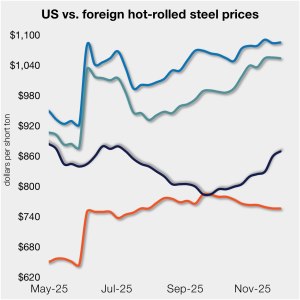

At SMU, we ask the big questions: To be or not to be? Hot band at a grand? On the one hand, whether hot-rolled coil price can or can’t go above $1,000 per short (st) is a silly argument. It’s just a number. On the other hand, round numbers are something that we tend to fixate on. They can be psychologically important to a market – even if they shouldn’t be.

Alton Steel Inc. (ASI), a special bar quality (SBQ) steel producer, said it will close operations later this week.

A report on the sheet market this week.

Metallus and the United Steelworkers (USW) have agreed to another tentative four-year contract, the specialty metal producer announced.

Cleveland-Cliffs' shuttered tin mill in Weirton, W.Va., caught fire on Saturday as a crew worked to recover scrap metal ahead of the plant's demolition, according to a local news reports.

The Bureau of Land Management (BLM) has provided Warrior Met Coal official permits for expanding its Tuscaloosa, Ala.-based mining projects.

Though they’re hopeful, domestic sheet market sources didn’t share a bullish outlook on the market this week.

SMU’s January ferrous scrap market survey results are now available on our website to all premium members.

This CRU Insight provides details on the decline of Venezuela’s steel, DRI, and iron ore industries, which highlights the potential scope of recovery with the right policy agenda and support.

The Current SMU Steel Buyers’ Sentiment Index has rebounded from our previous market check in December. However, Future Buyers’ Sentiment has edged down, according to our latest survey data.

The number of oil and gas rigs operating in the US fell this week, while Canadian activity surged, according to the latest data released from Baker Hughes.

Sources in the domestic hot-rolled sheet market say they are standing by for an uptick in customer demand. These service center market participants, located in various regions of the US, expect to handle an influx of customer orders this month.

The state of Louisiana has purchased 1,700 acres along the Mississippi River from Germania Plantation Inc. for $91 million for Hyundai Steel's proposed EAF operation.

Steel sheet and plate prices rose across the board to start the year on limited spot availability at some mills, expectations of higher scrap prices, and hopes of stronger demand in 2026.

Kloeckner Metals Corp. announced that beginning Jan. 1, 2026, the former Bauer Built Manufacturing site in Paton, Iowa, would lead all its commercial, manufacturing, and other operational activities.

Majestic Steel USA announced that Chad Broyles will now be the Executive Vice President for its business operations unit. The Cleveland-headquartered flat-rolled steel distributor and processor expects Broyles to help Majestic align its commercial and operational priorities. As EVP, Broyles will oversee service center operations, according to the company’s Jan. 5 statement. Todd Leebow, president and CEO of Majestic Steel USA, noted that since joining Majestic in 2025 Broyles’ has been a valuable contributor to its […]

Demand for heavy steel plate used in offshore wind farms faces renewed uncertainty after President Trump paused leases for five offshore wind projects.

Members of the United Steelworkers (USW) Local 1123 labor union voted against ratifying a second proposed deal with Metallus on Dec. 18.

Nucor Plate Group notified customers it was aiming to increase all plate product prices by $40 per short ton (st).

An SMU Community Chat with Timna Tanners.

The price gap between stateside hot band and landed offshore product continues to narrow, inching closer toward parity. The premium is now, on average, at its lowest level since July.

SMU and AMU are pleased to announce that Wells Fargo Managing Director Timna Tanners will be joining us for a Community Chat webinar on Wednesday, Dec. 17, at 11 am ET.

Metalforming manufacturers were mixed in their outlook, anticipating business conditions could either worsen or, at best, hold in the near-term, according to PMA's November report.

The price gap between stateside hot band and landed offshore product tightened further this week, as the average price for domestic hot-rolled was $10/st higher w/w.

German Economy Minister Katherina Reiche expressed frustration with US levies on steel and aluminum products. The US contends the EU is unfairly targeting its big tech firms.