Analysis

March 21, 2024

HRC futures: Bulls anticipate price increase announcements

Written by Dave Feldstein

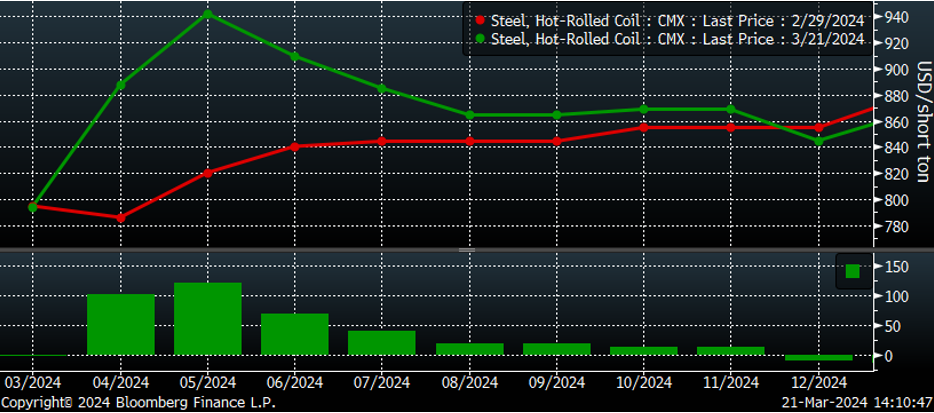

2024 started with a $200 per short ton (st), one-week demon drop in the CME Midwest hot-rolled (HR) coil futures. Then, HR futures consolidated in the low $800s/st with the April future trading to as low as $770/st as the curve shifted into contango or upward sloping.

A big move was expected, and a big move was delivered.

Thus far in March, HR futures have shot back up, with the April future gaining $102/st, settling today at $888/st, while the May future has gained $122/st, settling today at $942/st, as the curve has flipped back to backwardation.

“Where we’re going, we don’t need roads.”

– Doc Brown, “Back to the Future”

CME hot-rolled coil futures curve $/st

The May future has jumped $64/st over the past two days, with the price action indicating strong expectations that another mill price increase announcement is imminent. Moreover, the next price increase will be followed by an additional increase, or increases, considering May is trading at $942/st.

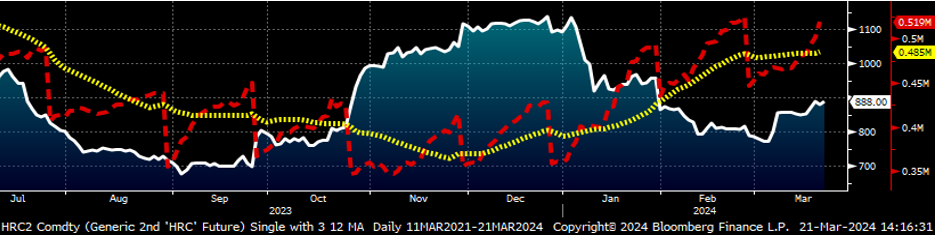

May CME HRC future $/st

Open interest (the number of outstanding futures contracts, or short tons in this case, across the HRC futures curve) climbed to 519,400 st Wednesday night, on track to increase on a m/m basis for the fourth consecutive month.

Rolling 2nd month CME HRC future $/st & open interest (red) (22-day MA ylw)

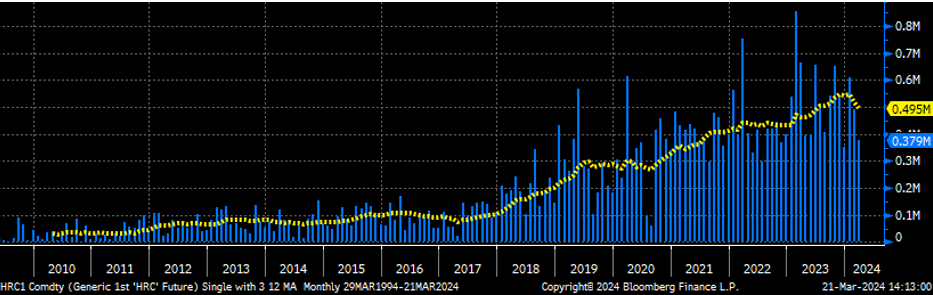

This chart shows monthly trading volume across the Midwest HRC futures curve going back to 2010. The yellow line is a 12-month moving average.

I picked a 12MMA because it made the chart look the best to help me prove my point, but that’s not important.

What is important is the steady growth in trading volume over the years.

Monthly volume CME HRC futures curve with 12MMA

Some might even call this exponential growth, but that is only because they don’t know what exponential growth is. Nonetheless, the good news is that the futures market has plenty of liquidity to get the trades you need done, just as long as you are willing to trade in the front months. There are even options that trade on HRC futures, which have also become relatively more liquid, especially on certain days.

Interestingly, a major force behind the growth in trading volume has arisen from financial players. Proprietary trading shops and hedge funds are flocking to HRC futures with their statistical models, technical analysis, cross-asset spreads, and volatility arbitrage strategies. This is a beautiful thing for commercial players, as they can take advantage of the crazy market moves sometimes driven by this crowd of financial types to better manage an extremely volatile period in flat rolled.

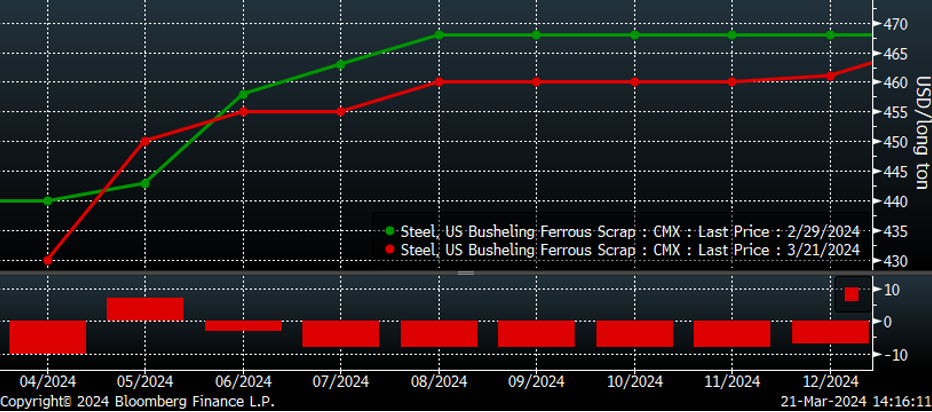

It was two weeks ago that Nucor and Cleveland-Cliffs announced price increases. Last week was tricky as the March busheling future settled down $51.04/long ton (lt) to $437.77/lt; the CRU dropped a surprising $62 w/w to $755/lt; and iron ore took a major beating, falling $15 to end the week at $99.91/metric ton.

The futures market shook that off this week and has been aggressively bidding the HR futures up. However, busheling futures have not yet seen anything resembling the move in the HRC futures.

In fact, busheling futures have declined thus far in March for all months except May. The moves have been rather negligible, but “Where’s the gold, Mikey?” and, for that matter, “Where’s the beef?”

I tell ya, busheling gets no respect.

How does hot rolled rally $100 in March, but busheling doesn’t budge?

CME busheling futures curve $/lt

Disclaimer: The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Mr. Feldstein should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.