US steel exports down to 5-year low in November

November steel exports tumbled 15% from October to the lowest monthly export rate since July 2020.

November steel exports tumbled 15% from October to the lowest monthly export rate since July 2020.

Steel imports remain weak in November and December according to recently released final US Commerce Department data. Many of the sheet and plate products we follow slipped to multi-year lows.

There is no evidence that unofficial talks are taking place to secure tariff reductions on Canadian aluminum or steel. One of the biggest challenges is simply understanding what the US actually wants from Canada.

Tariffs affect different parts of the economy differently. Tariffs on steel imports have contributed to price increases from domestic mills, improving their bottom lines. But orders from customers are slowing down, hurting downstream industries’ profitability and job prospects.

US steel imports have fallen sharply under the new 50% Section 232 tariff regime. Jerry Richardson, general director of CSN LLC, discussed on an SMU Community Chat this week how the market is now structurally tighter and more volatile than at any point in the past decade.

As more contracts are up for negotiation in 2026, labor is poised play a larger role in operational planning at a time when trade issues and high prices also are in play.

The volume of steel shipped outside of the country increased 11% from September to October 2025 to a seven-month high of 662,000 short tons (st), according to recently released data from the US Department of Commerce.

Members of the Congressional Steel Caucus met in Washington on Wednesday to assess the state of the domestic steel industry. Lawmakers and industry leaders discussed the importance of Section 232 tariffs, strong trade enforcement, and continued investment in American steelmaking.

According to recently released final US Commerce Department data, US steel imports rebounded 11% month on month (m/m) in October 2025 after falling to a multi-year low one month earlier. The latest license figures suggest imports eased back by 3% in November and by another 2% in December, with trade again nearing historical lows.

As we move into 2026, it’s time to look forward. While the “Donroe Doctrine,” Venezuela, and Greenland absorb significant press attention, important trade developments will also continue to make headlines this year. The unprecedented changes we saw in 2025 will continue in 2026, particularly in the areas of IEEPA and tariffs, USMCA, and the WTO.

The US Department of Commerce has officially published the anti-dumping and countervailing duty orders on corrosion-resistant steel sheet imports, the final step in the trade case originally filed more than a year ago. At the same time, Commerce also revealed it is allowing some CORE imports into the country without paying the AD or CVDs.

It's that time of year, when we look back at where we've been and forward to what the new year might bring. So, before we look forward to 2026, let’s take a quick look back at 2025.

Editor’s note This is an opinion column. The views in this article are those of an experienced trade attorney on issues of relevance to the steel market. They do not necessarily reflect those of SMU. We welcome you to share your thoughts as well at smu@crugroup.com. As we close out 2025, my best wishes to all […]

AISI's Kevin Dempsey looks back at 2025.

Following August’s modest 4% uptick, the volume of steel shipped outside of the country slipped 8% in September to 594,000 short tons, according to recently released data from the US Department of Commerce.

US Congressmen Mike Kelly (R-Pa.) and Chris Deluzio (D-Pa.) have introduced the Strengthening Trade Enforcement and Evasion Limitations Act (STEEL Act) into the House of Representatives. The bipartisan bill aims to curb unfairly traded imports and strengthen US trade enforcement.

We can be grateful for some things. One is the regional agreement between the US, Canada, and Mexico that is currently undergoing review. A decision is expected by July 2026 on whether to extend the agreement, which is set to expire in 2036, for another 16 years (to 2052). Three days of hearings just concluded with comments of five minutes’ duration from more than 50 witnesses.

The American Iron and Steel Institute’s (AISI's) Kevin Dempsey gave a series of policy proposals ahead of the review of the USMCA trade agreement next year.

Earlier this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to tariffs, imports, and evolving market events.

Economic activity across the US was largely static with some modest activity unfolding at a sluggish pace, according to the US Federal Reserve’s (The Fed) latest Beige Book report.

German Economy Minister Katherina Reiche expressed frustration with US levies on steel and aluminum products. The US contends the EU is unfairly targeting its big tech firms.

Wiley attorneys Alan Price and Ted Brackmeyer argue that significant changes to the USMCA and continued Section 232 tariffs on Canada and Mexico are needed to support American steelmaking.

You may have heard about traders “canceling” metal on the London Metal Exchange and shipping it out. Here's a guide to understand that process.

SMU sits down with Barry Zekelman to talk North American trade and the state of the US and Canadian steel industries.

US steel mills have received a boost from lower import levels because of sweeping tariffs this year. However, demand remained moderate in most sectors, aside from data center construction, after the summer.

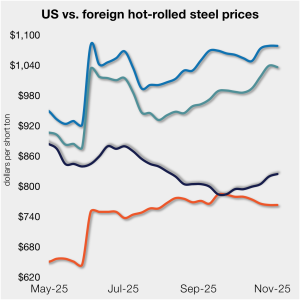

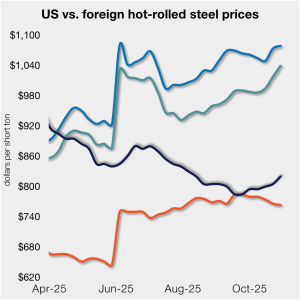

The gap between US hot band prices and imports narrowed slightly. But with the 50% Section 232 tariffs, most imports remain more expensive than domestic material.

Zekelman Industries said Canadians who report the use of foreign steel in active or future public construction projects are eligible for a CAD$1,000.00 (USD$711.62) payment.

US President Donald Trump and Chinese President Xi Jinping on Thursday had a much-anticipated meeting. Is it only a hiatus in the trade war, or did it really change the situation? I suspect the former, I but hope for the latter.

In dollar-per-ton terms, US product is on average $141/st less than landed import prices (inclusive of the 50% tariff). That’s down from $148/st last week.

It was only a matter of time before a shutdown happened. And, no, we aren’t talking about the federal government’s lapse in appropriations. On Oct. 9, Beijing announced a series of restrictions that will effectively shut down exports of rare earth elements, magnets, and certain downstream products vital to advanced manufacturing.