Analysis

January 16, 2024

Final thoughts

Written by Michael Cowden

There seems to be a growing consensus that the US sheet market has peaked at a high level and could begin losing ground from here.

Whether declines happen quickly or whether sheet prices bop around at current levels for a few weeks more is the primary question.

Lead times

Why the change? For starters, some market participants say that steel is readily available, a big change from Q4 when spot supplies were scarce.

Case in point: One major domestic EAF mill released updated lead times today. Two of their facilities are at the week of Feb. 12 for hot-rolled (HR) coil – or just under a month. One facility is the week of Feb. 19 for cold-rolled (CR) coil, or about five weeks.

In other words, it’s no trouble getting HR in February. And while prices at the mill level might be relatively steady, they are already falling on “the street,” according to some of you.

One contributing factor could be late orders, something that helped to keep US sheet prices at high levels in the fourth quarter. Mills are catching up on those late orders, some of which were placed at numbers well below current spot prices, sources said.

Inventories, futures, and imports

The latest SMU service center inventory data, meanwhile, indicates that stocks in December were slightly elevated vs. prior years. They also suggest that a trend of lower inventories stretching back to last summer has ended – with inventories modestly up in both November and December vs. prior years.

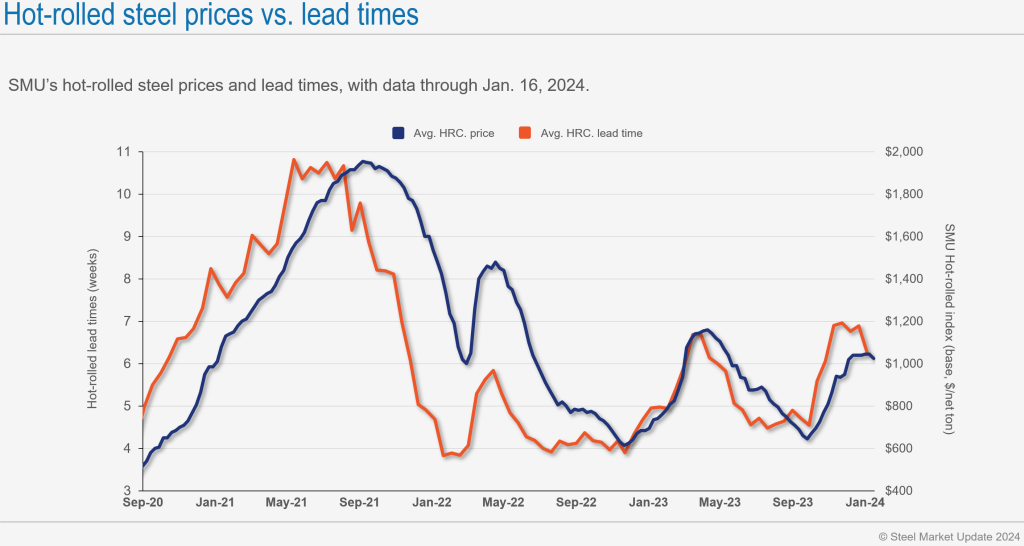

Also, look at the charts below, which compare HR lead times and prices:

HR prices have flattened out, and lead times have moved lower. You can see that’s typically a signal that prices will follow on a lag – and that’s what we started to see this week.

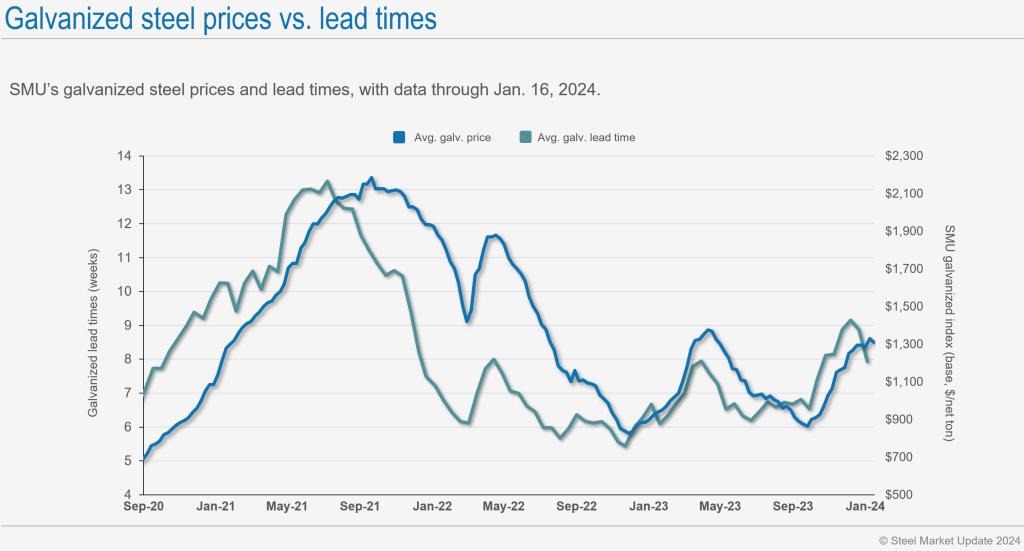

For what it’s worth, we’re seeing that trend not only in HR but, for example, in galvanized products as well:

Futures markets, meanwhile, continue to decline. The CME HRC contract for February was at $924/ton last I checked – down nearly $40 per ton from a prior settle of $963/ton. March was at $847/ton, down $34 per ton. And April was at $830/ton, down $26/ton.

Domestic mills have given no indication that they’ll bring prices that low. For the moment it seems that they’re keeping prices as close to $1,100/ton as they can for smaller buyers. And they’re not putting numbers below $1,000/ton out into the market unless there is a live buyer on the other side.

But I’ve heard import offers for much lower numbers for Q2 delivery to the US. For example, the $800s per ton when it comes to HR, and the $1000s-1100s/ton for cold-rolled. I’ve also heard that there aren’t many takers at those prices.

Why? Shorter domestic mill lead times increase the risk of ordering imports, which have significantly longer lead times. And the concern is that those foreign prices will not be attractive by the time the material arrives in April-May.

That lack of import could set the stage for a rebound in US prices around the same timeframe. But my guess is there might be more buyers than usual on the sidelines in the meantime – unless we see something like a major unplanned outage or a blast furnace being idled.

Red Sea tensions

Lewis Leibowitz wrote about escalating tensions in the Red Sea in our Sunday newsletter. Some of you have told me that delays on the Panama Canal were a bigger problem than you expect the Red Sea to be.

I hope that’s the case. But I’ve also heard from some of you who think the issue might have at least some impact here – especially in certain markets, such as light-gauged galvanized, that are more reliant on offshore production.

There has already been at least some impact: The M/V Gibraltar Eagle, a bulk carrier, was hit by an “unidentifiable projectile” in the Gulf of Aden last week. That story made mainstream news. What perhaps didn’t was this: According to a LinkedIn post by Eagle Bulk Shipping, the ship was carrying “a cargo of steel products.”

I did a channel check, and it seems that category doesn’t necessarily mean it was finished steel. It was perhaps a raw material like scrap, pig iron, or HBI. But even if steel’s direct intersection with this story is limited, could the impact on shipping rates, and the competitiveness of imports, be more lasting? Let me know your thoughts.

SMU Community Chat

Speaking of blast furnaces and global trade, you won’t want to miss the next SMU Community Chat on Jan. 24 at 11 am ET with CRU principal analyst Erik Hedborg, who specializes in all things iron ore.

Hedborg will talk about the structure of the global iron ore market for those in the EAF-dominated US who might not be overly familiar with it. He’ll also discuss recent market trends in both ore and pellets – as well as provide an outlook for 2024.

He’ll take your questions too. The live webinar will be free. You can register here.

Tampa Steel Conference

It was -7F here in Chicago on Tuesday morning, up from -10F on Monday. Add wind chill, and it felt like -35F. All of which to say it is winter in the Midwest.

If you’re looking for a break from the cold – and I know I am – it’s not too late to register for the Tampa Steel Conference. Nearly 450 people already have, putting us on track to break 2007’s record attendance of almost 500.

You can learn more about the event and register here.