Market Data

February 11, 2025

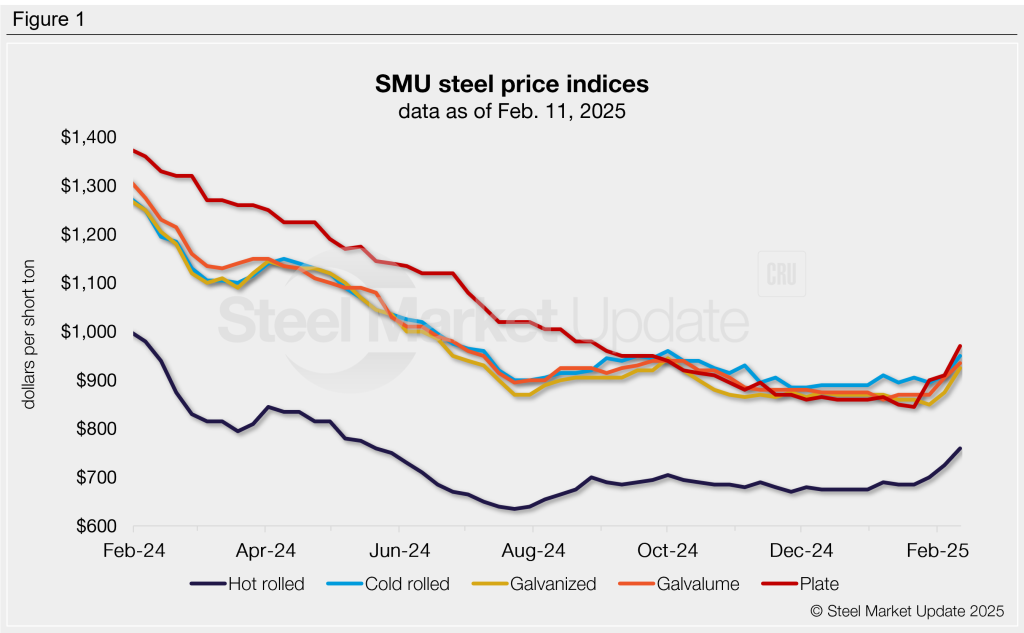

SMU price ranges: Sheet and plate see widespread gains on higher scrap and trade measures

Written by Brett Linton

Each of the steel product prices tracked by SMU saw significant increases this week. All four of our sheet price indices rose by $30-50 per short ton (st) on average. Plate prices popped $60/st compared to the week prior.

Several factors are driving this price surge. They include the revival of Section 232 effective March 12, rising steelmaking raw material costs (including for scrap), and recently announced preliminary countervailing duty (CVD) duties on imports of coated steel products. (Note, too, that prelim anti-dumping margins are just around the corner. They’re due by April 3.)

- Our hot-rolled steel index climbed for the third consecutive week, reaching an eight-month high of $760/st. Hot rolled prices are up $70/st from the start of the year.

- Tandem products all saw gains of $30-50/st week over week (w/w), with our cold-rolled, galvanized, and Galvalume indices all hitting four-month highs this week.

- Plate prices also continued their upward momentum, reaching a near-six-month high this week. Prices have rebounded $125/st in the last three weeks.

SMU’s price momentum indicator remains at higher for all sheet and plate products, indicating we expect prices to increase in the short term.

Refer to Table 1 for the latest SMU steel price indices and how prices have trended in recent weeks.

Hot-rolled coil

The SMU price range is $720-800/st, averaging $760/st FOB mill, east of the Rockies. The lower end of our range is up $30/st w/w, while the top end is up $40/st w/w. Our overall average is up $35/st w/w. Our price momentum indicator for hot-rolled steel remains at higher, meaning we expect prices to increase over the next 30 days.

Hot rolled lead times range from 3-7 weeks, averaging 4.9 weeks as of our Feb. 5 market survey.

Cold-rolled coil

The SMU price range is $900–1,000/st, averaging $950/st FOB mill, east of the Rockies. The lower end of our range is up $30/st w/w, while the top end is up $50/st w/w. Our overall average is up $40/st w/w. Our price momentum indicator for cold-rolled steel remains at higher, meaning we expect prices to increase over the next 30 days.

Cold rolled lead times range from 5-8 weeks, averaging 6.6 weeks through our latest survey.

Galvanized coil

The SMU price range is $890–960/st, averaging $925/st FOB mill, east of the Rockies. Our entire range increased $50/st w/w. Our price momentum indicator for galvanized steel remains at higher, meaning we expect prices to increase over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $987–1,057/st, averaging $1,022/st FOB mill, east of the Rockies.

Galvanized lead times range from 5-8 weeks, averaging 6.8 weeks through our latest survey.

Galvalume coil

The SMU price range is $900–970/st, averaging $935/st FOB mill, east of the Rockies. The lower end of our range is up $60/st w/w, while the top end is unchanged w/w. Our overall average is up $30/st w/w. Our price momentum indicator for Galvalume steel remains at higher, meaning we expect prices to increase over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,194–1,264/st, averaging $1,229/st FOB mill, east of the Rockies.

Galvalume lead times range from 5-8 weeks, averaging 7.0 weeks through our latest survey.

Plate

The SMU price range is $920–1,020/st, averaging $970/st FOB mill. The lower end of our range is up $70/st w/w, while the top end is up $50/st w/w. Our overall average is up $60/st w/w. Our price momentum indicator for plate remains at higher, meaning we expect prices to increase over the next 30 days.

Plate lead times range from 3-6 weeks, averaging 4.6 weeks through our latest survey.

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.