Market Data

July 23, 2024

SMU price ranges: HR declines moderate. Are we near a bottom?

Written by Brett Linton & Michael Cowden

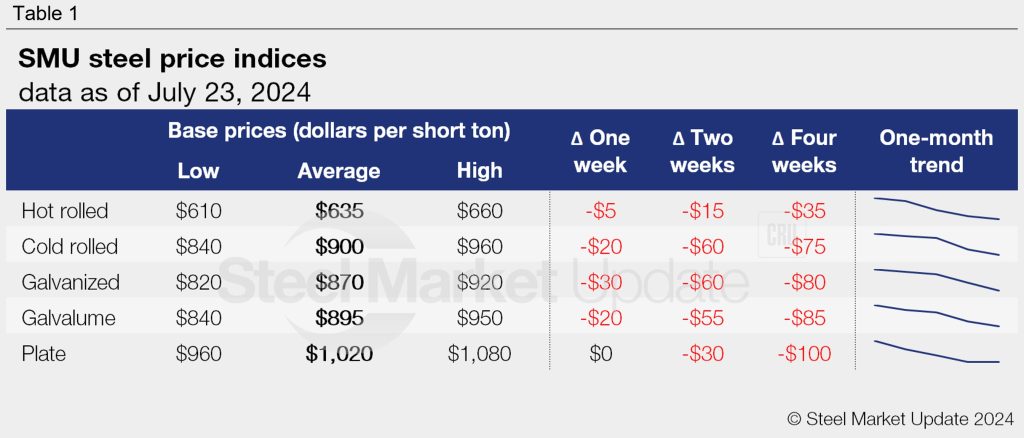

SMU’s sheet price ranges slid again this week. But the declines were more pronounced on tandem products, whereas prices for hot-rolled coil held roughly steady.

Our price for HR slipped to $635 per short ton (st), down $5/st from a week ago. HR prices remain at their lowest point since November 2022. But the pace of declines has slowed.

It’s a different story on cold-rolled and coated products, which continue to catch up to the sharper declines recorded in the HR side earlier this summer.

SMU’s CR price stands at $900/st on average, down $20/st from a week ago. Our galvanized price is at $870/st on average, off by $30/st. And Galvalume is at $895/ton on average, down $20/st from last week.

Note that mills have kept a historically wide spread between HR and tandem products, something that could result in CR and coated prices having more room to move lower.

Market participants were mixed on the future direction of prices.

Some speculated that there was little downside risk left, especially when it comes to HR. They noted that mills were probably already at or below breakeven on contract tons or large spot deals, both of which typically sell at a discount to prevailing spot prices. They also noted that imports have started to move lower. And they said they expected that trend to continue thanks to falling domestic prices and short domestic lead times. Some in addition noted that scrap appears to have stabilized.

But others questioned whether prices could find a floor with output still rising, new capacity coming online, and no obvious catalyst to drive demand higher or squeeze supplies. Some also noted that mills this year, unlike in 2022 and 2023, have to date made no major cuts to capacity.

SMU’s sheet and plate price momentum indicators continued to point lower. But we will remain vigilant over the weeks ahead, especially on the sheet side, for any clear signs that momentum might change.

Hot-rolled coil

The SMU price range is $610-660/st, averaging $635/st FOB mill, east of the Rockies. The lower end of our range is unchanged week over week (w/w), while the top end is down $10/st. Our overall average is down $5/st w/w. Our price momentum indicator for HR remains at lower, meaning we expect prices to decline over the next 30 days.

Hot rolled lead times range from 3-6 weeks, averaging 4.5 weeks as of our July 17 market survey.

Cold-rolled coil

The SMU price range is $840–960/st, averaging $900/st FOB mill, east of the Rockies. The lower end of our range is down $10/st w/w, while the top end is down $30/st. Our overall average is down $20/st w/w. Our price momentum indicator for CR remains at lower, meaning we expect prices to decline over the next 30 days.

Cold rolled lead times range from 4-8 weeks, averaging 6.2 weeks through our latest survey.

Galvanized coil

The SMU price range is $820–920/st, averaging $870/st FOB mill, east of the Rockies. Our range is down $30/st w/w across the board. Our price momentum indicator for galvanized remains at lower, meaning we expect prices to decline over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $917–1,017/st, averaging $967/st FOB mill, east of the Rockies.

Galvanized lead times range from 5-8 weeks, averaging 6.8 weeks through our latest survey.

Galvalume coil

The SMU price range is $840–950/st, averaging $895/st FOB mill, east of the Rockies. The lower end of our range is down $40/st w/w, while the top end is unchanged. Our overall average is down $20/st w/w. Our price momentum indicator for Galvalume remains at lower, meaning we expect prices to decline over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,134–1,244/st, averaging $1,189/st FOB mill, east of the Rockies.

Galvalume lead times range from 6-8 weeks, averaging 6.8 weeks through our latest survey.

Plate

The SMU price range is $960–1,080/st, averaging $1,020/st FOB mill. Our range is unchanged w/w across the board. Our price momentum indicator for plate remains at lower, meaning we expect prices to decline over the next 30 days.

Plate lead times range from 3-6 weeks, averaging 4.2 weeks through our latest survey.

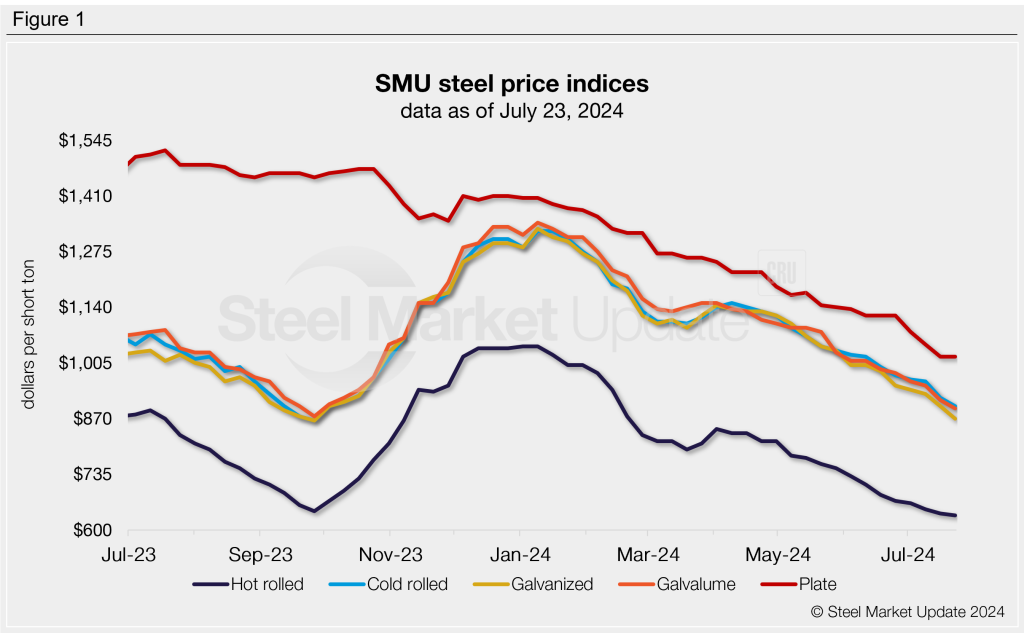

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

Brett Linton

Read more from Brett Linton