Market Data

July 3, 2024

SMU survey: Lead times remain short, nearing 9-month lows

Written by Brett Linton

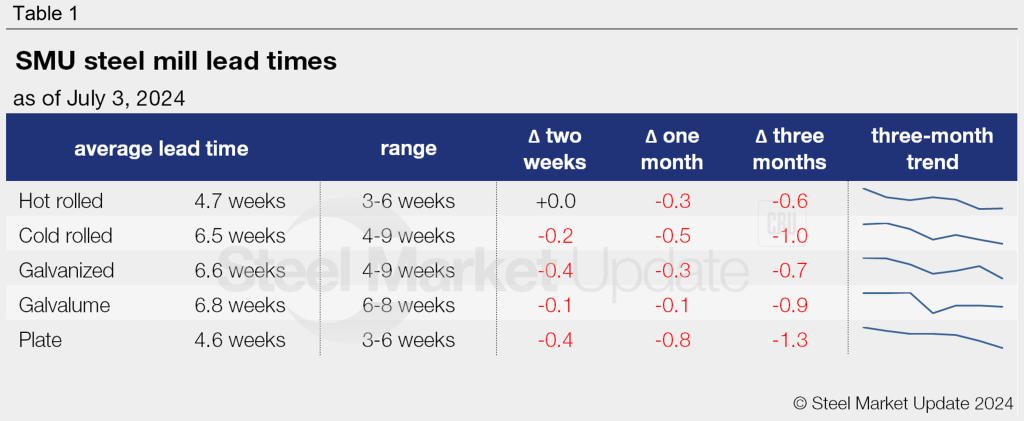

Steel mill lead times remain near some of the lowest levels witnessed in months, according to our latest market canvass of steel service centers and manufacturers.

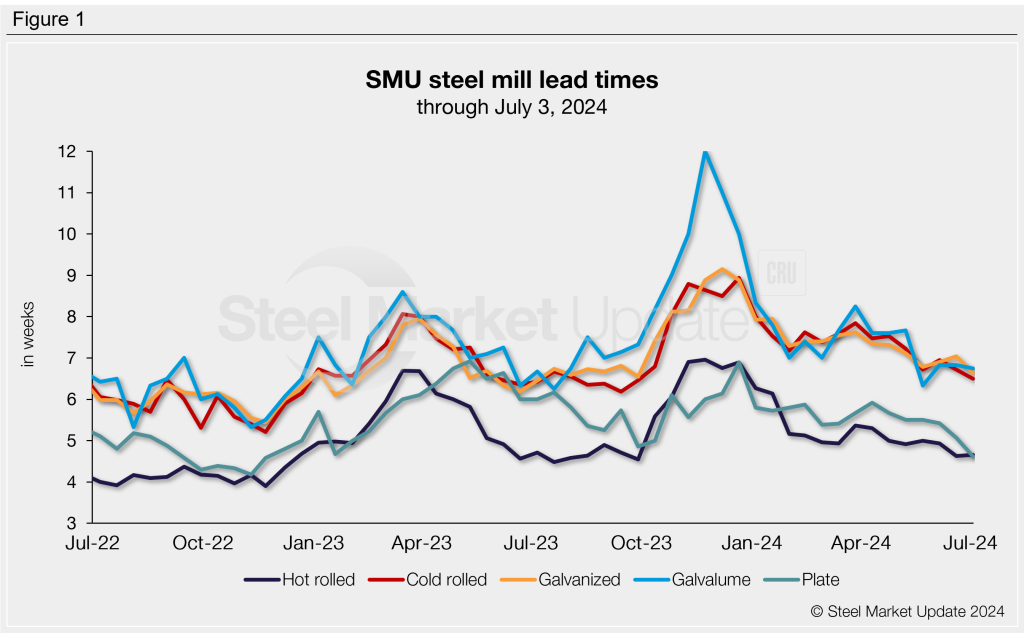

Survey respondents reported stable lead times for hot-rolled (HR) coil. Production times for all other sheet and plate products decreased from our previous check on the market two weeks ago. Lead times remain at or near lows not seen since September of last year.

Table 1 below summarizes current lead times and recent trends.

Survey results

More than two thirds of the companies we surveyed this week categorized current mill production times as shorter than normal. Most of the rest said lead times were within typical levels. None said they were extended.

Asked how lead times would be in two months, 21% of this week’s respondents predicted that lead times would longer at that time (down from 25% when polled in mid-June). Another 67% forecast that production times would remain stable (up from 63% previously). And 12% think they could contract (the same percentage as previously).

Here’s what respondents are saying:

“Mills will still be waiting to see where the market goes, so not going to jump on increasing or decreasing inventories.”

“Buyers will fill order books over the next 30 days due to low pricing.”

“There is a chance to see some degree of stability by late summer, but the macro view continues to weaken. How far can inventory restocking take the market?”

“Manufacturing will need to pick-up in order to increase demand.”

“The mills will start cutting back capacity.”

“Domestic mill lead times are a problem. Unless capacity comes offline somewhere, this bear market ought to continue.”

“As prices rise and less imports come in, domestic mills will be getting more orders.”

Figure 1 below tracks lead times for each product over the past two years.

3MMA lead times

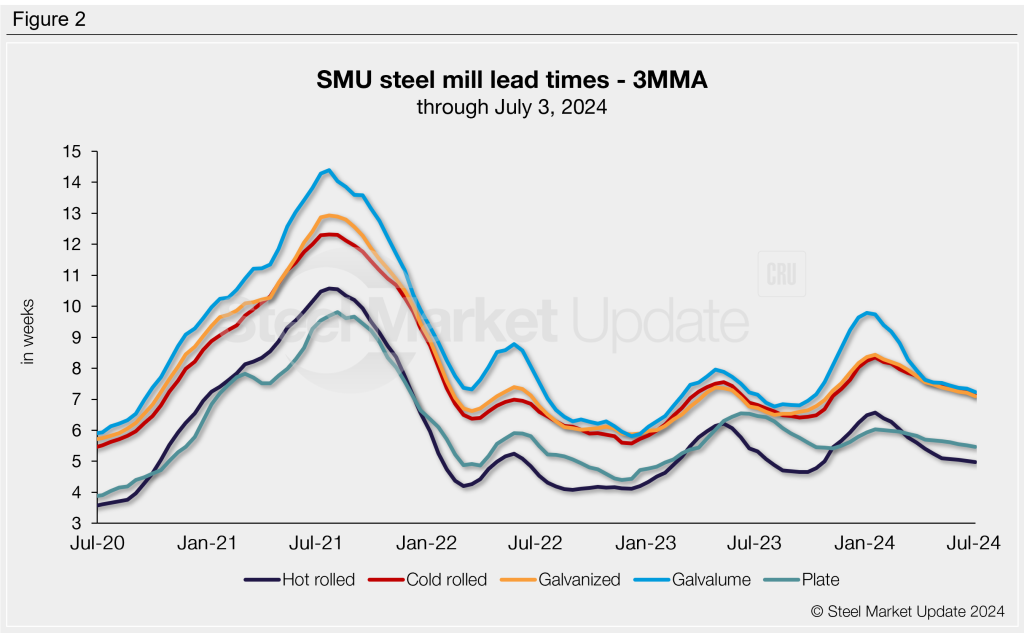

Looking at lead times as three-month moving averages (3MMA) can smooth out the variability seen in our every-other-week readings. On a 3MMA basis, lead times eased across the board and are now at levels last seen in late 2023.

The hot rolled 3MMA is now down to 4.97 weeks, cold rolled at 7.12 weeks, galvanized at 7.09 weeks, Galvalume at 7.23 weeks, and plate at 5.42 weeks.

Figure 2 displays 3MMA lead time movements across the past four years.

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis survey. SMU measures lead times as the time it takes from when an order is placed with the mill to when it is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our steel mill lead times data, visit our website. If you’d like to participate in our survey, contact us at info@steelmarketupdate.com.