Analysis

June 23, 2024

Final thoughts

Written by Michael Cowden

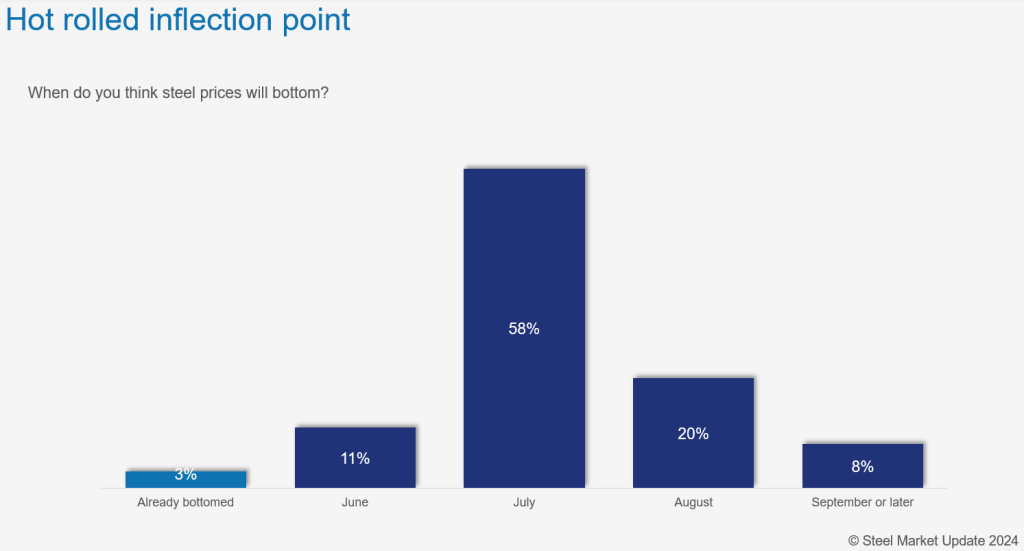

Many of our contacts remain bearish about the short-term direction of steel prices. But a consensus seems to be forming that a bottom will occur in July.

Consensus is also that hot-rolled (HR) coil prices won’t fall below $600 per short ton (st), according to our latest survey results.

In fact, many of you think we’d see capacity scaled back and/or mill prices hikes if HR were to fall deeper into the $600s/st. (Recall that SMU’s HR price currently stands at $685/st on average. We will update prices again on Tuesday.)

Below, I’m going to go over a few highlights from our latest survey. You can find the full results here.

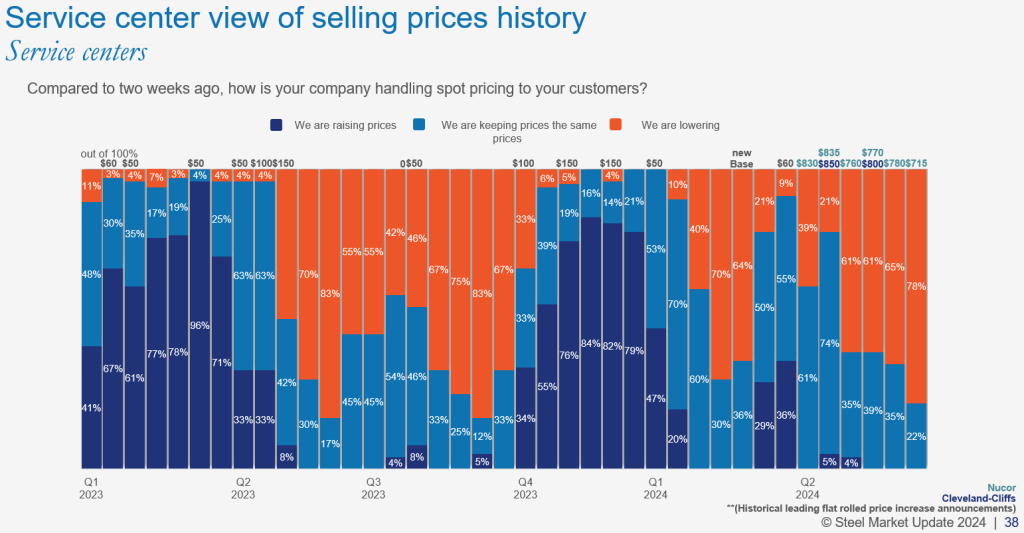

Service centers go lower

To things kick off, we’ll start with service centers. Most tell us that they continue to lower prices along with North American mills:

(Editor’s note: Click on these slides to expand them if you’re reading this in the emailed version of the newsletter.)

Seventy-eight percent of service center respondents to our latest survey report that they are lowering prices. Only 22% are trying to hold the line. And none are trying to raise prices.

That coincides with Nucor dropping its published HR prices. It also comes as SMU’s price for hot-rolled (HR) fell below $700/st and to an eight-month low.

We haven’t seen this many service centers reporting lowering prices since August of last year, just ahead of the UAW strike.

Here is what some of them had to say:

- “We will continue to be fair to all loyal, consistent customers. We are lowering the prices where it is necessary and keeping prices the same where necessary. … We are disciplined in the marketplace.”

- “Going with the market.”

- “Taking targeted shots to move tons. Hard to keep up with everyone else racing to the bottom.”

- “After a brief pause, we are now lowering again.”

- “As always, we’re seeing cheaper prices out there. We’re trying to stay competitive but not lead the market down.”

- “Every week the pricing drops across all indices, so we have to keep moving the needle as well to keep tons moving.”

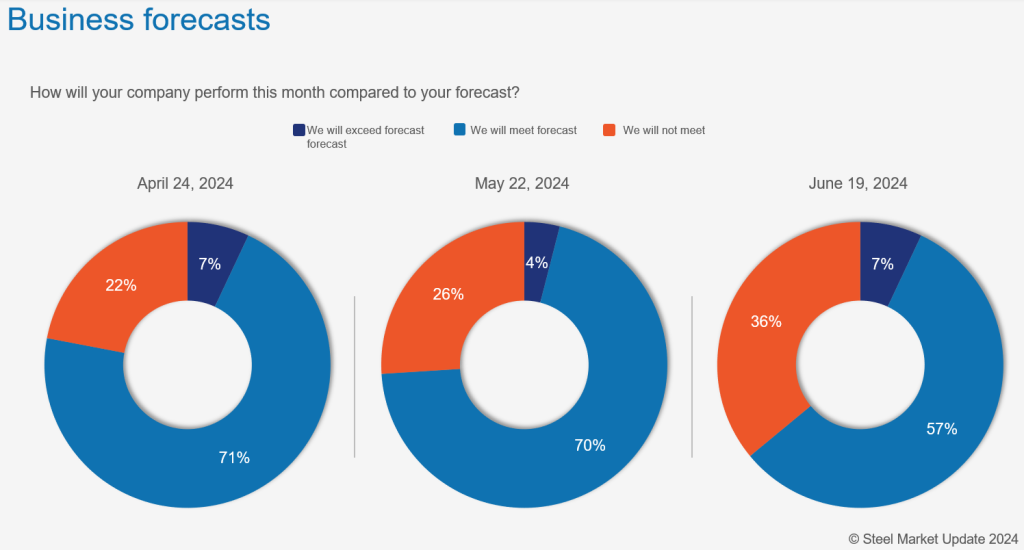

More companies missing forecast

When it comes to demand, it’s a roughly similar story. We continue to see more companies saying that they will miss forecast.

Thirty-six percent say they will miss forecast in June, up from 26% in May and 22% in April. That number has grown as the percentage of companies who say they will meet forecast has declined to 57% in June from ~70% in April and May.

Here is what some who are meeting or missing forecast had to say.

- “Demand has been soft.”

- “Meeting forecast will be tough. But we are on pace to hit our goal.”

- “Weak fundamentals 3-5 months ago are being felt now.”

- “Our forecast was aggressive, and we will be off by 10%.

- “Tonnage forecast will be close, but not profitability with everyone racing to the bottom for less tons to be had.”

But most think a bottom is near

That’s some pretty bearish feedback. And yet most respondents (72%) think prices HR will have bottomed out by the end of next month. Only 28% think that bottom won’t arrive until August or later this fall.

Here is what some who think a bottom is within the next month or so had to say.

- “Price will bottom in very late June. Domestic mills will take a stand.”

- “Mills are offering deals for large tonnage, but they are also holding the line. I think we have another 2-3 weeks of the CRU trickling down and mills holding their floor – then more buyers will start restocking.”

- “Mills will raise prices for August orders to stop the fall.”

- “Believe the bottom will be late June/early July – maybe coming back from the holiday we see an increase.”

- “Service center and OEM inventories will eventually run too lean.”

So assuming HR prices bottom in July and rebound, where will they be in late August?

More than 90% think that prices will be roughly where they are now or higher just ahead of Steel Summit. A mere 2% think that HR prices below $600/st are in the cards. Not many think they’ll get back above $800/st either. Does that mean we’ll see a return to mini-cycles?

Here is what some of them had to say.

- “Mills will not let HRC fall below $700 for long before they start taking down output.”

- “We are expecting figures to fall into the mid-$600s and then level and slowly rise to the low-to-mid $700s. No reason (right now at least) to see it spike back up.”

- “Expecting a soft bounce back, not enough demand for a surge in price.”

- “Once you get through the summer slowdown, mills should be able to raise pricing.”

- “There will be enough changes from maintenance, restocking, etc., to support some upside.”

- “The mills will raise prices, but the bounce won’t be as high as they’d like.”

What comes next?

Some of you noted that mills have in the past announced price hikes around Independence Day.

I went back through SMU’s price announcement calendar. We haven’t had a July 4-ish price hike in recent years. You’d have to go back nearly five years – to July 2019, to find a price hike around the Fourth of July. (And July 2021 doesn’t count. For most of 2021, there were few announced price hikes because no one needed a reminder that prices were moving up.)

So, if we do see such a hike, would that be a sign of the market getting back to something like a pre-pandemic normal? Or would it be just happenstance? Let us know what you think at info@steelmarketupdate.com.

Steel Summit

Speaking of important dates, Steel Summit is less than two months away! The big event will get underway on Aug. 26.

More than 800 people have registered from nearly 350 companies. And the numbers are still trending upward. If you haven’t registered yet, what are you waiting for? You can do so here.

Also, our room blocks are sold out. But there are plenty of hotels available around the Georgia International Convention Center (GICC), where the event will be held. We have some suggestions here.

And, most importantly, thanks to all of you for you continued support of SMU. We really do appreciate it.