Analysis

June 9, 2024

Final thoughts

Written by Michael Cowden

Where do sheet prices go from here? How is the state of steel demand? And is the dip in prices we’ve seen just a case of the summer doldrums, or is it something more significant?

Rather than try to answer these questions ourselves, we polled you, our readers. Below is that collective wisdom, presented with only minor edits for grammar and syntax – so that you look as smart as we know you are!

These are some highlights. If you want to see full results, you can find those here.

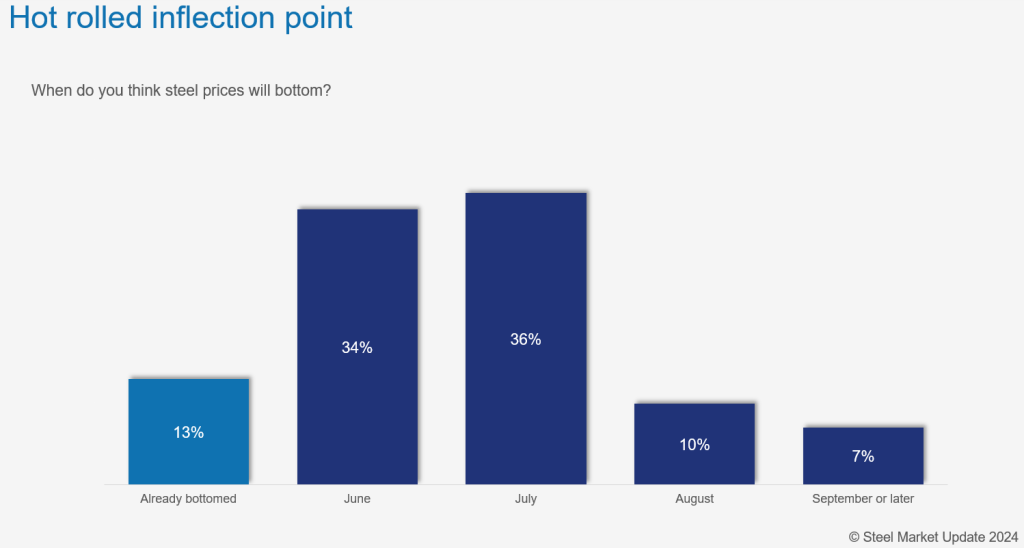

When do folks think hot-rolled (HR) coil prices will bottom?

Already bottomed

“Markets are trending upward. Demand increasing is driving pricing.”

June

“Costs bottoming out. Inventories are moderate, and lower imports expected to arrive.”

“Best guess based on futures. I assumed a mill increase would have been announced already.”

“Fundamentals are weak.“

“Based on the pace of the decline over the past month or two, we’ll reach my projected bottom price of $700 per ton in about 3-4 weeks.”

“Scrap prices will bounce.”

“I’m not expecting big price surges, but an uptick is in the cards. New orders for imports are dropping off.”

“Construction and automotive demand is lower.”

“Pretty much think they have bottomed, but still a few things left to get done that might pull index numbers down.”

July

“We are anticipating a bit longer to drift downward – not crazy numbers, but just slow and steady until mid-summer. $700 or slightly below seems realistic.”

“I expect the mills to reduce capacity in some way to stop the (downward) trend.”

“Mills will shore up the pricing, either with reduced capacity or with pricing increases.”

“The pipe mills are lowering prices to get more orders when in reality the orders are not coming due to market conditions, not pricing.”

“Need to work through imports and mills will get religion – i.e., discipline.”

“Not enough restocking needed quite yet to stop the sliding.”

August

“Summer slowdown has already hit. Automotive is very soft. Election looming. Could be September or later. But August is my guess.”

“We will have hit cost support levels and/or forced mill shutdowns.”

“Market uncertainty has customers transacting on a monthly basis now.”

“Summer doldrums but then preparation for Q4.”

September or later

“The upcoming election.”

Given that most of our survey respondents think that price will bottom in June or July, where do they thing HR prices will be in early August? In other words, where will prices be after that mid-summer bottom is (if yinz are right) in the rearview mirror?

Where will HR prices be in two months?

We got a lot of comments in response to this question. (Thanks!) To keep things succinct, I’ve highlighted just one for each of the potential responses.

$900/ton or higher: “More of a hope than a thought.”

$850-899/ton: “Heading into next contract season. I also expect the mills to reduce capacity in some way to stop the current downward trend.”

$800-849/ton: “We will be past the summer slowdown by then, and demand will pick back up as imports and inventories fall.”

$750-799/ton: “Decent demand will keep the market sideways for the next few months with subtle moves up and down. No doubt there is more upside risk potential then downside risk potential. But without an extended outage from a mill or increased demand, hot roll will continue to struggle.”

$700-749/ton: “Demand isn’t very strong. But utilization remains high and inventories low. Buyers will come back to the table, preventing a free fall.”

$650-699/ton: “Economic uncertainty. Market still adjusting to Nucor and Cliffs indices.”

$640/ton or lower: “Nucor’s CSP has been effective at keeping prices elevated. But eventually the fundamentals will take over, and they are not looking pretty.”

The talk of lower imports and potential capacity idlings above addresses the supply side of the equation. But what about demand?

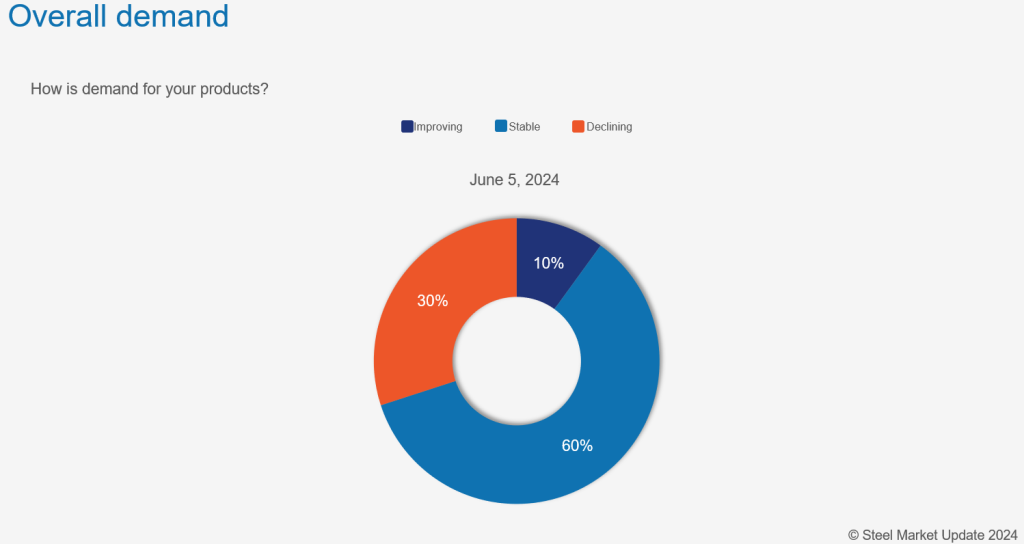

How is demand for your products?

Most of you continue to tell us that business is stable. But 30% say that demand is declining, up from 9% in late March. Similarly, only 10% say demand is improving, down from 22% in early/mid-April. (You can find historic data on this question – and some interesting patterns in the data – here.)

Improving

“Our short-term forecast is strong. Our best YTD.”

“We are currently expanding our distribution area.”

Stable

“Not up, but at least holding the line.”

“Stable. But still tenuous.”

“Just meeting contract minimums, so not leaving anything for spot.”

“We saw decline for June with spot buyers on the sidelines and contract buyers more focused on July with prices resetting.”

Declining

“Customers are cautious now. The economy is slowing, and projects are being delayed.”

“Transactional has seen a decline. Contract has been stable.”

“Tough to tell for certain, but we think of it as near-term softness.”

“It has seemed to be declining all year.”

“No big bright spots out there right now.”

“Seeing a slowing of the market on contract business now. Spot sales are essentially non-existent.”

My takeaways

The consensus: Prices will bottom this month or next. But a sizeable minority think that a bottom might not come until August or September. And many of you think it will take an extended mill outage or an idling for prices to find a floor.

Another thing I find notable: 80% of respondents think that HR prices will be roughly where they are now or higher come August. You don’t expect the market to come roaring back once lead times are in September. And you also don’t expect it to continue to drop into the typically busier fall months either. To me, at least, that suggests most of you think this price downtrend is seasonal rather than structural.

Also, 60% tell us demand is stable, which supports the idea that drop is temporary. And yet – and I’m not sure whether to read too much into this – the comments were pretty negative. Even among those who said demand was stable.

What’s up with that? Maybe folks reporting declining demand were just more verbose than those reporting improving or stable demand? Also, if you’re seeing improving demand, let us in on the secret.

SMU Steel Market Survey participation

I thought we’d see participation drop after Memorial Day and with a long period of lower sheet prices. We’ve seen that pattern in the past.

Instead, we’ve seen more and more of you taking taking part in our surveys – and taking the time to provide us with some really thoughtful comments.

Thank you. We appreciate you. And if you don’t participate in our surveys already but would like to, please contact us at info@steelmarketupdate.com.