Analysis

May 14, 2024

Final thoughts

Written by Michael Cowden

Our spot price is little changed this week after moving sharply lower last week on the heels of Nucor’s unexpected price cut.

Here’s one thought on that trend: Nucor’s weekly HR price (aka, its “Consumer Spot Price” or CSP) has, to date, functioned almost more like a monthly price.

A monthly price adjusted weekly?

In early April, for example, Nucor rolled out its first published spot HR price at $830 per short ton (st). That was a lot lower than some had expected – especially with Cliffs at the time at $900/st. The price then stayed within $5/st of that initial $830/st for the rest of the month – ending at $825/st on April 29.

On May 6, we saw another unexpected cut – down $65/st to $760/st. This week, Nucor’s HR price is unchanged from last week. Is that what we should expect from Nucor going forward – a sharp move (up or down) on the first Monday of the month, followed by minor adjustments after that?

And if that’s the case, what’s driving that pattern: Scrap prices (which are settled monthly)? Cleveland-Cliffs‘ monthly spot HR price? Competition with contract discounts? Something else?

It’s been just over a month since Nucor started publishing spot HR prices. So we don’t have enough data points to draw any big conclusions. And I’ve also heard that imports from some typically reliable and high-quality mills abroad are available for approximately $700/st. Does that mean Nucor’s CSP will drop next week instead of holding roughly flat? We’ll see.

CSP shock on par with UAW strike

Why do we keep writing about the CSP? It wasn’t just the futures market that registered an event that was (again) not “priced in,” – as StoneX’s Spencer Johnson noted in his column last week. We’ve continued to see reverberations in the physical market, too.

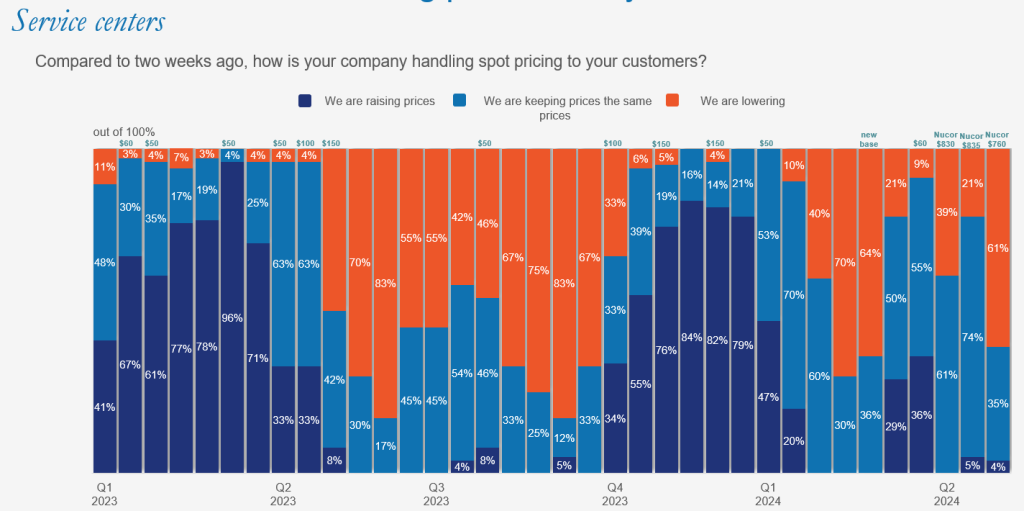

The chart below shows how service centers are handing prices to their customers. The dark blue bars indicate service centers raising prices. The light blue ones means that service centers are keeping prices steady. And the orange bars means that service centers are reducing prices. Above those bars are mill price announcements – including Nucor’s weekly spot HR prices.

(Editor’s note: You can click on the graphics below to expand them.)

In late March (so before Nucor’s first CSP print on April 8), approximately 36% of service centers were raising prices, 55% were holding them steady, and 9% were cutting prices. It looked like we were in for another upcycle in US HR prices.

By mid-May, the script had flipped. Following Nucor’s two surprise price cuts, only 4% of service centers were still trying to raise prices. About 35% were trying to hold the line. And 61% were cutting prices along with mills. You’d have to go back to the UAW strike in the summer of 2023 to find an external shock on par with that.

There are still more questions than answers with this one. We’ve heard from some sources that Nucor is holding the line at $760/st – even for customers placing thousands of tons. But what happens when a customer capable of placing tens of thousands of tons comes to restock, perhaps with a competitive offer from a mill outside the US?

We’ve also heard that the move might be driving what could become a two-tiered market. Namely, one with mills in the South closer to Nucor’s $760/st figure and those in the North (including EAFs) closer to $800/st.

Credit where it’s due: lower prices made sense

I don’t want to imply that Nucor didn’t have good reason to cut prices. As we’ve noted before, import competition has increased. And new capacity continues to ramp up (SDI Sinton, for example) or will soon be coming online (Big River 2, for example).

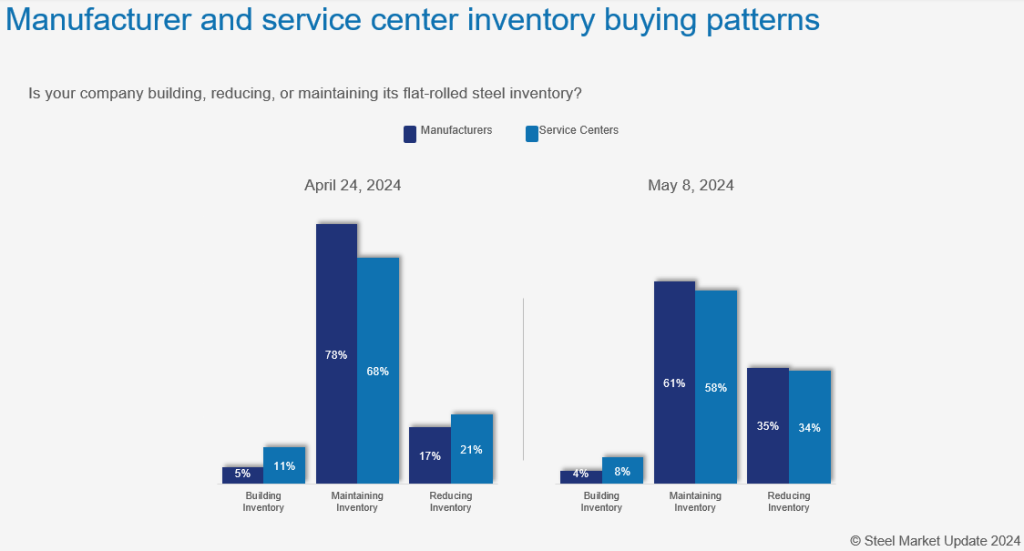

As for the data SMU tracks, service center inventories are not exactly lean. (Our premium readers will read about that on Wednesday afternoon.) And more steel buyers tell us they have shifted into destocking mode – as reflected in the chart below.

Meanwhile, mill lead times have been creeping lower. And mills continue to be more willing to negotiate lower prices, according to steel buyers.

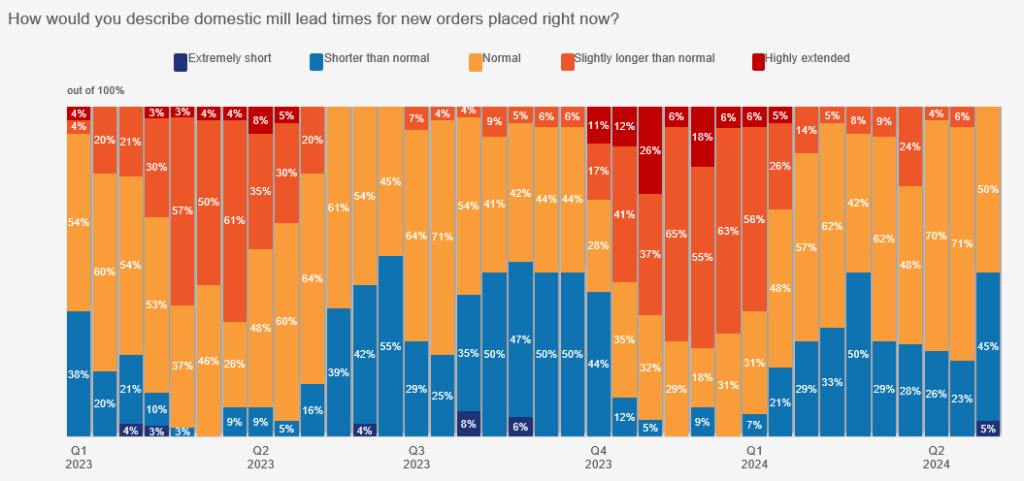

One illustration of that: Half of the buyers we surveyed last week said lead times were “shorter than normal” (blue) or “extremely short” (dark blue bars). The other half said they were “normal” (yellow bars):

Compare that to the beginning of the year when 62% said lead times were “longer than normal” (orange bars) or “highly extended” red bars. In fact, we hadn’t seen anyone reporting “extremely short” lead times since the summer of 2023.

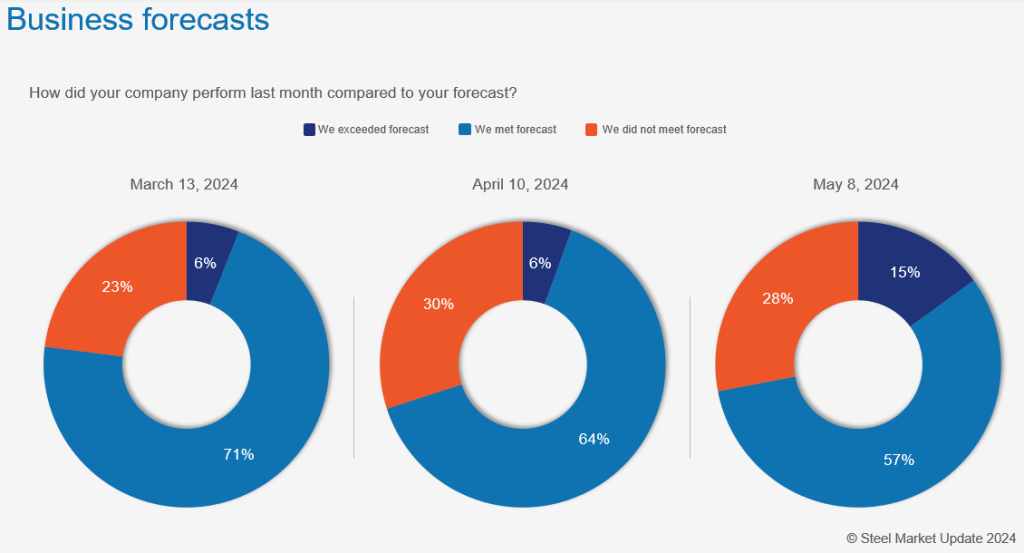

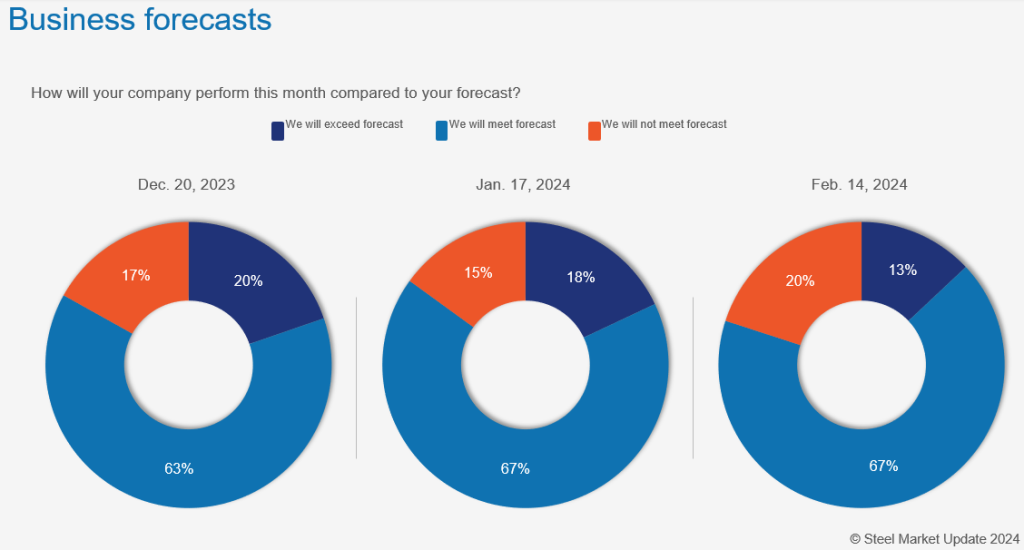

The good news is that most buyers tell us they continue to meet or exceed forecast:

The bad news: More buyers have told us they are missing forecast (~25-30%) in recent months. Compare that to earlier this year and late 2023, when only ~15-20% said they were missing forecast.

Is this just a case of the summer doldrums as lead times stretch into June and July, or is demand slowing down? Let us know what you’re seeing at info@steelmarketupdate.com.

SMU Community Chats

It’s not too late to register for the Community Chat on Wednesday, May 15 at 11 a.m. ET, with CRU Senior Analyst Ryan McKinley.

He’ll talk about trends in global steel markets and how those dynamics could impact the US. McKinley will also provide a one-year outlook for the domestic steel market. He’ll in addition discuss the factors that go into making such a forecast as well as some wildcards that he’s keeping his eye on.

And it’s not too early to register for our Community Chat on May 29 at 11 a.m. ET with Spencer Johnson of StoneX. Johnson will examine, through the lens of future markets, two perennial questions: “What’s the price?” and the perhaps more interesting, “What’s priced in?” You can register for that one here.

In the meantime, thanks to all of you for your continued support of SMU. We truly appreciate it.