Analysis

May 10, 2024

Final thoughts

Written by Laura Miller

What’s the tea in the steel industry this week?

Here’s the latest SMU gossip column! Just kidding… kind of.

Yes, some of the comments we receive in our weekly flat-rolled market steel buyers’ survey are honestly too much to put into print. Some make us laugh. Some make us cringe. Some are cryptic. Most are serious. We appreciate them all.

Below are some highlights from our survey results this week. Some of the comments that we can share with you are also included, in italics, in the buyers’ own words, with minimal editing on our part.

Grab your tea, maybe some popcorn – your call. Here’s the dirt.

Pricing is so hot right now

Nucor stunned the sheet market at the start of last week with a $65-per-short-ton drop in its weekly HRC spot price, so of course pricing has been a juicy topic this week. The market’s been reeling, most everyone waiting to see what the heck is happening.

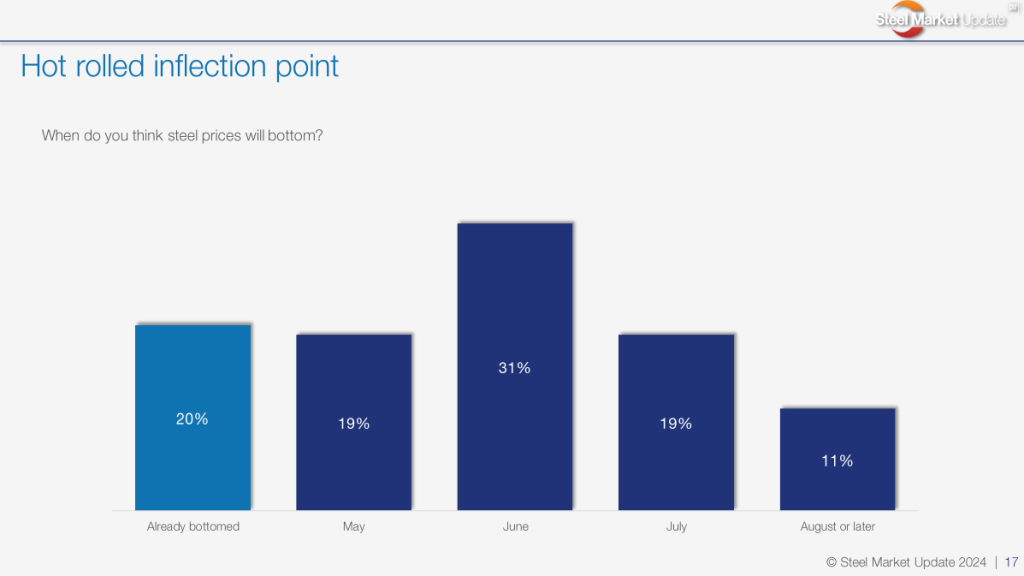

Are steel tags inflecting down? If so, when do you think sheet prices will bottom, and why?

May:

“We are about to hit bottom. It is unsustainable to continue with declines.”

“Mills may incentivize Q3 bookings with lower prices before bottoming and possibly bouncing softly up.”

“Demand is slowing.”

June:

“Late May/early June, going to see another inventory replenishment like in March.”

“Hard to predict now. I don’t see fundamentals to keep lowering too much longer.”

“Normal cyclical curve.”

“Market will remain rather flat. Large volume of imports will also temper price increases.”

“I think buyers are starting to push prices hard, and with the summer slowdown, the mills are probably in for six weeks of pain. But ultimately, it gets pushed too low, and there will be a rebound.”

July:

“There is still traction to go down a bit – spread over scrap allows for it.”

“Middle of summer – typical pattern for our industry.”

“Normally, mid-summer is the low point.”

August or later:

“We may see prices move up slightly for a few weeks before August. But ultimately, I feel our bottom will be in the fourth quarter.“

“Slowing economy.”

“We just don’t see a catalyst to push things higher. We are expecting a pretty lengthy downward cycle here.”

“OEM production is slowing.”

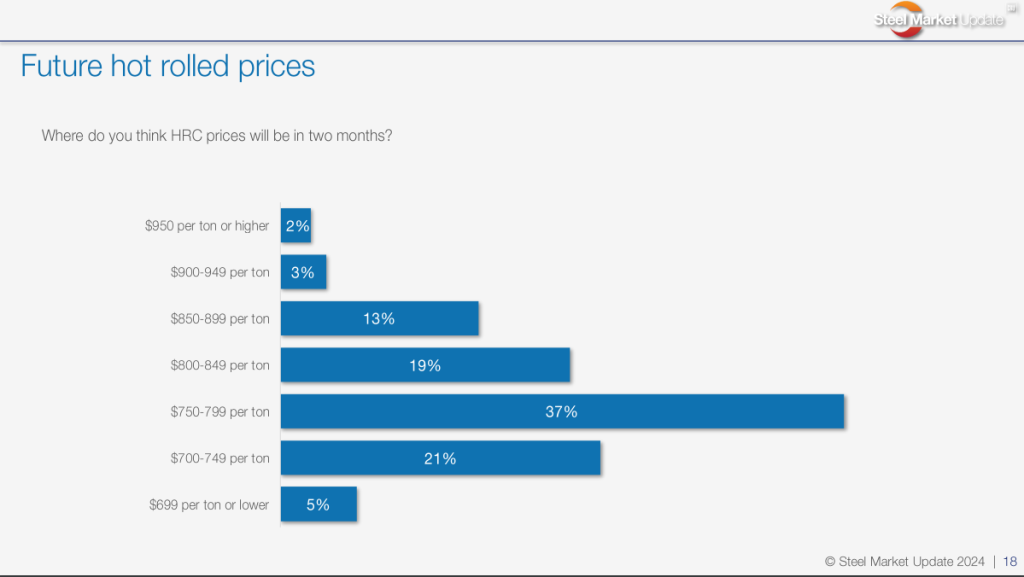

OK, but how low or how high are we thinking they will go?

Hot rolled coil prices averaged $815 per short ton in our last market survey. Where will prices be in two months?

$900-949/st:

“Looming demand.”

$800-849/st:

“Mills may incentivize Q3 bookings with lower prices before bottoming and possibly bouncing softly up.”

“I think in the next 6-8 weeks, prices get pushed too low, and then we rebound a bit on that eight-week mark.”

$750-799/st:

“Pent up inventory, inflation, and upcoming elections.”

“Slowing demand.”

“Should not fall much further – scrap seems to be leveling off. There is a new dynamic with the listed HR pricing, and it could have some effect.”

“Automotive demand is down.”

$700-749/st:

“Coming into summer months slower.”

$699/st or lower:

“Our hope is that things don’t overcorrect too much on the bottom. But of course they will. I don’t think sub-$700/ton is outlandish this summer.”

“Slowing economy, cheap foreign steel, and high interest rates.”

Right, OK, some good intel there.

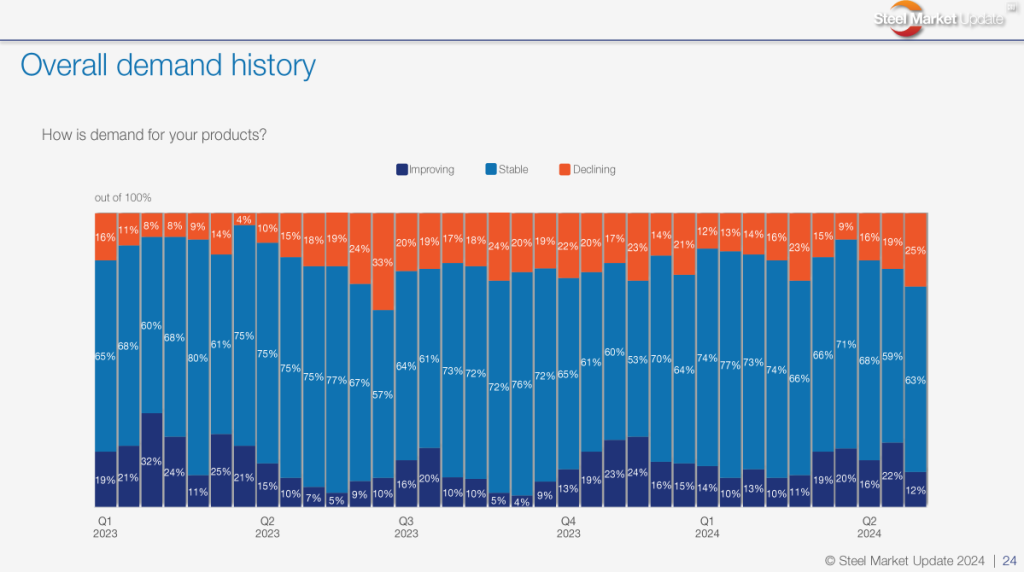

How about another burning issue that’s already been touched on here and there: demand. It’s been reported as steady for a while now. In last year’s second quarter, the number of buyers reporting falling demand declined steadily throughout the quarter. The same thing looks to be happening in the current quarter, but this year’s numbers are higher. Something to watch…

How is demand for your products?

“Construction season start-up will help demand.”

“Competing with stock on the ground in some product groups.”

“Better, but not on the same trajectory as one month ago.”

“We are construction, so we are seasonal. But construction is strong.”

“Slightly better. Spot market buyers likely to emerge again for June HRC in the coming 1-2 weeks.”

“Demand seems off.”

“With prices sliding, demand is moving down, and the summer auto slowdown is upcoming.”

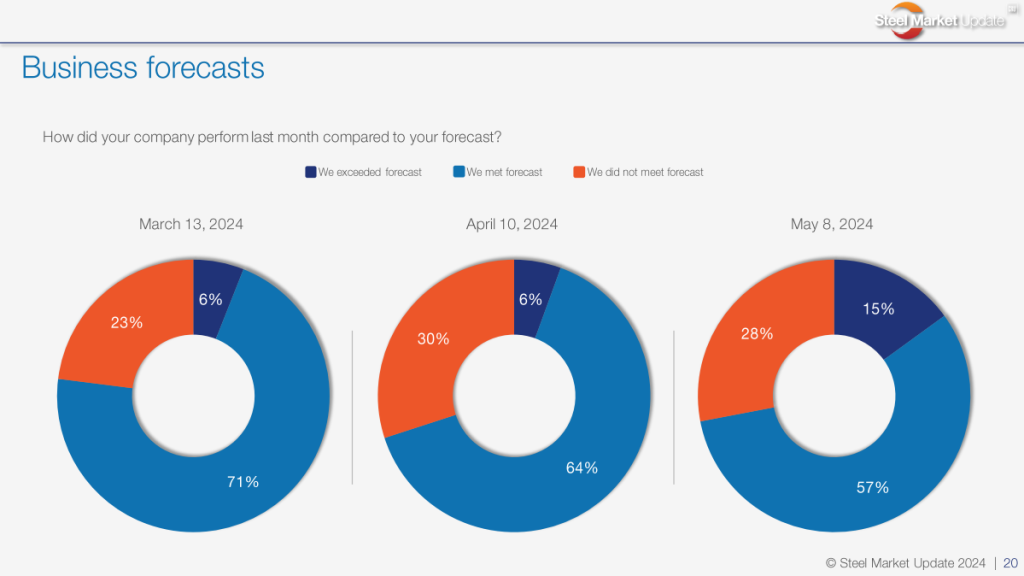

How did your company perform last month compared to your forecast?

We did not meet forecast:

“We are laser focused on correcting the situation.”

“Our customers missed their forecasts January through April.”

“Logistics problems.”

“Slower in ag and construction.”

“Some projects moved out from date of completion.”

We met forecast:

“We continue to steal market share and somewhat ‘keep our head down’ and act responsibly.”

We exceeded forecast:

“We made adjustments to our forecast, which obviously helped us achieve and even exceed our targets for each of our products.”

“Had forecasted a down month but ended up being stable instead. Better than expected, but still not a great month.”

“Strong contract buying, and benefit of spot orders booked in early March after the first increase.”

Nucor and Cleveland-Cliffs are still the talk of the town. Here’s the latest gossip on these steel industry celebs…

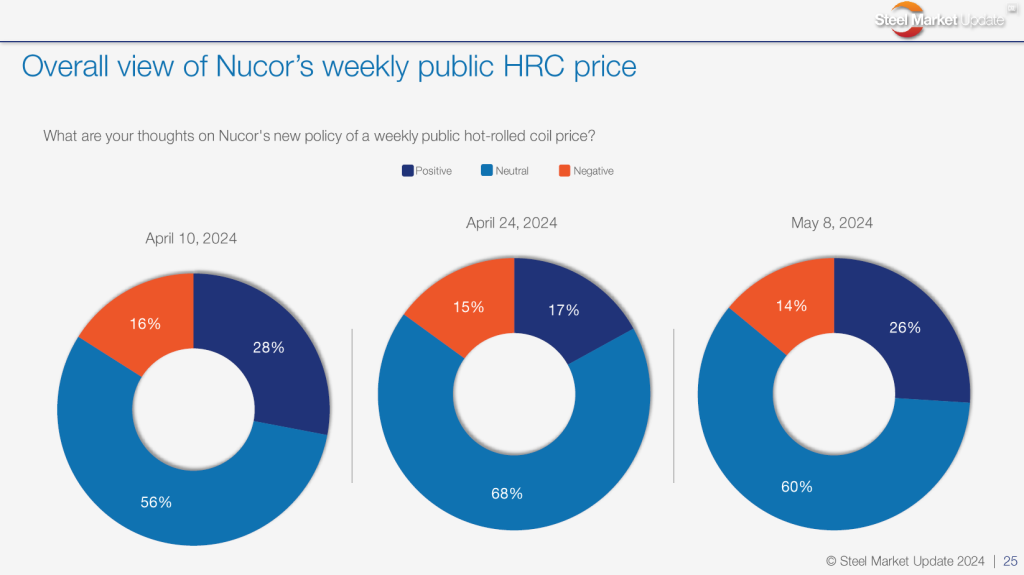

Thoughts on Nucor and Cliffs’ new public pricing mechanisms?

“As long as they are honest (this week, they were painfully honest), this will be good for the market.”

“Our thoughts haven’t changed, as we were always skeptical. Nucor’s drop this week only reinforced that.”

“I prefer monthly pricing.”

“Didn’t know Cliffs would be second out of the gate, but knew at least one other would join. Need to have one set the top and another to drive the bottom.”

“Doesn’t reflect the market – just their number.”

“I like the fact that there is some transparency from the mills on what they would actually sell at. I do think that there is a mini mill price and an integrated price, so I am not as concerned with the difference between the two published numbers.”

“Not certain we understand the overall objective.”

“Nucor’s CSP is having a dramatic effect on the market. Not necessarily a positive one.”

“It’s a mill price, and it’s being considered as some as an attempt to make a market index. Too much influence.”

Well, there you have it. Thank you to those who dished the latest with us around the SMU water cooler that is our weekly survey. Steel and steel prices might be some serious subjects, but that doesn’t mean we can’t have fun with them, too! Thanks for joining me for morning/afternoon/evening tea! If you hear any interesting rumors or have any juicy tidbits to share, please reach out!

Meet us at the hot spot

You just have to join us for the 2024 SMU Steel Summit! All the big names in the flat-rolled steel industry gather in Atlanta every August to share the latest happenings in the North American market. Industry celebs like Barry Zekelman, Geoff Gilmore, Alan Kestenbaum, Barry Schneider, Timna Tanners, and more will share what’s hottest in steel right now. Prices, demand, M&A, decarb, trade, distribution, logistics… what’s your pleasure? It’ll be fun, pinky promise. Hope to see you there!