Market Data

May 9, 2024

SMU survey: Lead times slip for most sheet and plate products

Written by Brett Linton & Ethan Bernard

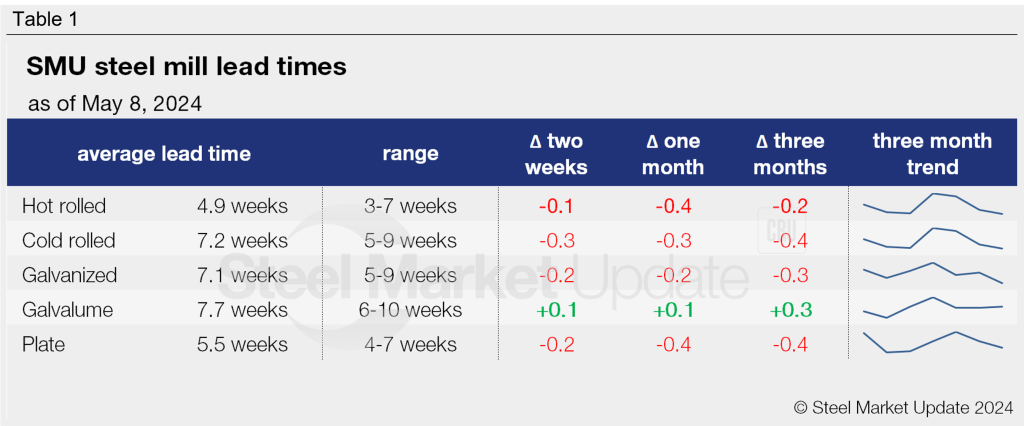

Most steel products tracked by SMU saw lead times contract this week from two weeks earlier, according to SMU’s most recent survey data.

Galvalume, however, bucked the trend, with lead times extending by 0.1 weeks to an average of 7.7 weeks.

While hot rolled lead times slipped 0.1 weeks to an average of 4.9 weeks, cold rolled had the largest contraction in lead times, decreasing 0.3 weeks from the last market check to an average of 7.2 weeks.

Table 1 below details current lead times.

Survey results

This week, 16% of survey respondents thought lead times will be extending two months from now, 62% believed they will be flat, and 22% expected them to contract.

Here’s what respondents are saying:

“It feels like we’re already seeing some contraction. We expect that to continue, at least until import pricing is no longer reasonable.”

“Cannot get much shorter. Able to get hot roll quickly.”

“Mill order books are light. All the forward buying will come to an abrupt end shortly.”

“Summer slowdown/maintenance outages.”

“Coming into summer – usual expectation.”

“Again, buyers push prices hard in the next six weeks and then we rebound.”

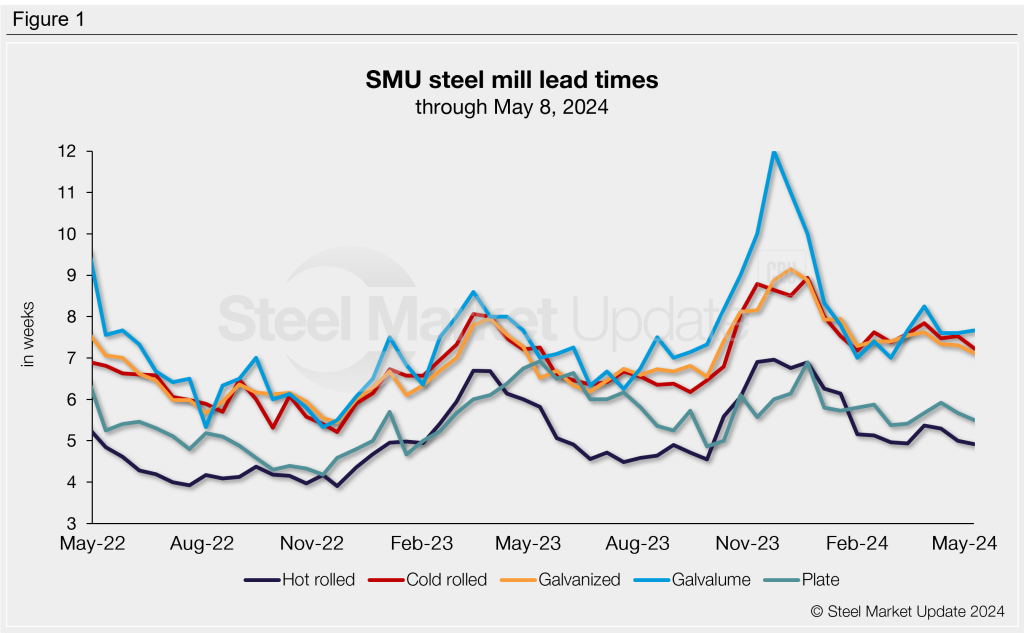

Figure 1 below tracks lead times for each product over the past two years.

3MMA lead times

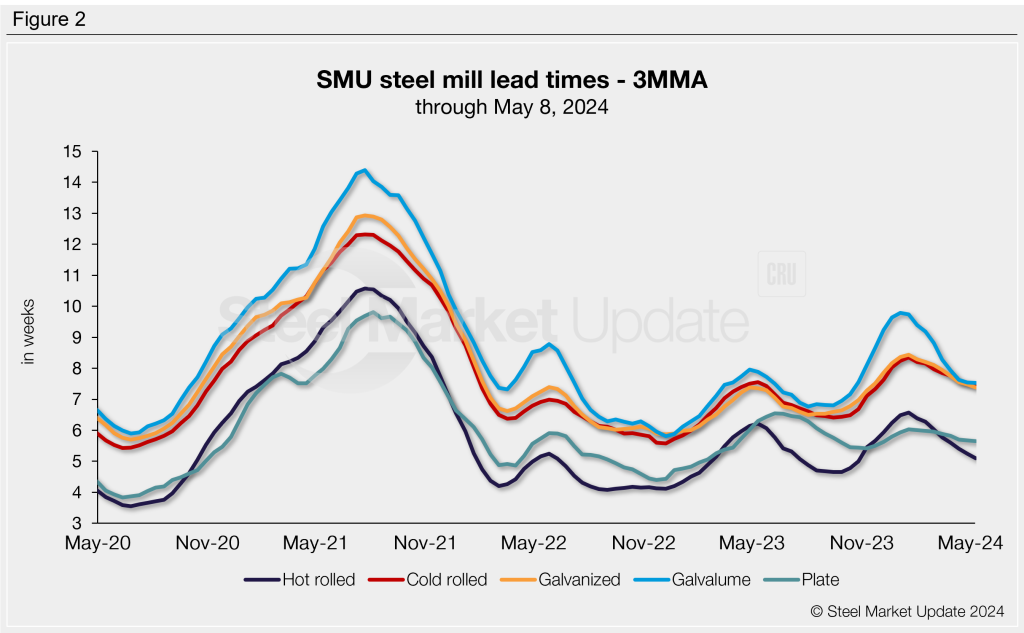

Looking at the three-month moving averages (3MMA) of lead times can smooth out the variability seen in our biweekly readings.

On a 3MMA basis, lead times contracted slightly for all products SMU surveys: with hot rolled at 5.09 weeks, cold rolled at 7.48 weeks, galvanized at 7.38 weeks, Galvalume at 7.52 weeks, and plate at 5.65 weeks.

Figure 2 highlights how lead times have been trending over the past four years.

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis survey. SMU measures lead times as the time it takes from when an order is placed with the mill to when it is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our steel mill lead times data, visit our website. If you’d like to participate in our survey, contact us at info@steelmarketupdate.com.

Brett Linton

Read more from Brett Linton