Sheet

May 3, 2024

Steel imports strengthen through April licenses

Written by Brett Linton

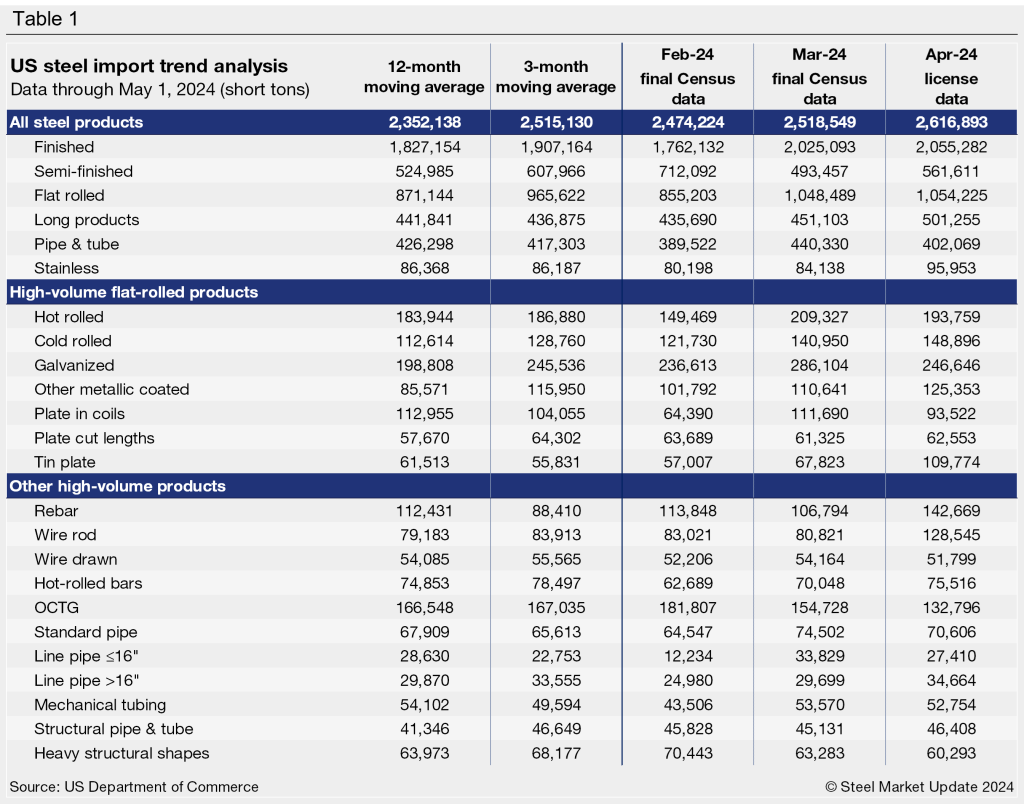

March steel import data was finalized at 2.52 million short tons (st) this week, according to the latest US Commerce Department release. March represents the third highest monthly rate seen over the prior year. April import licenses now tally up to 2.62 million st as of May 1, potentially surpassing March by 4% and now in the running for the second highest month of the past year.

Smoothing out the data

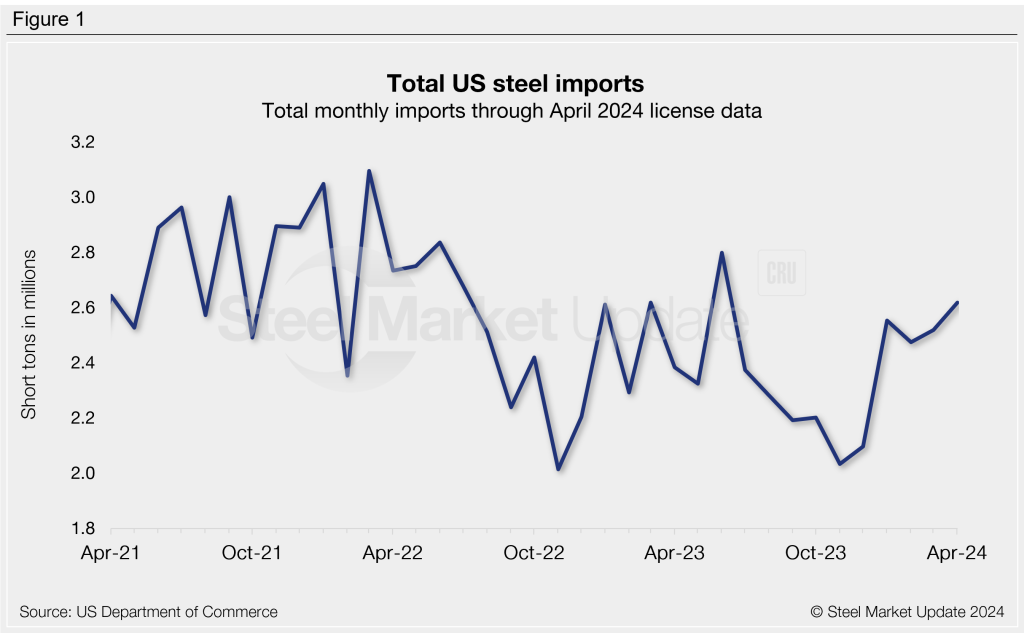

Looking at imports on a three-month moving average (3MMA) basis can smooth out the variability seen month to month. On a 3MMA basis, imports through final March data are up to a 19-month high of 2.52 million st, 6% higher than the previous month. The 3MMA through April is up another 1% to 2.54 million st. Figure 2 shows the strong rally after imports slowed in the latter part of 2023.

Semi-finished vs. finished breakdown

Imports of semi-finished steel have generally hovered between 400,000-700,000 st since the start of 2023, averaging 524,000 st per month last year. March levels are 6% shy of that average at 493,000 st, a 31% reduction from February’s eight-month high. April licenses reflect 562,000 st of semi-finished material entering the country, up 14% from March but still 21% lower than February’s peak.

Meanwhile, finished steel imports jumped 15% in March to a 19-month high of 2.03 million tons. For reference, finished imports averaged 1.83 million st in 2023. The latest finished import licenses through April are up to 2.06 million st, up 17% from March and potentially at a 20-month high.

Flat-rolled

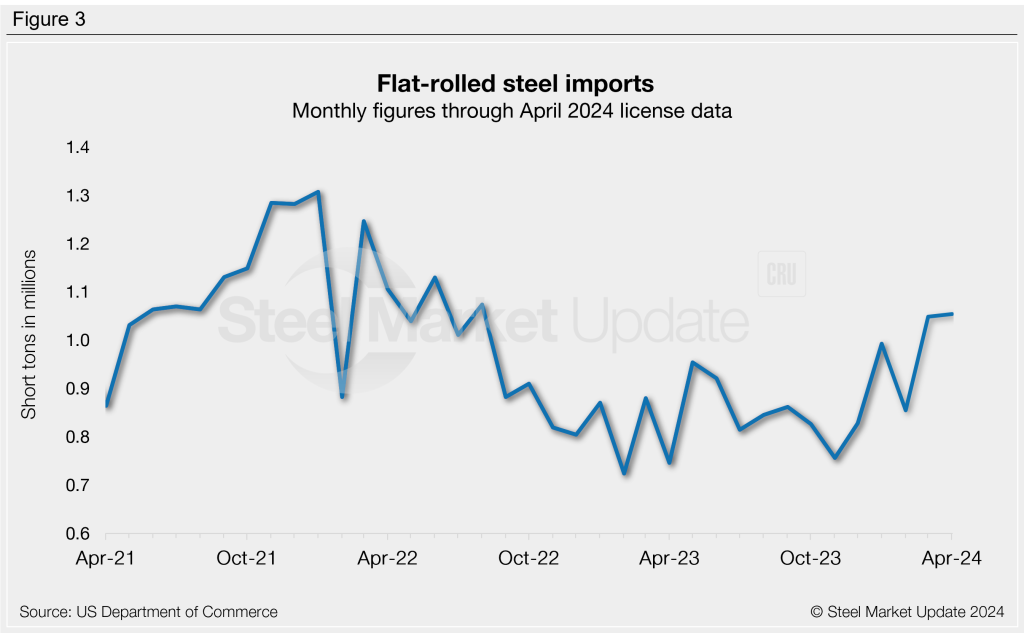

Flat-rolled steel imports rebounded 23% from February to March to a 19-month high of 1.05 million st (the 2023 monthly average was 836,000 st). April data indicates flat-rolled imports will overall be just as strong as March, with current licenses up another 1%.

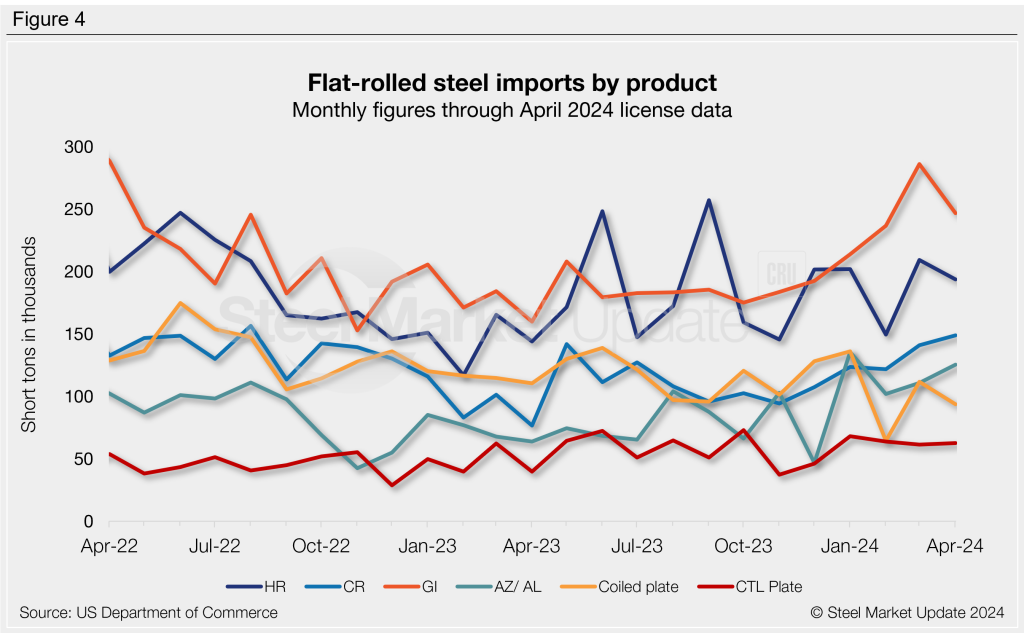

Figure 5 shows flat rolled imports by popular products. After declining in February, most products rebounded into March. The largest monthly gain was seen in plate in coils (+73%), followed by hot-rolled coils (+40%), galvanized (+21%), tin plate (+19%), and cold rolled (+16%).

April licenses are mixed across the products we track, with four products up and three down m/m. The latest data indicates significant monthly swings in tin plate (+62%) and plate in coils (-16%). One notable mention: while cold rolled imports are currently showing a modest 6% gain over March, imports are potentially up to a 20-month high.

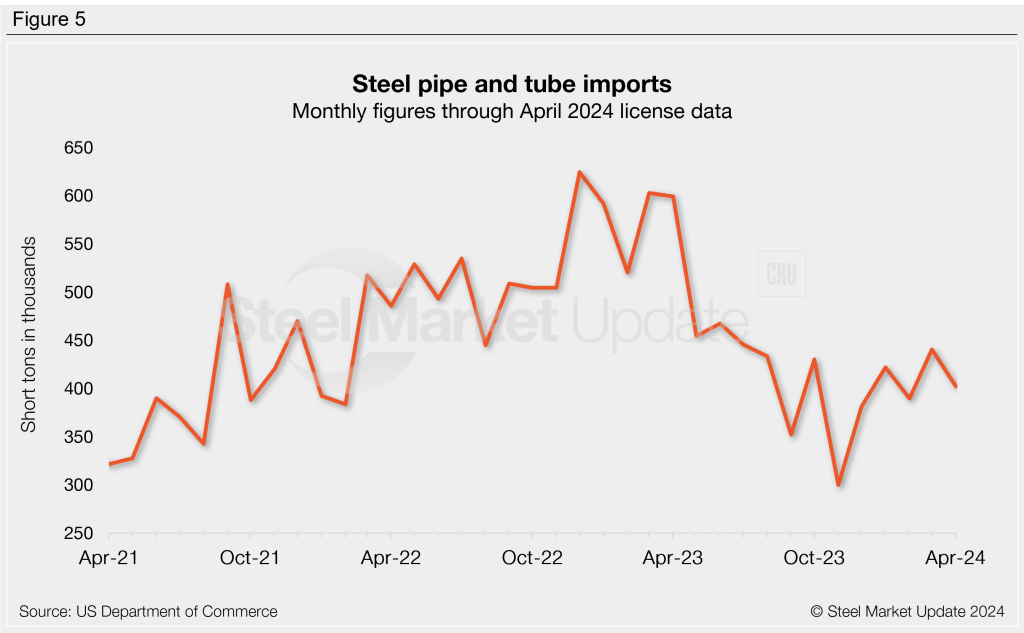

Pipe & tube

The final March count for pipe and tube imports rose 13% month over month (m/m) to 440,000 st. April levels are currently 9% lower at 402,000 st through the latest license data. Pipe and tube imports have been substantially lower over the last few months compared to years prior.

Imports by product

The chart below provides further detail into imports by product, highlighting high-volume steel products. Explore this steel trade data deeper on the Steel Imports page of our website.