Market Segment

May 2, 2024

U.S. Steel Q1 earnings slip, BRS expansions proceed

Written by Michael Cowden

| First quarter ended March 31 | 2024 | 2023 | % Change |

|---|---|---|---|

| Net sales | $4,160 | $4,470 | -6.9% |

| Net earnings (loss) | $171 | $199 | -14.1% |

| Per diluted share | $0.68 | $0.78 | -12.8% |

U.S. Steel posted slightly lower first-quarter earnings as stronger results from its sheet mills were partially offset by a weaker performance from its tubular division.

All told, the Pittsburgh-based steelmaker reported Q1’24 earnings of $171 million. That’s down 14.1% from $199 million in Q1’23 on sales that fell 6.9% to $4.16 billion in the same comparison.

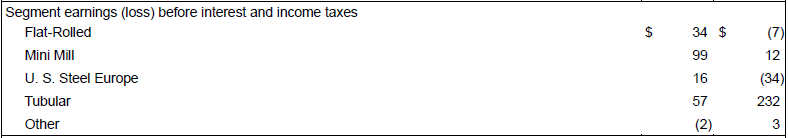

Details on performance by segment are below:

Nippon Steel deal

“We delivered a solid first quarter while maintaining an unwavering focus on safety as we progress towards the close of our pending transaction with Nippon Steel Corporation,” U.S. Steel CEO David Burritt said.

He made the comment in a statement released along with earnings data after the close of markets on Thursday.

U.S. Steel said it expects its merger with the Japanese steelmaker to conclude in the second half of 2024.

The company said both it and Nippon were cooperating with an antitrust review of the nearly $15 billion dollar deal. The probe is being conducted by the Justice Department. Such reviews are typical of big mergers under US antitrust laws.

The deal is opposed by Cleveland-Cliffs, the United Steelworkers (USW) union, and politicians from both leading parties. U.S. Steel noted in a presentation that Nippon has committed to investing $1.4 billion in mills represented by the USW.

The USW represents U.S. Steel’s integrated mills. Big River Steel, its EAF sheet mill in Osceola, Ark., is non-union.

Outlook

Looking ahead, U.S. Steel said it expected a better Q2 from its integrated mills in North America, which typically see “seasonal mining headwinds” in the first quarter.

Note those headwinds stem mostly from the costs of stockpiling raw materials, such as iron ore from the Mesabi Range, over the winter. U.S. Steel ships that ore across Lake Superior to the lower Great Lakes in the spring when navigation resumes.

But U.S. Steel said its EAF segment (shorthand for Big River Steel) was expected to be “negatively impacted” in Q2 by lower selling prices.

And its European operations (namely, a mill in Kosice, Slovakia) were expected to “remain challenged” by “mounting commercial headwinds” on the continent. U.S. Steel said it would, as a result, extend a planned outage on the No. 2 blast furnace at the Slovakian mill.

Operations update

U.S. Steel said it recently commissioned a new dual Galvalume/galvanized coating line at Big River. The company added that it remained on track to start up Big River 2 in the second half of this year.

Big River 2, another EAF sheet mill, should double capacity at Osceola from 3 million short tons per year (stpy) to 6 million tpy once it is fully ramped up. U.S. Steel broke ground on that $3-billion project in February 2022.