Analysis

April 14, 2024

Final thoughts

Written by Laura Miller & Michael Cowden

Last week was a newsy one for the US sheet market. Nucor’s announcement that it would publish a weekly HR spot price was the talk of the town – whether that was in chatter among colleagues, at the Boy Scouts of America Metals Industry dinner in Chicago, or in SMU’s latest market survey.

Some think that Nucor’s spot HR price could bring stability to notoriously volatile US sheet prices. Others think it’s too early to gauge its impact. And still others said they were leery of any attempt by producers to control prices, according to SMU’s latest steel market survey.

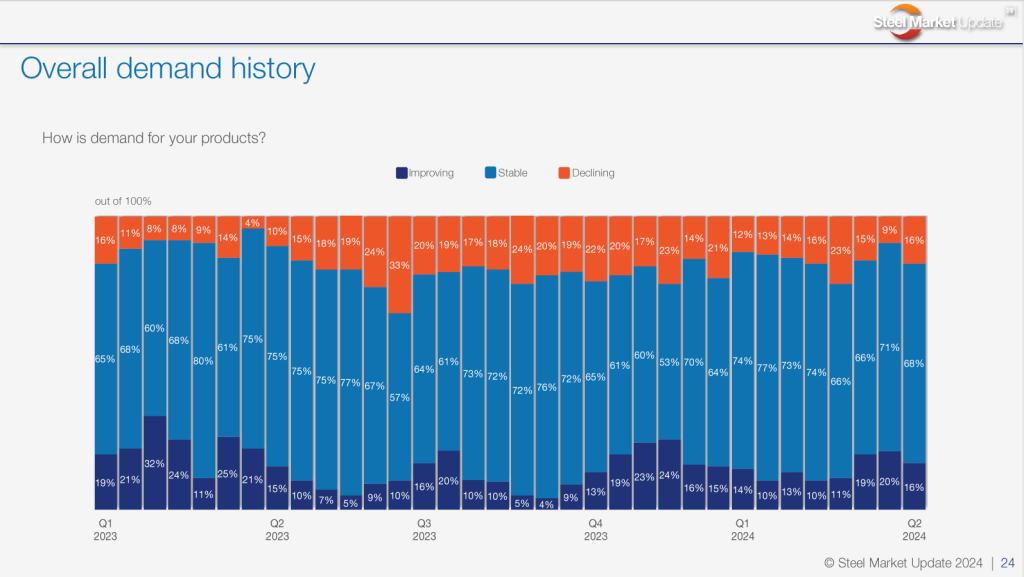

SMU also asked people about demand and pricing in general. Most continue to see demand as stable. But predictions about the direction of sheet prices have diverged. Some think an upcycle that began in March has already run out of steam. Others see the gains continuing into the summer months.

Details – and some good commentary from our readers – are below.

First, let’s talk demand.

Most folks say demand is stable. The rest are split on whether demand is improving or declining. Of note this week was a rise in those reporting lower demand. We saw a similar pattern this time last year. Will the trend continue throughout Q2, as it did in 2023?

How is demand for your products?

Improving:

- “Q1 demand was lower than anticipated, but things have been trending upwards since the last week of March.”

- “Conservatively improving.”

Stable:

- “Depending on market segment.”

- “Demand is steady to increasing.”

- “Automotive seems a bit stronger.”

- “Most of the movement in price has not been demand driven, purely mill driven.”

Declining:

- “Mix changes in some areas.”

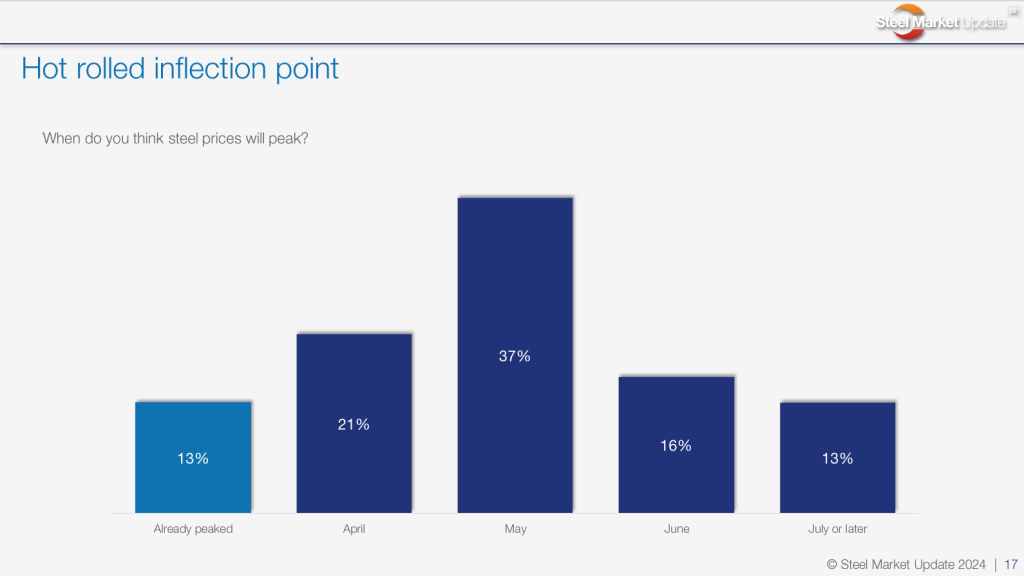

As for where prices will go from here, buyers have mixed thoughts on the matter. Thirty-four percent think HR prices have peaked or will later this month. Thirty-seven percent think prices will peak in May. And 29% think gains could continue into June-July.

When do you think sheet prices will peak, and why?

Already peaked:

- “Input costs and demand down.”

- “We’re resuming the pattern that got off track – almost unprecedented – in January. In most years, markets firm from late December or early January through late March to early April and – unless it is a very strong steel year – start losing steam.”

April:

- “Demand is still king at this point.”

- “This cycle will be short-lived.”

- “We just don’t see a major reason for pricing to head much higher from here.”

May:

- “Mills will try for another $50-60 increase. $20 of that might be realized in the market. Nucor will try to drive spot pricing higher with their new weekly spot transaction number. With scrap at $420, minis have a lot of room to negotiate.”

- “Demand is increasing.”

- “Heavy orders at low prices for April will carry into May.”

- “With Nucor’s new approach, we may still have some runway on spot prices.”

- “I think there is some upside in the near term. But pressure will come again when we hit the June/July lead times and the summer slowdown.”

- “Spring demand will increase, and offshore volumes will be reduced short-term due to less buying in January.”

- “Demand will improve, and plant outages will take place.”

June:

- “Lead times are surprisingly long from the recent big deals in early/mid-May. That will continue the cycle of needing to place more orders to compensate for extended lead times.”

- “Demand improvement due to seasonality, mill outages, and low Q2 imports will boost market prices. But the cycle will be short-lived.”

July or later:

- “Steel demand is steady and will increase. Supply conditions will keep prices rising. Input costs are bottoming out and will increase – iron ore, coking coal, scrap, energy, etc.”

- “Imports are flooding the market, holding price increases down.”

- “June onwards market will pick up. Also, quotas for imports will be exhausted.”

- “Summer lull will come regardless of mill efforts to keep prices up.”

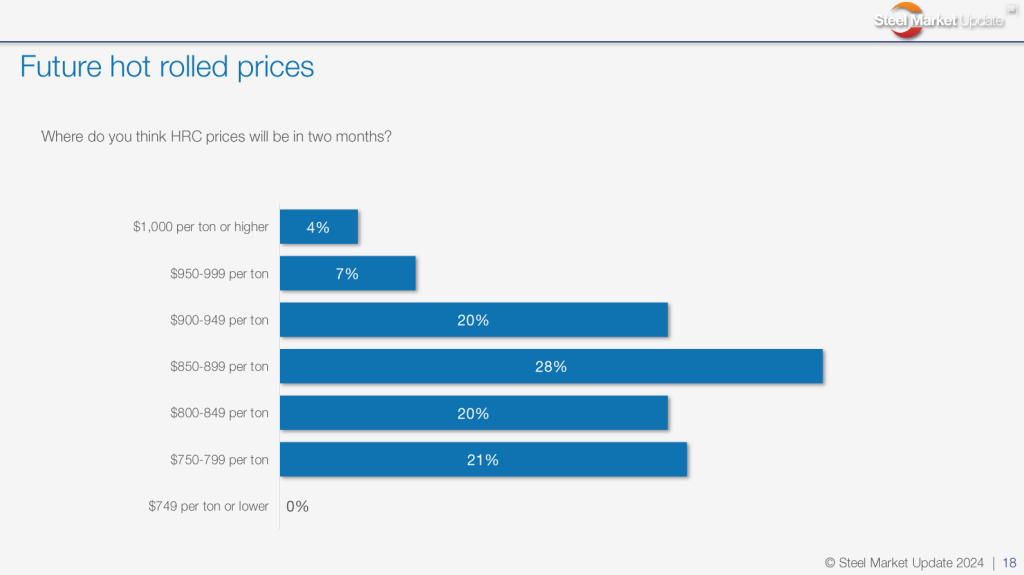

Hot rolled coil prices averaged $835 per short ton in our last market survey. Where will prices be in two months?

$750-799/st:

- “Hot rolled supply continues to outpace demand.”

- “Demand for HR coil is soft overall.”

- “I think there are enough things out there pointing towards medium-term downward momentum than the other way.”

- “Inputs, imports, and demand.”

- “I feel we will see prices slowly (hopefully) decrease now and continue moving downward well into Q3.”

$800-849/st:

- “This has been where the mills have drawn the line in the sand recently.”

- “Expecting to drop a bit, but much lower, and production levels at the mills will drop.”

- “Market may pop up above $850 and then fall back.”

- “I think they go below $800. But in two months, we will be back in the low $800s.”

- “Demand doesn’t appear to support a long-term higher price.”

$850-899/st:

- “Slight firming from here, and then early summer begins to knock it down.”

$900-949/st:

- “Getting to the new normal.”

- “Prices will keep increasing until they don’t.”

- “Order books filling up, lead-times moving into late May.”

$950-999/st:

- “Demand is stronger, and lead times are being stretched out.”

- “Demand will improve for summer.”

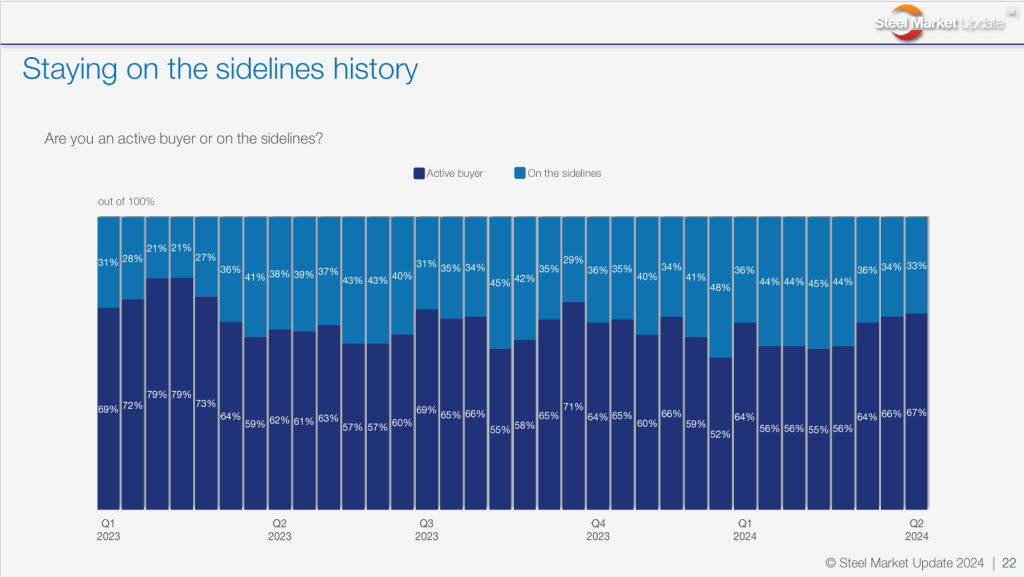

So, with current demand and pricing dynamics, what’s that mean for current levels of steel buying?

Two-thirds of survey respondents reported being active buyers of steel. That’s the most reporting that since the end of Q3’23.

Are you an active buyer or on the sidelines, and why?

Active:

- “Actively buying for back-to-back contracts.”

- “Inventory is tight enough that I cannot afford to be on the sidelines.”

- “Contract only.”

- “We buy every month on contracts, but spot orders are few and far between.”

- “Only to backlog.”

- “Active, but only what we need to fill holes.”

- “Replenishment buying.”

On the sidelines:

- “I think there are enough things out there pointing towards medium-term downward momentum than the other way.”

- “We are continuing to watch cash closely and also don’t believe this market is heading much higher.”

- “After increased buying, we are back to normal again.”

- “Demand, interest rates, high housing costs, etc., etc.”

- “Don’t need any steel right now.”

- “I don’t believe prices have flattened, and my inventory is manageable.”

- “After increased buying, we are back to normal again.”

Nucor’s weekly spot HR price

And finally, let’s talk about Nucor’s recent surprise move to be more transparent with HR pricing.

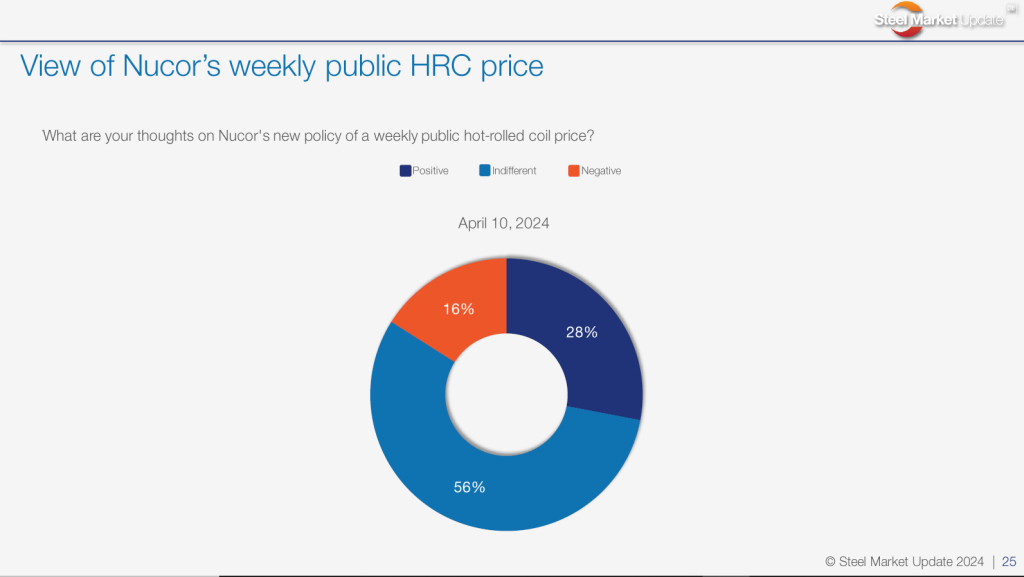

More than half of buyers in our survey see the move as neutral at this point. About quarter see it as a positive. And the rest aren’t thrilled about the development. While speculation has been rife, it’s probably too early to say for sure what the impact of Nucor’s price will be on the domestic HR market.

What are your thoughts on Nucor’s new policy of a weekly public HRC price?

Positive:

- “I feel a relevant published price is going to help the flat-rolled steel market, hopefully reducing the gap between the peaks and valleys.”

- “If they are honest and disciplined, this should increase stability in the market and is welcomed.”

- “We need multiple sources providing this type of information.”

Neutral

- “It’s too subjective. In addition, with so much of their business tied up in contracts/internal downstream, etc., do they really need to concern themselves with spot pricing that much?”

- “I commend the effort to establish something universal. The issue is that many mills offer weekly spot ‘bucket pricing‘ with a discount to CRU.”

- “Skeptical. Is there any longevity in a falling market?”

- “I think it will create more speculation.”

- “Need to see how it works.”

Negative

- “They can create the narrative.”

- “Let the indices do that.”

- “It is another way for mills to control prices and push out other indexes that they … do not like.”

Viva Las Vegas!

SMU and our sister publication, Recycled Metals Update (RMU), will be at ISRI’s annual conference from Mon-Thurs, April 15-18, at the Mandalay Bay Resort and Casino in Las Vegas. We’ll be at booth 2260. Stop by and say hello!

In the meantime, a big “thank you” to everyone for being part of the SMU community. We appreciate your business and your support.

Laura Miller

Read more from Laura Miller