Analysis

March 28, 2024

Final thoughts

Written by Laura Miller & Michael Cowden

SMU’s latest steel market survey paints the picture of a sheet market that has hit bottom and begun to rebound.

Lead times are extending again after stabilizing earlier this month. Mills are far less willing to negotiate lower sheet prices – even if there are still deals to be had on plate, according to the steel buyers we canvassed.

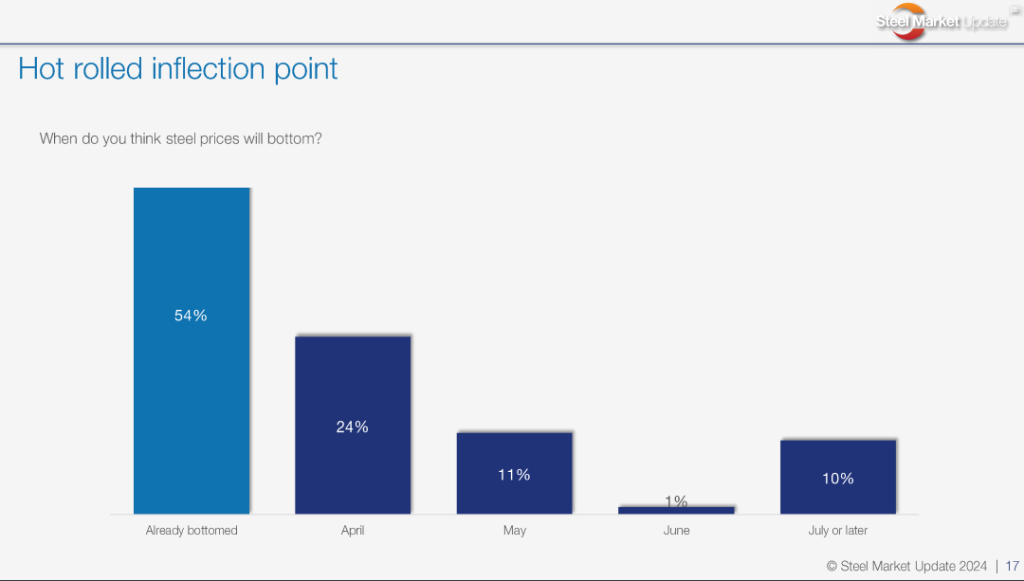

The result: As you can see below, nearly 80% of respondents to our survey think hot-rolled (HR) coil prices have already bottomed or soon will. Few think HR will fall back into the $700s per short ton (st) before summer.

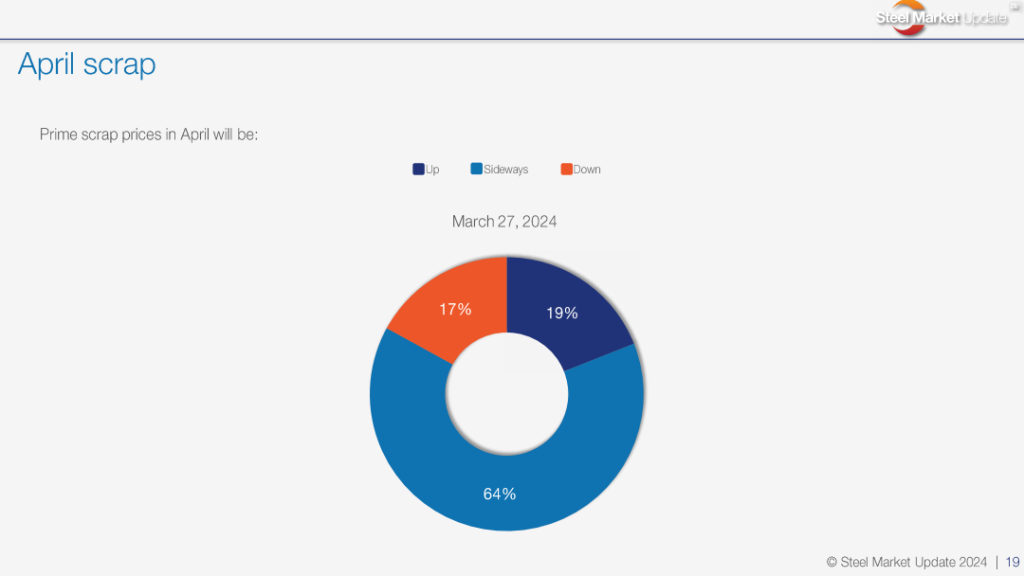

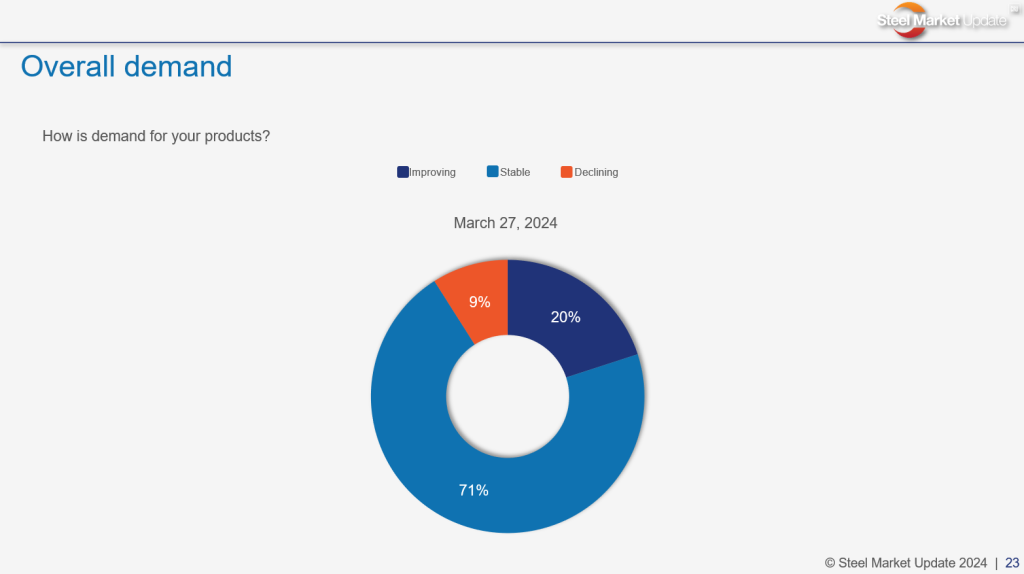

Also, many think scrap prices will stabilize in April after falling earlier this month. They also continue to report stable or improving demand.

Highlights of the survey and what respondents had to say, in their own words, are below. Our premium members can find the full results here.

When do you think sheet prices will bottom, and why?

Already bottomed:

“Demand is increasing.”

“I would say the first price increase is working.”

“I would expect index prices to rise the next several weeks.”

“Prices bottomed on carbon flat steel. Other steel products – like rebar and plate – might still adjust down.”

“Mills are not lowering pricing – increases are coming.”

“Cyclical pickup.”

“Prices already moving higher on new transactions.”

“Let’s hope it has bottomed.”

“I feel we hit the bottom in March, and the mills have enough momentum to move prices higher for the next couple of months. We will see a new bottom late in the third quarter or early fourth quarter.”

April:

“I think there’s another fall before the spike. I reserve the right to be wrong again!”

“Still softening market, last increases didn’t push a lot of buyers into big buys.”

“Demand is still weak, and supply is moving slowly.”

“Looks like mills have set a temporary floor. We’ll see how long it holds and if it will pop up more before falling again in a seasonal summer slowdown.”

“I think we’ll still see things go down a bit more. I don’t know if we’ll get below $750/ton for HRC, though.”

May:

“Even though increases were announced, they will not stick.”

“Accumulated inventory shortages will be replaced.”

“Demand has not bottomed yet.”

June:

“While prices have ticked up, I believe it will be a dead-cat bounce. The global market is depressed, and import levels will remain heavy and steady.”

July or later

“Mills tried to increase prices and are meeting some resistance.”

Hot-rolled coil prices averaged $795 per short ton in our last market survey. Where will prices be in two months?

$950/st or higher – 6%:

“Domestic mills will just push up until they cannot.”

$900-949/st:

“I think prices rise over the next two months, but then start to come back down as lead times hit July.”

$850-899/st:

“Acceptable trigger price.”

“Delusion that the mills will want slow and steady improvement.”

“Demand will improve while domestic production will decrease and import volumes will decline.”

“Right around $850-860.”

$800-849/st

“We are expecting things to drift lower, bounce higher, and then fall back heading into summer.”

“Getting to the new normal.”

“If the latest increases hold, we may see numbers above $800 until summer.”

“Not much to drive it up.”

$750-799/st

“Increases not sticking.”

$700-749/st

“Softening demand.”

“Offshore volumes and orders are still coming in, and demand has slowed.”

Prime scrap prices in April will be:

Up:

“No real opinion, other than stampers have been slow, demand should pick up, which should create pressure on scrap.”

Sideways:

“Mixed reasons. Domestic demand is steady, and the price of finished products is increasing. Domestic mill maintenance means less demand, and some exports could be softer due to holidays like Ramadan.”

“Global markets not showing enough liquidity.”

“Sideways in April due to EAF mill outages; set to increase in May.”

Down:

“Scrap being so soft definitely throws some cold water on the bullish takes.”

How will your company perform this month compared to your forecast?

We will meet forecast:

“We are still fighting through a robust backlog.”

“New forecast.”

“Auto trending down, other business trending up.”

We will not meet forecast:

“Bookings are still down due to caution from buyers still. Might improve next month.”

“Volumes will be OK, but margin compression will stink.”

“Segments of our business have shown near-term weakness. We expect this to persist but steadily improve through H1.”

“Stampers have been slow.”

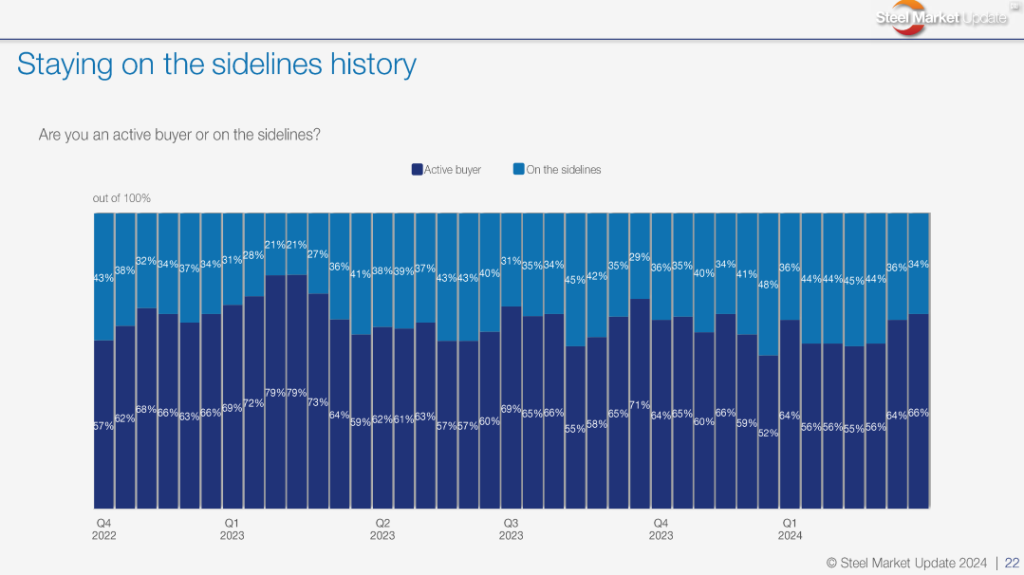

Are you an active buyer or on the sidelines, and why?

On the sidelines:

“Bought big a couple weeks ago.”

“Purchased prior to the mill increases.”

“Business conditions.”

“Buy for orders in hand.”

“Why buy spot when you can maximize contracts.”

“Both for pricing/market and cash concerns, we continue to run our inventories lean.”

Active buyer:

“Following our demand.”

“Demand has picked up, and we are working to support that.”

“We buy every month. Slow and steady. We let the timers do their thing.”

“But buying smaller quantities more often.”

“Active, but only what we need to fill holes. A few weeks ago, we made larger purchases to get us out into the third quarter.”

“We are looking for opportunities only.”

“Active for back-to-back contracts. Always buying for orders. No inventory or speculation.”

“Pricing is low, and it’s a good time to lock up pricing before increases start.”

“Only for backlog.”

“Active buyer – but only what we need. Not building inventory.”

“Replenish inventory.”

“Need to keep our inventory pipeline full.”

How is demand for your products?

Stable:

“Demand did improve, some went from declining to stable.”

“Stable, but we hear improved demand is on the horizon.”

“Stable at good levels.”

“Purchased prior to the mill increases.”

Improving:

“Contract and spot buying is better than previous months.”

Editors’ notes

Your participation in our surveys really helps us keep our finger on the pulse of the market. If you don’t already participate but would like to, please contact us at info@steelmarketupdate.com

Also worth noting: Our offices will be closed on March 29 in observance of Good Friday. We will have no Sunday issue this week. We wish a Happy Easter to those who observe it.

We’ll see you again when we’re back at our desks on Monday. In the meantime, thank you to everyone who participates in our surveys, chats with us each week, and is a member of the SMU community!

Laura Miller

Read more from Laura Miller