Analysis

March 19, 2024

Final thoughts

Written by Michael Cowden

SMU’s price for hot-rolled (HR) inched lower this week. I wouldn’t be surprised, however, if we start to see prices and lead times move higher in the weeks ahead.

The modest declines in HR this week are probably the result of lingering deals cut at “old” prices, as sometimes happens after mill price increases. But those deals will probably be out of the market soon if they aren’t already.

So why do I float the idea of higher prices? Some big buys have been placed. It reminds me a little of what we saw last fall when people restocked in anticipation of higher prices once the UAW strike was resolved.

And look at HR futures. They’ve been gaining ground and continued to do so on Tuesday.

Restock underway

Also, as SMU reported last week, service center inventories moved lower in February. And shipments increased modestly – despite continued concerns in some corners about future demand.

We won’t have March service center inventory data available until April 15. But results from our latest steel market survey indicate where things might be headed.

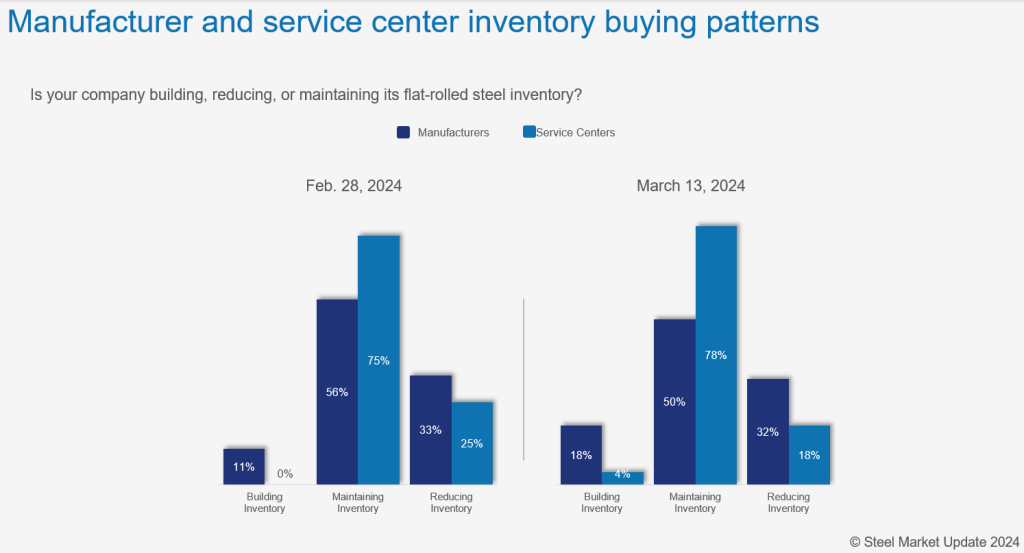

Namely, we’re seeing the early signs of that restock I mentioned:

That might not seem like a big shift from late February to mid-March.

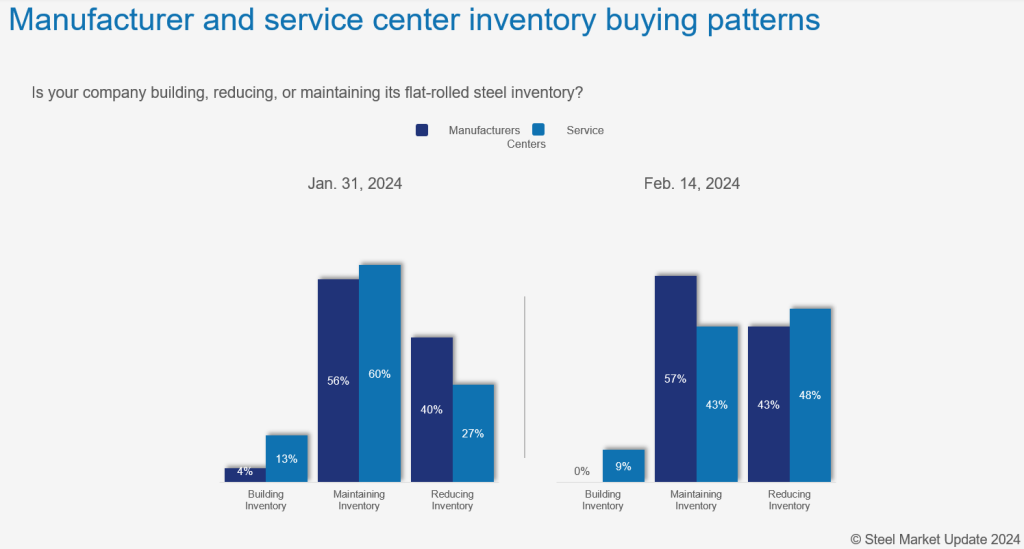

But compare that to what we were seeing a month ago:

I can say a restock is underway. You might or might not agree with that. But it’s fair to say that the destock we saw earlier in the year is coming to a close.

A second increase, imports, and scrap

With that in mind, I would not be surprised if we see another round of mill price announcements. You know the playbook: Mills make one price hike to stop the bleeding. And if conditions are right, they announce another to actually increase prices. In fact, rumors of a second increase are arguably what spurred increased buying activity of late.

Then there is the matter of imports. License data indicate that imports of flat-rolled steel were down modestly in February from a 17-month high in January. We’ll see whether that trend continues into March.

I would not be surprised if imports slide more meaningfully in Q2. Why? Because high US prices in Q4 led to higher import volumes in Q1. Falling US prices in January/February probably spooked people from buying heavy on the import side for spring/summer delivery.

Some of you might point to scrap prices, which were down in March, to say that talk of another price hike is premature. That makes some intuitive sense. Many of us who have been in steel for a while were conditioned to think that steel and scrap move in tandem.

But at least since Section 232 was rolled out in 2018, that relationship isn’t as tight as it used to be. Recall that the Trump-era trade policy continued under the Biden administration, placed tariffs and quotas on finished and semi-finished steel but not on scrap.

Trade action against Mexico?

Finally, and perhaps related to that, here is a wildcard to keep an eye on: There are persistent rumors that a trade action could be announced by the US against Mexico on steel. It’s no secret that the two sides have been trading barbs.

Some sources say an announcement is imminent and raises the prospect of Section 232 tariffs of 25% being re-imposed on the US’s southern neighbor because of an alleged “surge” in exports. Others say that talks between the two countries are ongoing, that the data do not support a surge from Mexico – and that the numbers instead show that it is the US that has surged steel exports to Mexico.

I’m not going to weigh in out what might happen, or even whether anything will. But, again, it’s something to watch and it’s something that appears to be, at least on the margins, providing another support for US sheet prices.

SMU Community Chat

Don’t miss our next Community Chat on Wednesday at 11 am ET with Barry Zekelman, executive chairman and CEO of Zekelman Industries, one of the largest independent steel pipe and tube manufacturers in North America.

Zekelman is known for his straight talk and, because his company is one of the largest steel buyers in North America, his expertise in steel market trends.

You can register here.