Analysis

December 8, 2023

November import licenses fall to recent low

Written by Laura Miller

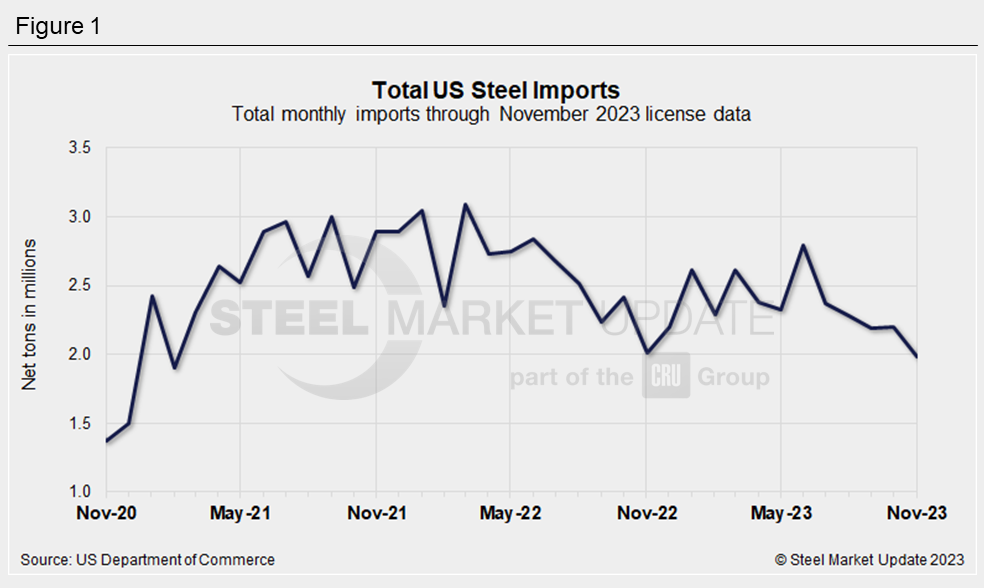

A count of November license applications suggests steel imports were at their lowest monthly level in 33 months (see Figure 1).

Import license applications fell below the 2-million-net-ton mark in November, coming in at just under 1,983,000 tons, according to data from the US Department of Commerce’s International Trade Administration. That’s a 10% decline from October’s final import count of almost 2,201,000 tons, and just 2% lower than November 2022 imports of 2,013,420 tons.

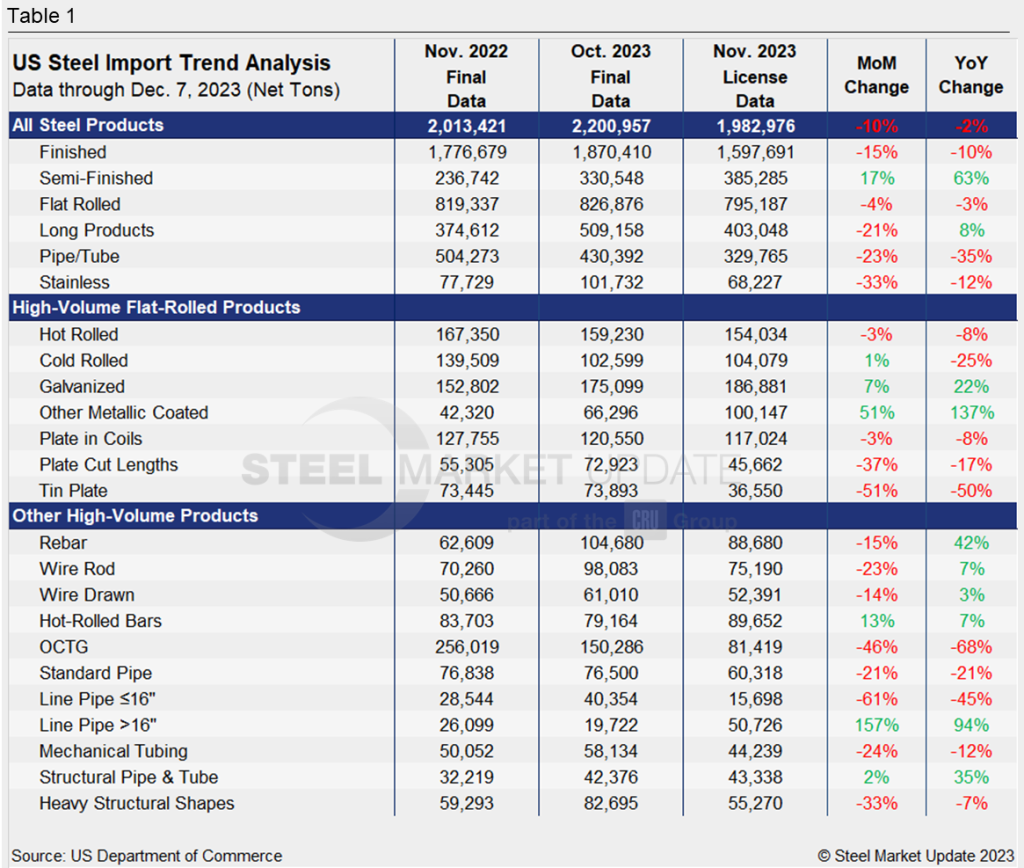

Licenses to import semi-finished steel bounced back after dipping in October, with November’s license count of 385,285 tons 17% higher month on month (MoM). Compared to the same month of 2022, November licenses are 63% higher.

Finished steel import licenses, meanwhile, were 15% lower MoM and 10% lower year on year (YoY) at almost 1,597,700 tons in November. Products seeing significant increases included line pipe greater than 16 inches in diameter, other metallic-coated sheet, hot-rolled bars, and galvanized sheet (see Table 1).

Licenses for other metallic-coated sheet products rose on higher monthly shipments from Mexico, South Korea, Taiwan, and Japan.

Imports of line pipe with diameters greater than 16 inches look to have been at their highest monthly level so far this year, with 50,726 tons of licenses in November. The increase is due to a spike in shipments from Turkey, with nearly 23,530 tons of licenses counted in November.

As SMU has been reporting, domestic hot-rolled coil (HRC) prices have been surging, creating a growing gap in domestic vs. import pricing. SMU has been hearing of increasingly more attractive import offers coming from multiple countries. Because of this, an increase in imports is possible in the coming months.

Note that license counts can differ from preliminary and final figures, as import licenses are required to be obtained before actual importation.

We’ll take a deeper dive into November imports when preliminary figures are released later this month.