Plate

November 21, 2023

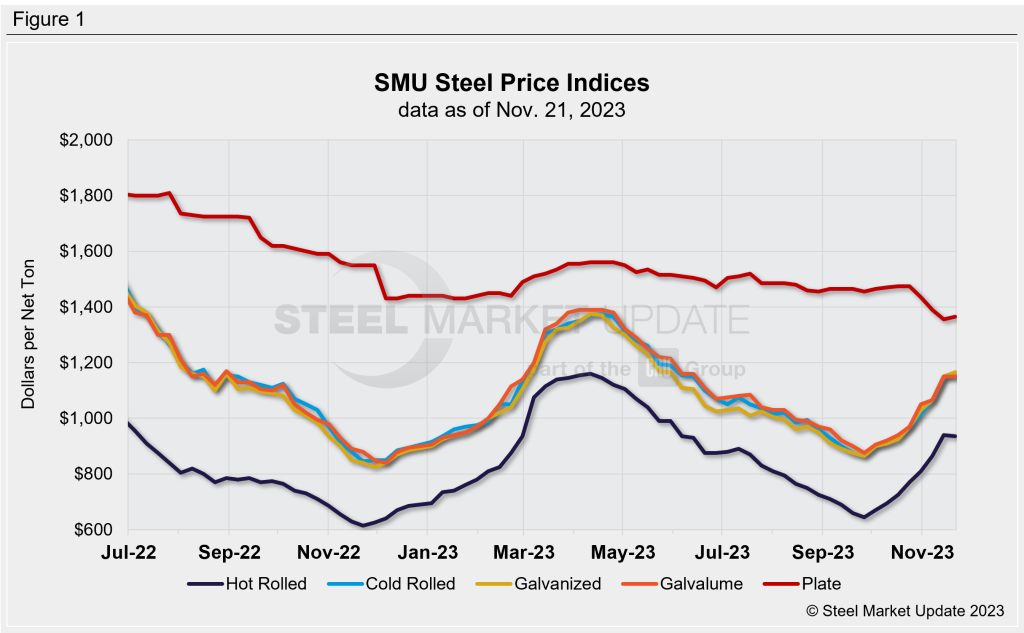

SMU price ranges: Sheet, plate mostly sideways ahead of Thanksgiving

Written by David Schollaert & Michael Cowden

Flat-rolled steel prices were in a holding pattern ahead of Thanksgiving.

SMU’s hot-rolled coil price stands at $935 per ton ($46.75 per cwt) on average, down $5 per ton from a week ago.

Tandem products were flat or up modestly. Cold-rolled was unchanged at $1,150 per ton on average. Galvanized stood at $1,165 per ton on average, up $15 per ton from a week ago. And Galvalume was unchanged at $1,150 per ton.

Plate prices were at $1,365 per ton on average, little changed from a week ago.

Some market participants predicted that HR would continue its upward trek to $1,000 per ton after the holidays. They also said that $1,200 per ton for CR/galv base was all but a foregone conclusion – especially given that mills are sold out for the year and that some have limited tons for January.

Others said that the upward momentum might fade as significant amounts of material ordered earlier in the year is placed into inventory and as lower-priced imports put pressure on US prices.

Still others predicted that any dip in lead times or prices was more reflective of the slow holiday week than anything else.

In the meantime, our sheet momentum indicators continue to point upward and our plate momentum indicator remains pointed lower until a clear trend is established after the holidays.

Hot-Rolled Coil

The SMU price range is $870–1,000 per net ton ($43.50–50.00 per cwt), with an average of $935 per ton ($46.75 per cwt) FOB mill, east of the Rockies. The bottom end of our range declined $10 per ton vs. one week ago, while the top end of the range was unchanged compared to the prior week. Our overall average is down $5 per ton week over week (WoW). Our price momentum indicator for HRC continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Hot Rolled Lead Times: 6–8 weeks

Cold-Rolled Coil

The SMU price range is $1,100–1,200 per net ton ($55.00–60.00 per cwt), with an average of $1,150 per ton ($57.50 per cwt) FOB mill, east of the Rockies. The lower end and the top end of our range were unchanged WoW. Thus, our overall average is sideways vs. the week prior. Our price momentum indicator for CRC continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Cold Rolled Lead Times: 6–12 weeks

Galvanized Coil

The SMU price range is $1,120–1,210 per net ton ($56.00–60.50 per cwt), with an average of $1,165 per ton ($58.25 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $20 per ton vs. last week, while the top end of our range was also up $10 per ton WoW. Our overall average is up $15 per ton vs. the prior week. Our price momentum indicator on galvanized steel continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,217–1,307 per ton with an average of $1,262 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 6-11 weeks

Galvalume Coil

The SMU price range is $1,100–1,200 per net ton ($55.00–60.00 per cwt), with an average of $1,150 per ton ($57.50 per cwt) FOB mill, east of the Rockies. The lower end and the top end of our range were unchanged WoW. Thus, our overall average is sideways vs. the week prior. Our price momentum indicator on Galvalume steel continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,394–1,494 per ton with an average of $1,444 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-15 weeks

Plate

The SMU price range is $1,330–1,400 per net ton ($66.50–70.00 per cwt), with an average of $1,365 per ton ($68.25 per cwt) FOB mill. The lower end of our range was up $10 per ton WoW, while the top end of our range was $10 per ton higher compared to the week prior. Our overall average is up $10 per ton vs. one week ago. Our price momentum indicator on steel plate shifted from neutral to lower, meaning SMU expects prices will decrease over the next 30 days.

Plate Lead Times: 4-7 weeks

SMU Note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

David Schollaert

Read more from David Schollaert