Prices

May 3, 2019

Hot Rolled Coil Price Volatility: Buckle Up!

Written by Tim Triplett

By CRU Research Manager Chris Houlden, CRU Principal Analyst Josh Spoores and CME Metals Products Manager Sean Kessler.

U.S. Midwest HR coil price volatility has increased markedly in recent months as opaque policy decision-making processes and inelasticity of domestic supply have led to large variations in physical market price.

Concurrently, volume and open interest on CME Group’s hot rolled coil futures and options contracts, settled on CRU’s U.S. Midwest HR coil price (“The CRU”) has surged as physical market participants look to manage price risk. This CRU Insight, written in partnership with CME Group, identifies the reasons for U.S. Midwest HR coil price volatility, suggests it is here to stay and presents options for both understanding future market fundamentals and therefore price, and managing price risk now.

Prices and Policy More Volatile

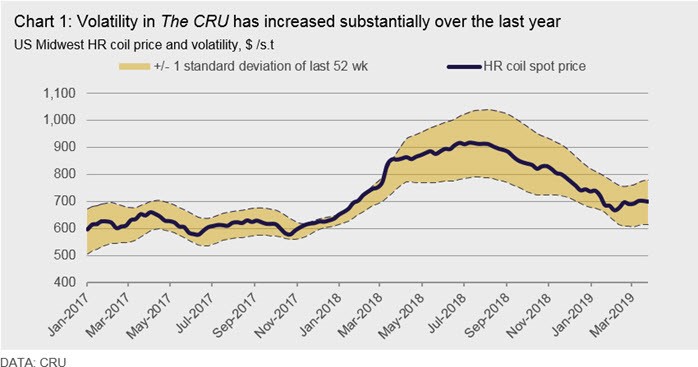

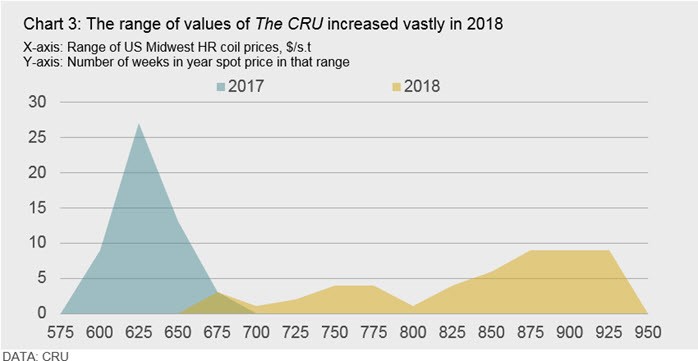

Volatility in U.S. Midwest HR coil prices increased markedly in 2018. One measure of this, standard deviation in weekly data points of “The CRU,” increased from $19 /s.t in 2017 to almost $75 /s.t in 2018 (Chart 1). Meanwhile, the range of prices across the year also increased significantly from $83 /s.t to $330 /s.t (Chart 3).

HRC Futures Volumes and Open Interest Surge in 2018; Reach Record Levels in Q1 2019

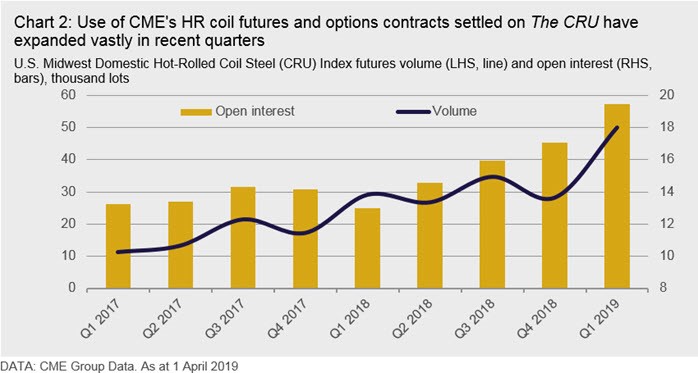

Use of CME HR coil futures and options contracts expanded greatly in 2018 and into 2019, as Chart 2 below shows. Open interest, for example, increased 14 percent y/y in 2018 Q4, over 37 percent y/y in January 2019 and 50 percent y/y in Q1 2019.

This futures contract has enabled users of The CRU to effectively hedge with minimal basis risk, taking advantage of a contract that has grown consistently and increasingly rapidly in liquidity while settling their physical contracts on the index of choice in that market.

In line with increased use of futures by commercial firms, there has also been growth in futures trading activity by financial participants. These firms are hedging their exposures to industry financing or providing liquidity to the market overall. As a consequence, January 2019 saw another monthly record volume in the CME futures. Why have prices become more volatile?

Underlying Causes of Volatility

One of the main sources of volatility in commodity prices is short-term inelasticity in either demand or supply. Unanticipated changes in either that are not immediately matched by the other generate the potential for large variation in spot prices. CRU sees no evidence that speculation in steel futures markets causes physical steel market price volatility. Rather, it is physical market fundamentals as described here that are responsible for creating HR coil price volatility observed over the past year.

Supply Shock

On March 8, 2018, a type of physical market supply disruption came along in the form of confirmation of the extent and degree of Section 232 (S232)—a 25 percent tariff on all steel imports from the vast majority of countries of origin (but with some exemptions that were subsequently removed) and in addition to any pre-existing anti-dumping (AD) or countervailing duties (CVD). This was significant in terms of the level of tariff and considering that before the introduction of S232, c.20 percent of market supply to the USA was from imports.

Steel demand in the short term is price inelastic because it cannot immediately be substituted by another material. Product redesign, retooling and reconfiguration of the supply chain takes time, and comes at a cost.

At the same time, domestic production was unable to respond (i.e. increase) at least immediately to reductions in import volumes. Operating rates of U.S. EAFs serving flat product markets were, for the most part, already high due to good domestic demand at that time. This meant that the most responsive source of domestic supply was somewhat constrained. Meanwhile BOF-based production was certainly unable to respond immediately. Blast furnaces typically require two-three months to bring back on line, and up to four months before they are producing usable iron, assuming sufficient raw materials are available from stock.

Further, decisions to bring back idled BOF-based production were not immediate, with some level of certainty about future market conditions necessary before a restart call. Certain idled facilities were therefore restarted but with some delays, while there were no greenfield developments planned specifically in response to this new pricing environment, in part due to hesitancy to make large investment decisions given forward policy disclarity.

This lack of supply response was exacerbated by low inventory levels at the time in comparison to shipments, resulting in market tightening. While the Trump government’s general trade policy stance was already clear and the market had begun to price in additional protectionist measures, specific details had not been announced until March. Therefore, price rises, ongoing since November 2017, accelerated rapidly in March 2018 when the extent of the action and tariff level became known, with a near-immediate jump in U.S. domestic prices to international levels, plus c.$100 /s.ton in logistics costs plus a further 25 percent.

Policy Uncertainties

Yet despite the March announcement, uncertainties remained around policy specifics and consequences: the possibility of further geographical exemptions and exclusions for slab; potential demand destruction and; simply the duration of the policy. At the time, CRU commented that there was “chaos swirling around the President’s decision.” These questions, like those before, seemed difficult to assess in the absence of good visibility of the decision-making process around the specifics of trade policy. Therefore, a disruption to supply and the wide and variable consequences of it were themselves determined by a policy formation and decision process that was also unpredictable. An example highlighting this was when, to the consternation of established trade partners, the U.S. ended its exemptions from the 25 percent tariff on steel products for Canada, Mexico and the EU two months later at the end of May.

Roller Coaster

Eventually, additional domestic supply came on stream, mainly from existing assets being worked harder. Alongside falls in international steel prices, this resulted in domestic U.S. Midwest HR coil price falls, sometimes rapid, from August 2018. From peak to recent trough, these totaled $250 /s.t, unwinding most but not all of the S232-fulled increases.

But in February 2019, prices started to march back upward, in part as a consequence of a recent tragic event—the Feijão tailings dam collapse in Vale’s Paraopebas complex and subsequent suspension of production in its Southern System (SS) and Southeastern System (SES). For U.S. steel producers, this spells higher iron ore pellet and scrap costs, and higher Brazilian slab costs for a number of rerollers.

These developments, and those which have started to push prices back down most recently, demonstrate that price volatility and its fundamental causes are not going away any time soon. In this uncertain pricing environment, one option available to physical market players is to try and understand the risks and fundamentals driving price better. CRU offers a number of Market Outlook services, including the Steel Sheet Products Market Outlook, in order to meet this need.

In addition, use of financial derivatives markets can be an attractive option to managing price risk. For the vast majority of those who use index-based pricing in the physical market in the USA, the natural choice for this is the U.S. Midwest Domestic Hot-Rolled Coil Steel futures contract from CME Group, as this is settled on CRU’s U.S. Midwest physical price. The use of this contract surged in 2018 in tandem with the increase in price volatility observed for the reasons described above.

Complete Service Bundle

CRU provides insight into physical market fundamentals and provides the physical market HR coil benchmark in North America, The CRU. This is the most trusted and relied-upon price used in the settlement of the vast majority of physical contracts, and in parallel is the settlement price for the U.S. Midwest Domestic Hot-Rolled Coil Steel (CRU) Index futures and options contracts from CME Group.

CME’s futures contracts provide a robust hedging and risk management tool for use by all sectors of the market. CME combines state-of-the-art trading technology and secure central counterparty post-trade risk management to support its markets. Together, these provide the market with the reliable physical market price data and market intelligence and a means to manage price risk in what has proved to be a more volatile pricing environment.

CRU can provide further analysis of these issues as they impact the steel market at this critical point in time—please get in touch and let us help you navigate the market.

To learn how CRU can support your business and to trial our services, please email steel@crugroup.com or click the form button below.

Further details of CME Group’s hot rolled coil steel futures can be found at www.cmegroup.com/ferrous. You can also contact the CME Group metals team at metals@cmegroup.com.