Analysis

March 9, 2025

Final Thoughts

Written by Ethan Bernard

One thing we’ve learned from our survey here at SMU: When prices are rising, people have a lot to say. You can be assured that with our most recent survey, the comments were coming in fast and furious.

Someone even said we might be looking at a kind of grand slam on the prices front:

“The trends would lead us to believe that the domestic suppliers will push for a new all-time high, which is well above $1,000.”

While the language of that comment was somewhat analytical, another survey participant expressed a similar sentiment but in a different manner.

“The wave is big enough to keep ridin’ it.”

To that I can only reply: Cowabunga, dude.

But it’s not all sunshine and roses.

A recurrent theme was this: Buyers worried mills would yank up prices way too fast in a fit of exuberance. Make a lot of money. Only to see prices crash painfully back to earth. (I think we’ve seen that movie before.)

Another concern was that underlying demand just wasn’t there to match the rapid pace of price hikes. Additionally, with sky-high prices, imports could still be profitable – tariff or no tariff.

As we’ve noted in past issues, lead times are extending, and mills show almost no willingness to negotiate lower spot prices. Despite the potential price risks, our Buyers’ Sentiment Indices remain rather strong. Welcome to 2025 and Trump 2.0.

So now let’s give the slides and the survey participant comments a chance to do the talking.

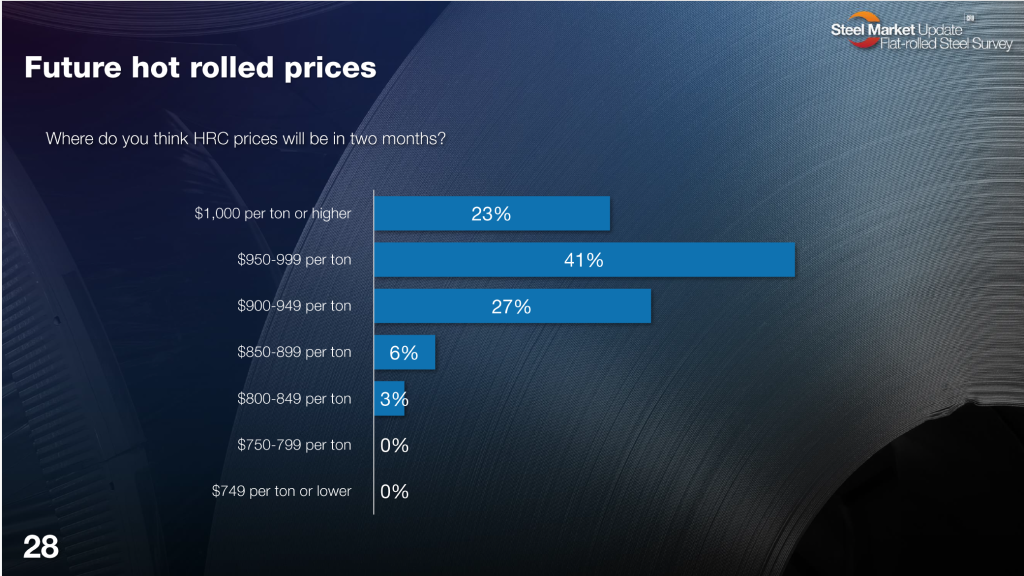

Where do you think HRC prices will be in two months?

“Lack of imported steel availability (due to price after duty) to meet even the weak domestic demand.”

“Impact of tariffs.”

“Tariff speculation.”

“Price hikes driven by tariffs could shake up the market.”

“This is a good landing spot after such a drop the last year.”

“HR is approaching pricing that will allow foreign imports to deliver and simply add the tariff burden while remaining competitive.”

“I expect leveling of prices after the March initial tariffs.”

“Underlying demand isn’t strong enough to support pricing levels above $900/ton.”

“Prices will go up. But true demand is unclear.”

“I hope that domestic mills don’t get too greedy as we will not be competitive.”

“If the mills go too high, foreign companies can afford the tariff.”

“US manufacturers need to stay disciplined and not price themselves out of the market, even with 25% tariffs on foreign steel.”

“I don’t feel that the mills are ready to slow down the increases.”

“I think buyers will push back and start to draw down inventories as higher contract prices set in, imports start to flow again, and maintenance outages will be finished up. This will lead to lead times reducing.”

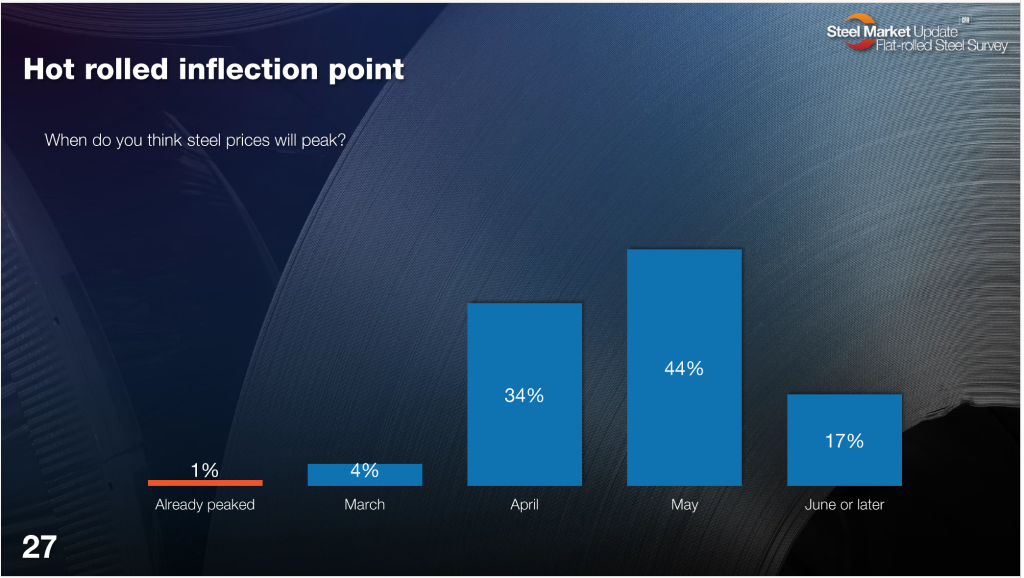

That covers where survey participants see prices in two months. When do they think the roller coaster will hit the top of its climb? While no month held a majority, 44% of our respondents saw prices peaking in May.

When do you think steel prices will peak?

“Reciprocal tariffs will hit steel imported from rest of the world (ex-USMCA).”

“The domestic suppliers have been pushing for an upward trend in pricing for some time. The tariffs have given them the ammunition they needed to push pricing up. We have seen how they handle tariffs on foreign steel in the past. I expect domestic steel producers to increase pricing.”

“Peak timing: Prices are likely to peak within the next six to 12 months, driven by continued supply chain disruptions, energy costs, and geopolitical risks.”

“The impact of tariffs will continue to impact steel pricing for the balance of the year.”

“Domestic mills are chasing buyers to source offshore.”

“I don’t believe the tariffs will be there much longer than 60 days.”

“Imports will be arriving.”

“Tariff cloud will have started to clear and scrap will correct.”

“Tariffs and trade cases will restrict supply.”

“Service center are holding pricing until 3rd quarter.”

“Mills have the advantage, but the demand won’t sustain a long upward trend.”

“I feel June or later, with the caveat that major deals aren’t negotiated to significantly impact tariffs that are due to go into effect within the next couple weeks.”

“This could last longer than May, but demand currently is not strong enough to maintain mill price strength.”

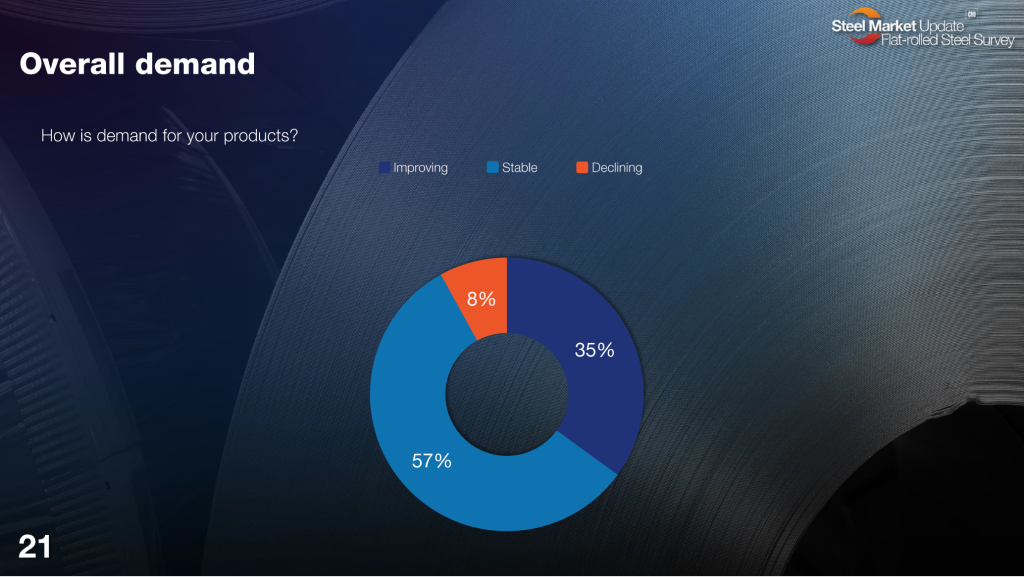

Finally, you might note that some of the comments above fretted about demand. What did our survey respondents have to say when asked directly about that?

Despite the rocketing prices, the majority of our survey participants found demand to be stable, and 35% thought it was improving. Of note, only 8% said it was declining.

How is demand for your products?

“Everyone wants to buy domestic.”

“Reduction in demand due to tariffs.”

“We have had decent order bookings in the last month.”

“No increase in demand yet, but the phones are ringing.”

“Customers are committing further out, but their demand is not increasing.”

“We have yet to see big spends get released. Customers still seem to be concerned about the macroeconomy.”

“The most noticeable effect on demand is that orders are getting pulled in to beat future price increases.”

“Consumers worried about lack of scrap imports.”

There you have it. And that’s just three survey questions out of the dozens we explore. Our premium-level subscribers can find the full steel survey results here. You might want to check out our scrap survey results while you’re at it. Those are here.

If this has piqued your interest, and you’re not a premium member yet, there’s no time like the present to sign up. If you want to upgrade from executive to premium, please contact SMU sales executive Luis Corona at luis.corona@crugroup.com.

In our next steel survey, which we’ll release on March 21, chances are we are going to have another bonanza of insightful data. We can’t wait. And, as always, we appreciate all of your support.