Market Data

February 4, 2025

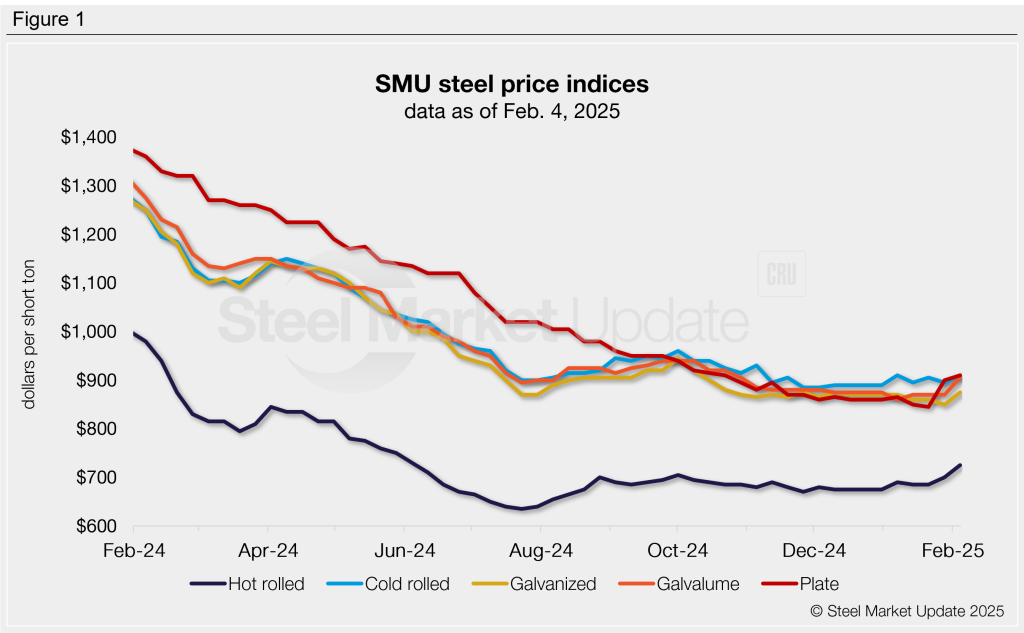

SMU price ranges: Market picks up steam

Written by Brett Linton

SMU’s steel price indices rose across the board this week. Sheet prices increased as much as $35 per short ton (st) compared to last week, while our average plate price ticked up by $10/st.

Our hot-rolled steel index climbed for the second consecutive week, rising $25/st week over week (w/w) to $725/st. Hot-rolled tags are now at their highest rate since June 2024.

Cold-rolled prices rose to $910/st, tied with early January for a three-month high.

Our galvanized index jumped to $875/st, now back to levels last seen in early December. Galvalume prices also gained traction, rising to a 14-week high of $905/st.

Plate prices increased for the second week in a row, reaching a near-four-month high of $910/st this week.

SMU’s price momentum indicator is now at higher for all sheet and plate products, following last week’s adjustment to higher for hot-rolled coil and plate.

Refer to Table 1 for the latest SMU steel price indices and how prices have trended in recent weeks.

Hot-rolled coil

The SMU price range is $690-760/st, averaging $725/st FOB mill, east of the Rockies. The lower end of our range is up $10/st w/w, while the top end is up $40/st w/w. Our overall average is up $25/st w/w. Our price momentum indicator for hot-rolled steel remains at higher, meaning we expect prices to increase over the next 30 days.

Hot rolled lead times range from 4-6 weeks, averaging 5.0 weeks as of our Jan. 22 market survey. We will publish updated lead times in our Thursday issue.

Cold-rolled coil

The SMU price range is $870–950/st, averaging $910/st FOB mill, east of the Rockies. The lower end of our range is up $30/st w/w, while the top end is unchanged. Our overall average is up $15/st w/w. Our price momentum indicator for cold-rolled steel has been adjusted to higher, meaning we expect prices to increase over the next 30 days.

Cold rolled lead times range from 4-8 weeks, averaging 6.6 weeks through our latest survey.

Galvanized coil

The SMU price range is $840–910/st, averaging $875/st FOB mill, east of the Rockies. The lower end of our range is up $20/st w/w, while the top end is up $30/st w/w. Our overall average is up $25/st w/w. Our price momentum indicator for galvanized steel has been adjusted to higher, meaning we expect prices to increase over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $937–1,007/st, averaging $972/st FOB mill, east of the Rockies.

Galvanized lead times range from 4-8 weeks, averaging 6.4 weeks through our latest survey.

Galvalume coil

The SMU price range is $840–970/st, averaging $905/st FOB mill, east of the Rockies. The lower end of our range is up $10/st w/w, while the top end is up $60/st w/w. Our overall average is up $35/st w/w. Our price momentum indicator for Galvalume steel has been adjusted to higher, meaning we expect prices to increase over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,134–1,264/st, averaging $1,199/st FOB mill, east of the Rockies.

Galvalume lead times range from 4-8 weeks, averaging 6.5 weeks through our latest survey.

Plate

The SMU price range is $850–970/st, averaging $910/st FOB mill. The lower end of our range is down $10/st w/w, while the top end is up $30/st w/w. Our overall average is up $10/st w/w. Our price momentum indicator for plate remains at higher, meaning we expect prices to increase over the next 30 days.

Plate lead times range from 2-6 weeks, averaging 4.5 weeks through our latest survey.

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.