Market Data

January 21, 2025

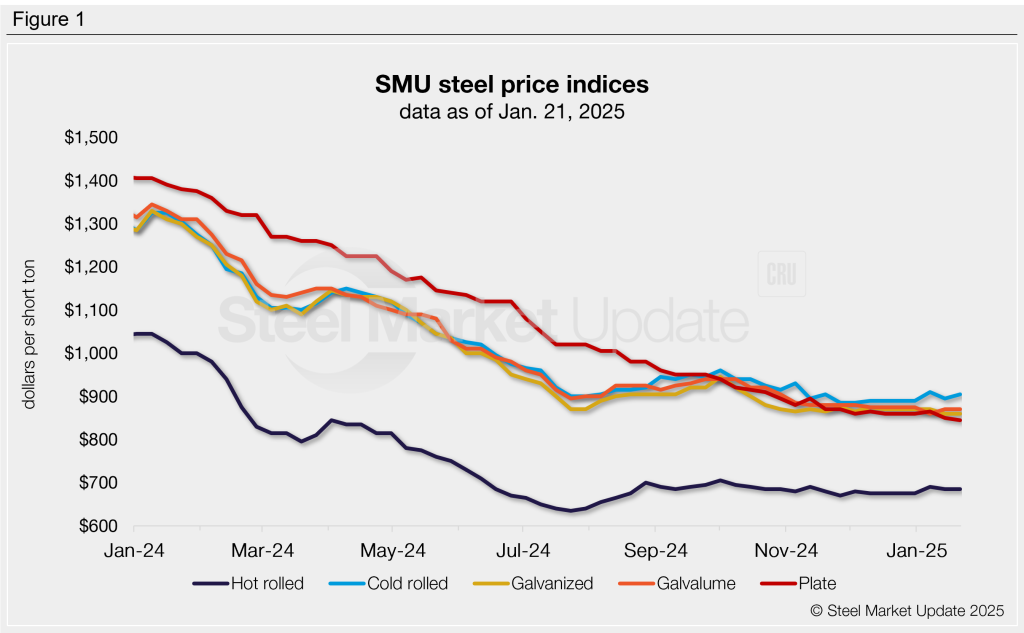

SMU price ranges: Market in holding pattern as clarity sought on Trump tariffs

Written by Brett Linton & Michael Cowden

Sheet and plate prices remained in a holding pattern this week as the market awaited more specifics on potential Trump administration tariffs.

Prices and momentum

SMU’s hot-rolled coil price is unchanged $685 per short ton (st). Our cold-rolled coil price stands at $905/st, up $10/st from a week ago.

Galvanized and Galvalume base prices, meanwhile, remain unchanged at $860/st and $870/st, respectively. Lead times are as short as approximately four weeks at one major mill.

On the plate side, prices slipped to $845/st on average, down $5/st vs. a week ago.

Our momentum indicators remain at neutral as we wait for more clarity on US trade policy and for the market to establish a clear direction.

Market commentary

Certain Canadian mills have paused shipments as they wait to see what might happen with tariffs. A major Mexican mill, in contrast but for the same reason, continued to ship, market participants said.

Recall that President Donald Trump on his first day in office said he was thinking about applying 25% across-the-board tariffs on imports from Canada and Mexico as soon as Feb. 1. And sources said other nations could face tariffs as well, with some noting a potential expansion of Section 232 tariffs.

The trade threats had customers all along the supply chain, from scrap suppliers to steel consumers, questioning what might happen next and how to react.

But in some corners of the market, the fact that tariffs weren’t applied immediately was interpreted as an invitation from the Trump administration to foreign nations to negotiate – and in doing so, to avoid tariffs.

There was also some optimism on the hot-rolled coil side that Trump policies aimed at boosting oil and gas drilling could increase demand for oil country tubular goods (OCTG) and line pipe. Certain sheet mills might already have seen an uptick in orders (and an extension of lead times) because of that, market participants said.

The tone was muted on the plate side. Any new demand for energy tubulars would probably benefit sheet more than plate. And President Trump’s antipathy toward wind energy could leave plate mills without demand from what had previously been considered a growth market.

Cold enough for you?

Another big talking point had nothing to do with politics. Namely, the weather. With freezing temperatures and snow as far south as Houston, some market participants questioned whether we could see the kind of outages that sparked a supply squeeze in early 2021.

But others noted that it was the power outages, not the snow, that caused “Snowmageddon” in early 2021. Assuming there are no power cuts, the biggest impact should be a few days of snarled shipments before the market returns to normal, they said.

Hot-rolled coil

The SMU price range is $660-710/st, averaging $685/st FOB mill, east of the Rockies. The lower end of our range is up $10/st w/w, while the top end is down $10/st w/w. Our overall average is unchanged w/w. Our price momentum indicator for hot-rolled steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Hot rolled lead times range from 3-7 weeks, averaging 4.7 weeks as of our Jan. 8 market survey. We will publish updated lead times this Thursday.

Cold-rolled coil

The SMU price range is $870–940/st, averaging $905/st FOB mill, east of the Rockies. The lower end of our range is up $20/st w/w, while the top end is unchanged w/w. Our overall average is up $10/st w/w. Our price momentum indicator for cold-rolled steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Cold rolled lead times range from 5-8 weeks, averaging 6.4 weeks through our latest survey.

Galvanized coil

The SMU price range is $820–900/st, averaging $860/st FOB mill, east of the Rockies. Our range is unchanged w/w. Our price momentum indicator for galvanized steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $917–997/st, averaging $957/st FOB mill, east of the Rockies.

Galvanized lead times range from 5-8 weeks, averaging 6.7 weeks through our latest survey.

Galvalume coil

The SMU price range is $830–910/st, averaging $870/st FOB mill, east of the Rockies. Our range is unchanged w/w. Our price momentum indicator for Galvalume steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,124–1,204/st, averaging $1,164/st FOB mill, east of the Rockies.

Galvalume lead times range from 6-8 weeks, averaging 7.0 weeks through our latest survey.

Plate

The SMU price range is $800–890/st, averaging $845/st FOB mill. The lower end of our range is down $20/st w/w, while the top end is up $10/st w/w. Our overall average is down $5/st w/w. Our price momentum indicator for plate remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Plate lead times range from 2-6 weeks, averaging 3.9 weeks through our latest survey.

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

Brett Linton

Read more from Brett Linton