Market Data

December 5, 2024

Hot rolled vs. galvanized price spread nears 16-month low

Written by Brett Linton

The price premium that galvanized-coil holds over hot-rolled (HR) coil has stabilized over the past two months. This week, the spread between these two products is only a few dollars away from a 16-month low.

Recent prices

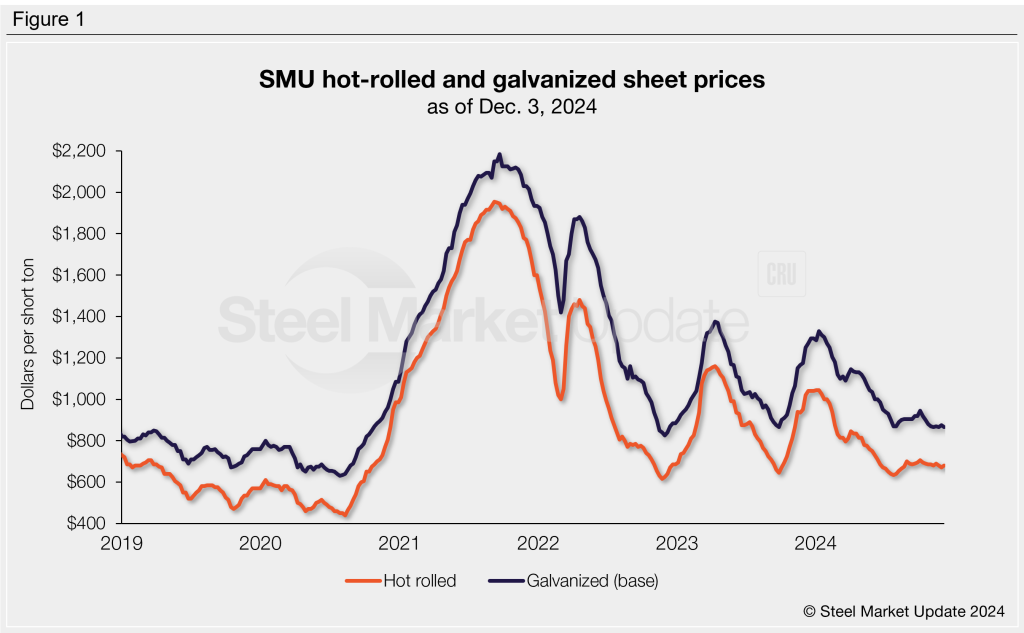

SMU’s hot-rolled coil price ticked up $10 per short ton (st) this week to $680/st. HR prices have fluctuated within a relatively narrow range of $670-705/st for nearly four months. Prices touched a four-month high in early October but have since trended lower, currently at the second-lowest level recorded in the last 16 weeks. Recall the 19-month low HR price of $635/st recorded back in July.

This week our galvanized index eased $10/st week over week (w/w) to $865/st (base price with no extras included). This is tied with two weeks in November for the lowest price recorded since September 2023. Like hot rolled, galvanized prices have trended lower since early October. Across 2024, prices had risen as high as $1,330/st at the beginning of the year.

Figure 1 graphs the pricing relationship between these two products over the last five years.

Galvanized premium

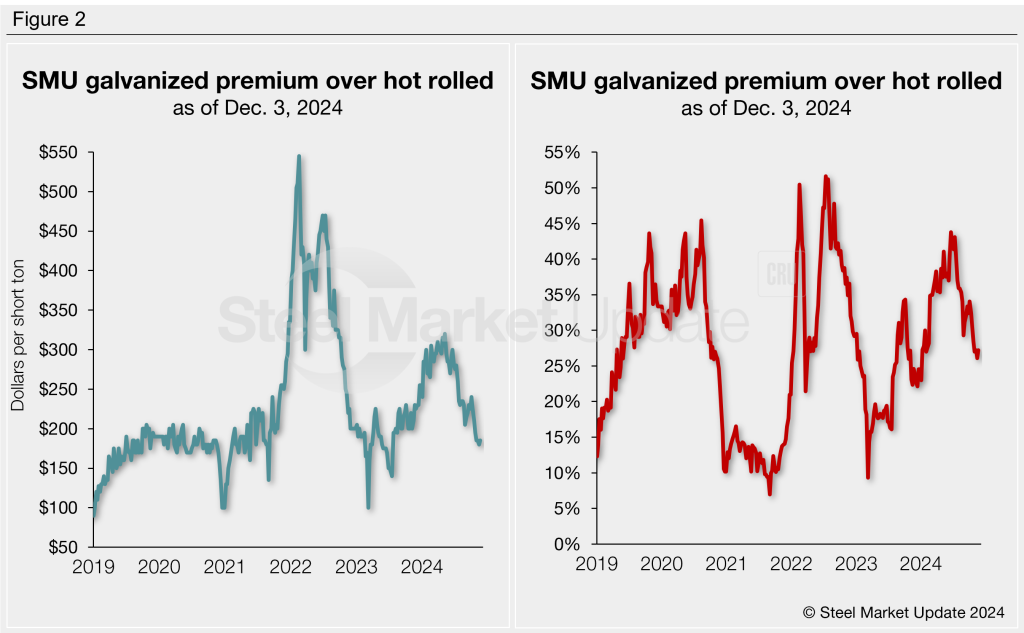

As shown on the left of Figure 2, the relationship between hot rolled and galvanized prices turned volatile in late 2021.

Galvanized currently holds a $185/st price premium over hot-rolled steel. This is one of the lowest spreads seen since July 2023, only higher than the mid-November spread of $180/st. The spreads we have experienced over the past two months are similar to those seen in the second half of 2023.

Looking across the last 12 months, the spread was $230/st this time last year and was beginning to grow. It peaked in May at $320/st, then gradually declined to where we are today. The average spread over the last 12 months was $257/st. For historical reference, we saw pre-pandemic spreads mostly between $85-220/st for over a decade.

Another way to compare these two products is to look at the galvanized premium as a percentage rather than a dollar value. The right graph in Figure 2 shows the hot-rolled/galvanized price spread as a percentage of the hot rolled price.

The percentage premium paints a slightly different picture than the dollar premium. The latest percentage premium is down to 27%, one of the lower measures across the last 10 months. The premium had reached an almost two-year high of 44% in June of this year, an upwards trend generally witnessed since March 2023 (when the premium had fallen to 9%). This time last year the premium was smaller at 23%.

Prior to the pandemic volatility, galvanized prices held an average premium of 24% above hot rolled prices from 2017 through the end of 2021. The premium reached a record high of 52% in July 2022.