Analysis

November 3, 2024

Final Thoughts

Written by Brett Linton & Ethan Bernard

Next week promises to be a big week for the country. Could even top the World Series. (Congrats to the Dodgers). As we all hold our breath to see what happens next, it’s a good time to reflect.

A big question, outside the Beltway, is whether recently announced price hikes will hold. Opinions are mixed. Pricing directions for different products are mixed. Yes, it’s mixed.

Sometimes, the best thing to do in such a situation is to pore over recent data and draw your own conclusions. Luckily, we have a lot of that data at no more than a click away. We’ve moved from October to November, and thus we have provided you with a bunch of metrics to use in any way you see fit.

Feed them into Excel, into the AI of your choice, have a spirited conversation about them with a co-worker, or even pour tea leaves over them and see what they say — the choice is yours.

Without further ado, we present October at a glance.

SMU’s October at a glance

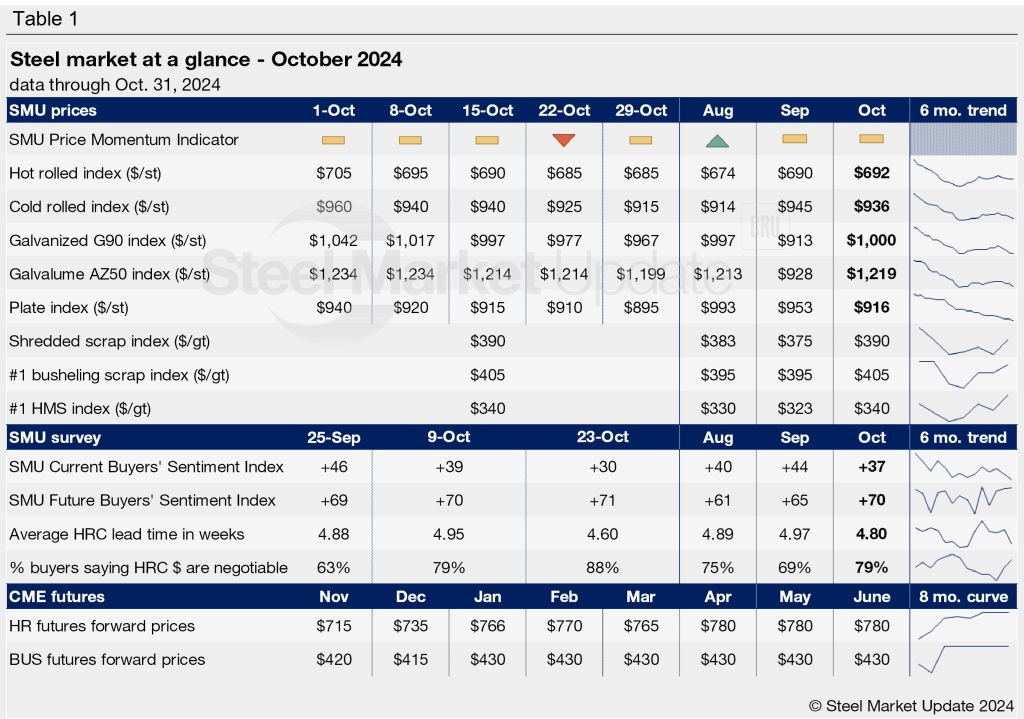

SMU’s Monthly Review provides a summary of important steel market metrics for the previous month. Our latest report includes data updated through Oct. 31.

Steel prices for both sheet and plate products eased across October. Sheet prices remained near multi-month lows, similar to late July/early August levels, while plate prices continued to edge lower from their mid-2022 peak.

This past week, both U.S. Steel and Nucor announced price increases on sheet products, though the impact has yet to be felt in the market. SSAB announced a plate price increase on Oct. 24, while Nucor reduced its plate prices on Oct. 30. When polled at the start of this week, buyers’ expectations for future prices varied.

The SMU Price Momentum Indicator closed the month of October at Neutral for both sheet and plate products. Price momentum on sheet products was briefly adjusted to Lower on Oct. 22. It reverted back to Neutral one week later on Oct. 29 as we wait to see whether the price increases will stick or not. After a six-month period at Lower, our Price Momentum Indicator for plate was adjusted to Neutral on Oct. 29 for similar reasons.

October saw increased scrap prices and marked just the second month of 2024 to see month-over-month increases in prices for shredded, busheling, and heavy melt scrap. Prices rose by $10-18 per gross ton from September to highs last seen earlier this year. Buyers are not as optimistic for November, expecting a sideways to down market this month.

Steel Buyers’ Sentiment steadily declined across October, falling to a four-year low by the end of the month. Our Current Sentiment Index suggests buyers are still optimistic about their businesses’ ability to succeed in today’s market, albeit not as positive as they were in prior months. Our Future Sentiment Index continues to indicate that buyers foresee favorable business conditions into 2025.

Steel mill lead times shortened throughout the month, returning to lows that were last seen in July. By the end of October, more than nine out of every 10 steel buyers we surveyed reported that mills are willing to negotiate pricing on new orders, with rates climbing to a multi-year high.

See the table below for other key October metrics (click here to expand). Historical monthly review table can be found on our website.

Brett Linton

Read more from Brett Linton