Plate

October 22, 2024

SMU price ranges: Sheet and plate slip as market chugs along

Written by Brett Linton

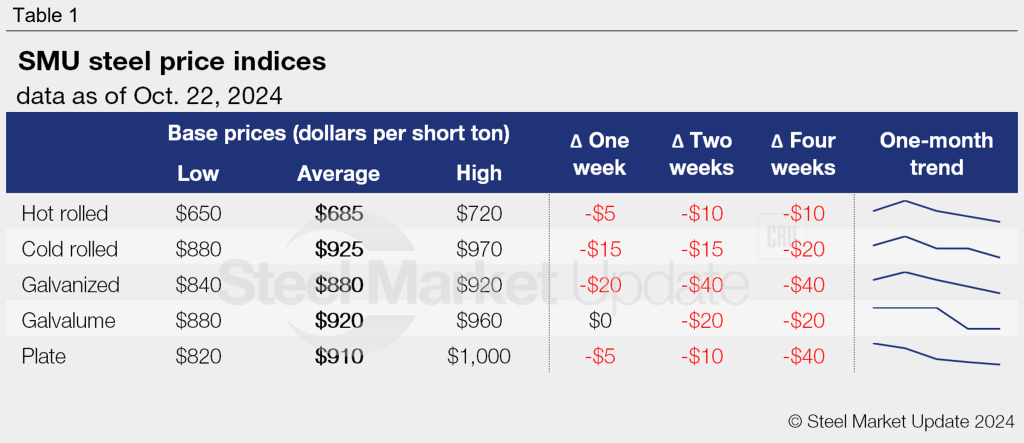

Steel prices ticked lower again this week for most of the products SMU tracks. Our indices have declined as much as $40 per short ton (st) across the last four weeks.

Sheet prices are now at or near some of the lowest levels observed since August. Plate prices continue to slowly recede from their mid-2022 peak. They declined this week for the fourth consecutive week.

Buyers see no strong indications that the market will move upward in the near future, especially with the election and holidays right around the corner. As previously reported, mill lead times remain short, and the majority of buyers say mills are willing to talk price on new orders.

In light of this, SMU’s sheet price momentum indicator has been adjusted from Neutral to Lower this week. Prior to this week, sheet momentum had been at Neutral for six weeks. Recall that sheet momentum was previously at Lower earlier this year between May 7 and July 29. Our plate price momentum indicator remains at Lower, as it has been for nearly six months.

SMU’s hot-rolled steel index declined by $5/st w/w to $685/st this week, while cold rolled slipped $15/st to $925/st. Our galvanized index eased $20/st w/w to $880/st, while Galvalume held steady at $920/st. Plate prices fell $5 w/w to $910/st – a low not seen in more than three and a half years.

Hot-rolled coil

The SMU price range is $650-720/st, averaging $685/st FOB mill, east of the Rockies. The lower end of our range is down $10/st w/w, while the top end is unchanged w/w. Our overall average is down $5/st w/w. Our price momentum indicator for hot-rolled steel has been adjusted to lower, meaning we expect prices to decline over the next 30 days.

Hot rolled lead times range from 3-7 weeks, averaging 5.0 weeks as of our Oct. 9 market survey. We will publish updated lead times this Thursday.

Cold-rolled coil

The SMU price range is $880–970/st, averaging $925/st FOB mill, east of the Rockies. The lower end of our range is down $20/st w/w, while the top end is down $10/st w/w. Our overall average is down $15/st w/w. Our price momentum indicator for cold-rolled steel has been adjusted to lower, meaning we expect prices to decline over the next 30 days.

Cold rolled lead times range from 4-9 weeks, averaging 6.9 weeks through our latest survey.

Galvanized coil

The SMU price range is $840–920/st, averaging $880/st FOB mill, east of the Rockies. The lower end of our range is down $40/st w/w, while the top end is unchanged w/w. Our overall average is down $20/st w/w. Our price momentum indicator for galvanized steel has been adjusted to lower, meaning we expect prices to decline over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $937–1,017/st, averaging $977/st FOB mill, east of the Rockies.

Galvanized lead times range from 5-10 weeks, averaging 7.1 weeks through our latest survey.

Galvalume coil

The SMU price range is $880–960/st, averaging $920/st FOB mill, east of the Rockies. Our range is unchanged w/w. Our price momentum indicator for Galvalume steel has been adjusted to lower, meaning we expect prices to decline over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,174–1,254/st, averaging $1,214/st FOB mill, east of the Rockies.

Galvalume lead times range from 6-9 weeks, averaging 7.5 weeks through our latest survey.

Plate

The SMU price range is $820–1,000/st, averaging $910/st FOB mill. The lower end of our range is down $40/st w/w, while the top end is up $30/st w/w. Our overall average is down $5/st w/w. Our price momentum indicator for plate remains at lower, meaning we expect prices to decline over the next 30 days.

Plate lead times range from 2-6 weeks, averaging 4.2 weeks through our latest survey.

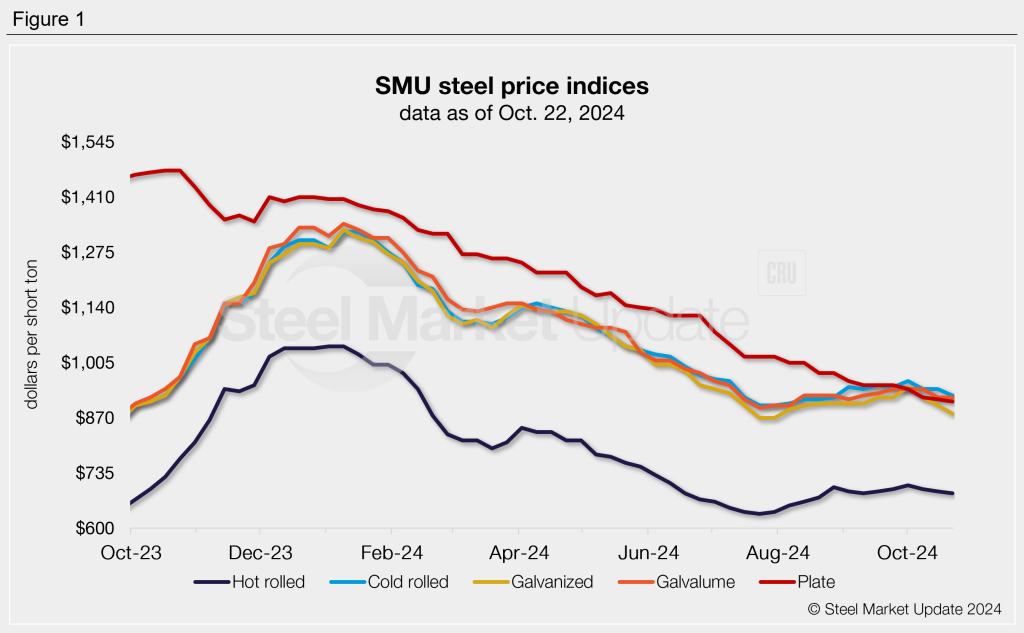

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.