Plate

October 15, 2024

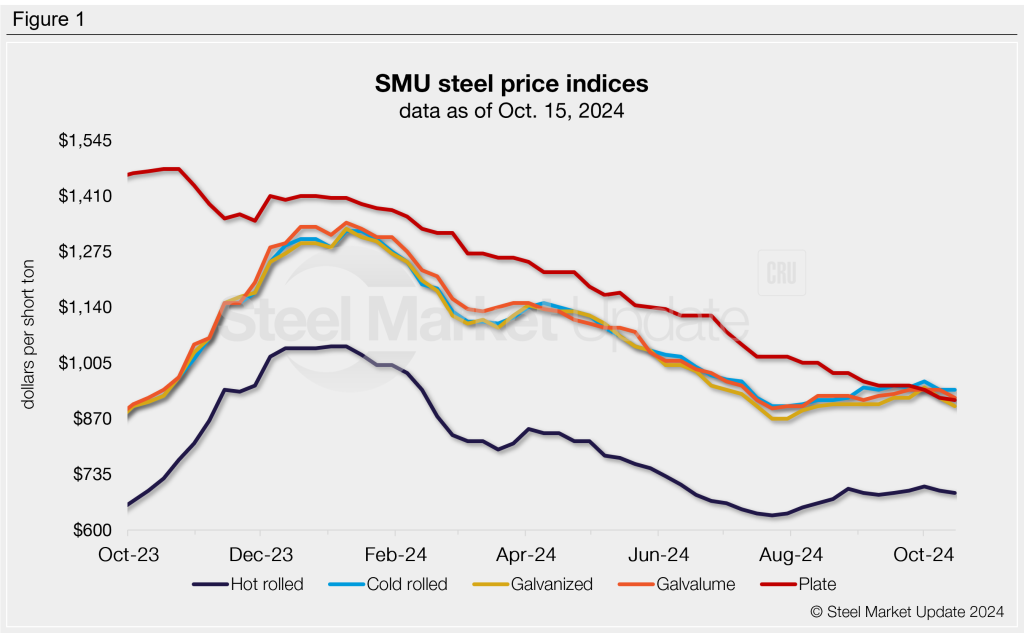

SMU price ranges: Most sheet and plate products drift lower

Written by Brett Linton

Sheet prices mostly edged lower for a second week, reverting to levels seen in the first half of September, while plate prices slipped for the third consecutive week.

SMU price indices for hot-rolled, galvanized, Galvalume, and plate steels declined $5-20 per short ton (st) from last week. Our cold rolled index was unchanged week over week (w/w). Prices are down $15-45/st from the start of the month.

Some buyers expect prices to continue to drift lower as fall maintenance outages linger and mills entertain year-end deals. As we reported last week, mill lead times remain historically low, and most buyers report that mill prices are negotiable for new orders. Also supporting lower prices are seasonally high service center inventories, as we reported to Premium members earlier today.

SMU’s hot-rolled steel index decreased $5/st from last week to $690/st, while cold rolled held steady at $940/st. Our galvanized and Galvalume indices both slipped $20/st to $900/st and $920/st, respectively. Average plate prices eased $5/st to $915/st, a level not seen since the first week of 2021.

SMU’s sheet price momentum indicator remains at neutral following our Sept. 10 adjustment. Our plate price momentum indicator remains pointing lower.

Hot-rolled coil

This week’s SMU price range is $660-720/st, averaging $690/st FOB mill, east of the Rockies. The lower end of our range is unchanged w/w, while the top end is down $10/st. Our overall average is down $5/st. Our price momentum indicator for hot-rolled sheet remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Hot rolled lead times range from 3-7 weeks, averaging 5.0 weeks as of our Oct. 9 market survey.

Cold-rolled coil

SMU’s price range is unchanged from last week at $900–980/st, with an average of $940/st FOB mill, east of the Rockies. Our price momentum indicator for cold-rolled steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Cold rolled lead times range from 4-9 weeks, averaging 6.9 weeks through our latest survey.

Galvanized coil

The SMU price range is $880–920/st, averaging $900/st FOB mill, east of the Rockies. The lower end of our range is unchanged w/w, while the top end is down $40/st. Our overall average is down $20/st. Our price momentum indicator for galvanized steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $977–1,017/st, averaging $997/st FOB mill, east of the Rockies.

Galvanized lead times range from 5-10 weeks, averaging 7.1 weeks through our latest survey.

Galvalume coil

The SMU price range is $880–960/st, with an average of $920/st FOB mill, east of the Rockies. The lower end of our range is down $20/st w/w, as is the top end of our range. Our overall average is down $20/st w/w. Our price momentum indicator for Galvalume steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,174–1,254/st, averaging $1,214/st FOB mill, east of the Rockies.

Galvalume lead times range from 6-9 weeks, averaging 7.5 weeks through our latest survey.

Plate

This week’s SMU price range is $860–970/st, averaging $915/st FOB mill. The lower end of our range is unchanged w/w, while the top end is down $10/st. Our overall average is down $5/st. Our price momentum indicator for plate remains at lower, meaning we expect prices to decline over the next 30 days.

Plate lead times range from 2-6 weeks, averaging 4.2 weeks through our latest survey.

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.