Analysis

September 15, 2024

Final thoughts

Written by Michael Cowden

We got a little flack for adjusting our sheet momentum indicators to neutral last week. To be clear, we didn’t adjust them to lower. Part of the reason we moved them to neutral was because there are some unusual cross-currents in the current market.

On the news side, you could make a case that there should nowhere to go but up.

US mills continue to push to increase prices (Nucor publicly so), even if it’s incrementally compared to the triple-digit price hikes we’ve seen at times over the last three years.

Futures markets roared back to life last week on the news that Cleveland-Cliffs would place the C-6 furnace at Cleveland Works on hot-idle until demand improves (aka indefinitely).

And a wide-ranging trade case against imports of coated sheet could have broad repercussions as more traders and overseas mills stop offering into the US market. (And as some US customers pivot toward domestic sources.)

Coated case update

SMU’s Laura Miller has a good summary of the potential market impact and of key dates in the case here. As she notes, the next important date is Wednesday, Sept. 25. That’s when US Department of Commerce will decide whether to move forward with the case.

Here two more date that merit repeating:

“If claims of critical circumstances are verified, duties can be applied retroactively 90 days. That means the CPB could begin collecting CVDs on CORE material that entered the country as early as Aug. 31, and ADs as early as mid-November.”

You can see why some companies have already hit the pause button on imports of galvanized, Galvalume, and aluminized from certain countries targeted in the case.

It’s also worth noting that while several domestic mills are participating in the case, they’re not all on the same page. Nucor, for example, did not join the petition against Mexico – where it operates a sizeable coating joint venture with the Japanese steelmaker JFE.

And U.S. Steel, Wheeling-Nippon and the United Steelworkers (USW) union are sitting out the portion of the case against Canada. As Miller notes, the USW has 225,000 members in Canada.

Survey says

So why didn’t we keep our sheet momentum indicators pointed toward higher? At risk of stating the obvious, blast furnaces aren’t typically idled indefinitely when demand is great. And we hear from many of you that demand is anything but great.

We see that reflected in our survey data as well. Buyer sentiment has slipped following a Steel Summit bounce in late August. And it remains well below year-ago levels. Sheet lead times, meanwhile, have dipped lately. Also, most steel buyers say that mills – despite the coated trade case, price increases, and the Cliffs idling – remain willing to negotiate lower prices.

You can see why that’s the case if you dive a little deeper into the results.

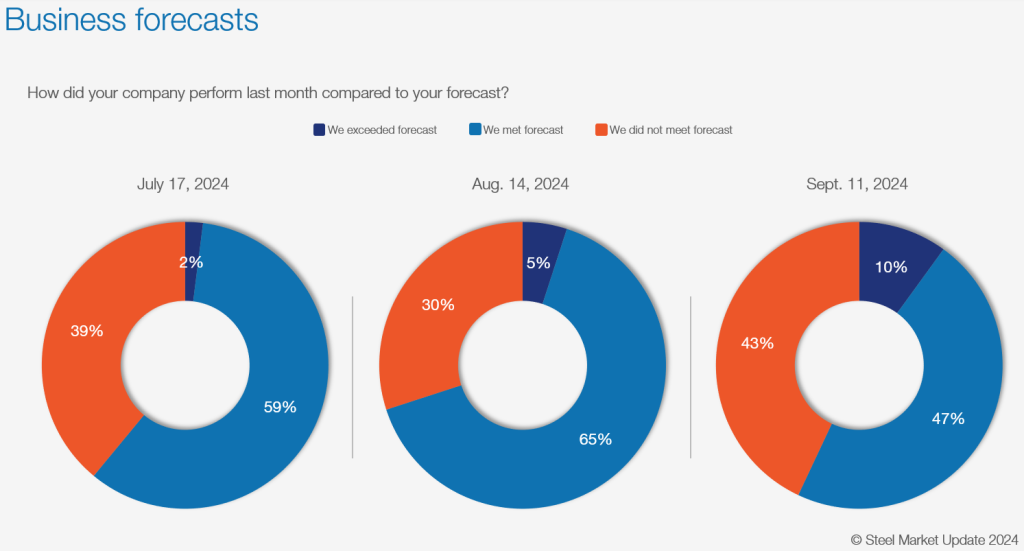

For starters, nearly 45% of survey respondents tell us that they did not meet forecast last month. That’s the highest reading we’ve had on that question since we started asking it a few years years ago.

Here is what some respondents had to say on the matter:

“Slightly down, but seasonally predictable.”

“Mixed bag, some locales exceeded forecast others did not.”

“Most customers are fairly flat.”

“Some softness in automotive and spot.”

“Nobody is meeting their forecast in 2024 – this year sucks.”

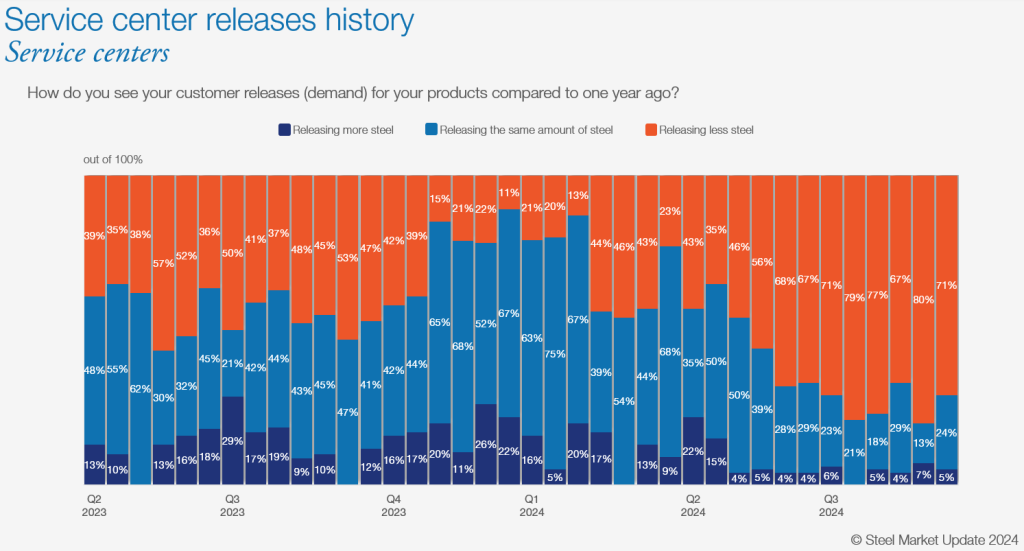

Also, most service center respondents say that they’re releasing less steel than a year ago.

We haven’t seen a sustained period of approximately 70-80% saying they’re releasing less steel year over year since the spring of 2020.

I don’t want to go too far down the rabbit hole with comparisons to spring 2020. But we saw something similar when it comes to service centers’ sheet inventories for July. I’m curious to see whether that will remain the case when we release sheet inventories for August this week to our premium subscribers. (If you’d like to upgrade from executive to premium, please contact our account executive, Luis Corona, at luis.corona@crugroup.com.)

Given all that, why didn’t we take the more radical step of adjusting our momentum indicators to lower?

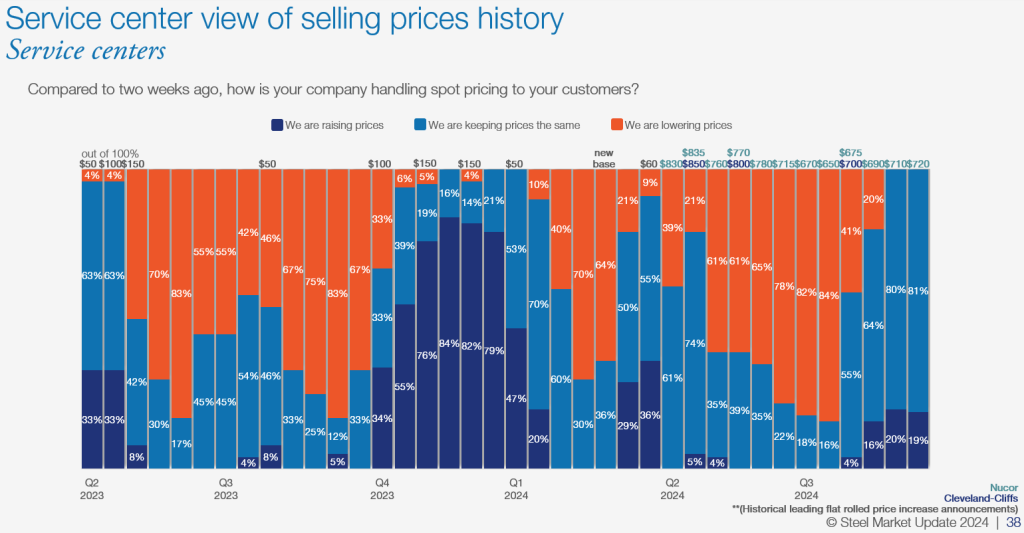

For one, most service centers are at least holding the line on prices. Some are trying to increase them. And none tell us that they are cutting prices.

That’s a massive change from July and early August when approximately 80-85% of centers said they were cutting prices. Not surprisingly, the shift occurred when mills stopped lowering prices.

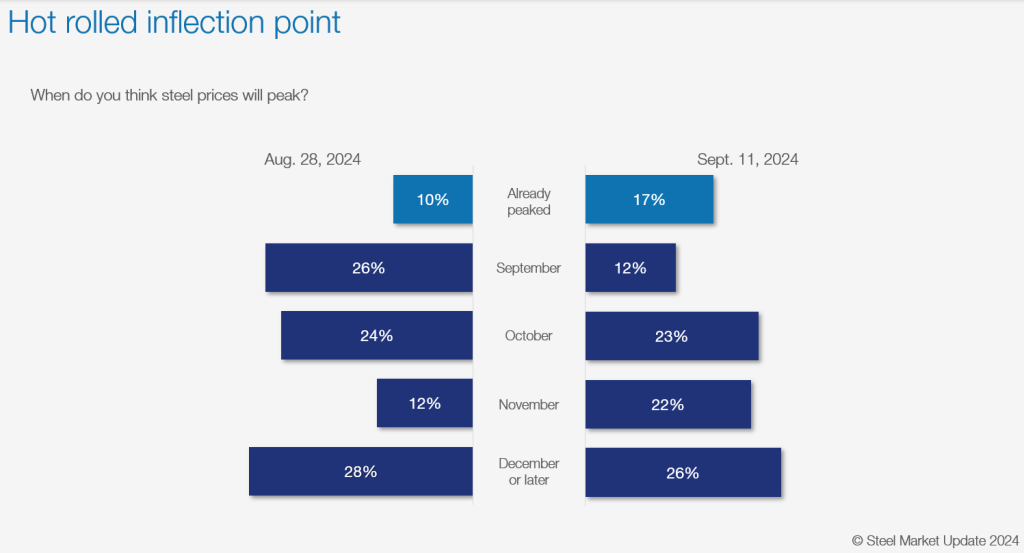

Also, most survey respondents tell us that prices haven’t peaked yet. In fact, only 17% say they have.

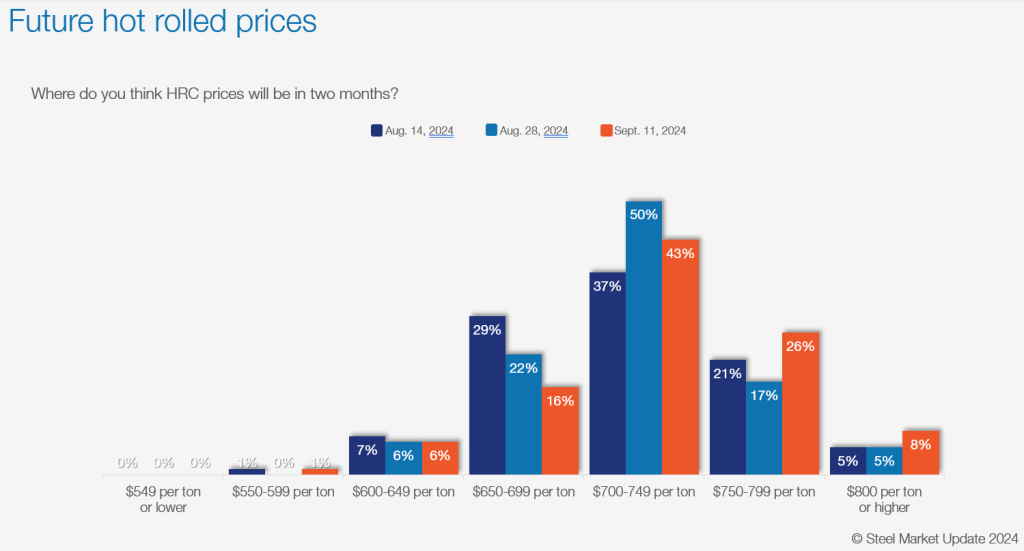

That said, most see prices hot-rolled (HR) coil prices rising into the $700s per short ton (st) over the next two months – not much higher than where we are now. Only 8% see HR going to $800/st or higher by mid-November.

Here is what some survey respondents had to say on the question of future HR prices:

“Small upward trend due to outages taking our 1 million tons of steel from the supply side.”

“Soft demand for flat rolled even with outages. Up but not too much.”

“Protectionism by domestic mills will keep prices up. Higher raw material costs too.”

“Mills are getting aggressive with their increase announcements and need to be in the $700s.”

“No real, strong drivers either direction. Mills setting the bottom.”

“If demand was better, it would go higher.”

“Very soft demand, but mills showing some discipline (for now).”

“We are obviously bearish on this ‘rally.’ We just still see poor-to-Ok demand and plenty of capacity out there (even with the mill outages).”

“Maybe lower. Weak demand and mills unwilling to take down any capacity.”

“Indirect effect of the trade cases and slight improvement in the market in general.”

Another date to watch

Reuters reports that the Committee on Foreign Investment in the United States (CFIUS) has until Monday, Sept. 23, to decide whether the nearly $15 billion acquisition of U.S. Steel by Japan’s Nippon Steel poses a national security threat.

If the committee decides there is a threat to US interests, then the White House could block the deal. As Ethan Bernard noted last week, we at SMU don’t pretend to know how that process might unfold.

Especially in an election season, it’s hard to tell which developments are significant and which might be floating potential outcomes to test public reaction.

SMU Community Chat and Hedging 101

Our next Community Chat will be on Wednesday, Sept. 18, at 11 am with Steel Warehouse Chief Commercial Officer Marc Lerman. You can register here.

We’re excited to start off our fall series of webinars. We’re hoping you’re looking forward to it to. Don’t forget to bring a good question or two to the discussion.

Also, it’s not too late to register for our one-day Hedging 101 workshop on Sept. 25 in Chicago. It’s a small group – about 25-30 people so far – so you’ll have plenty of time to ask questions in a more intimate, classroom environment. You can learn more and register here.