Plate

September 3, 2024

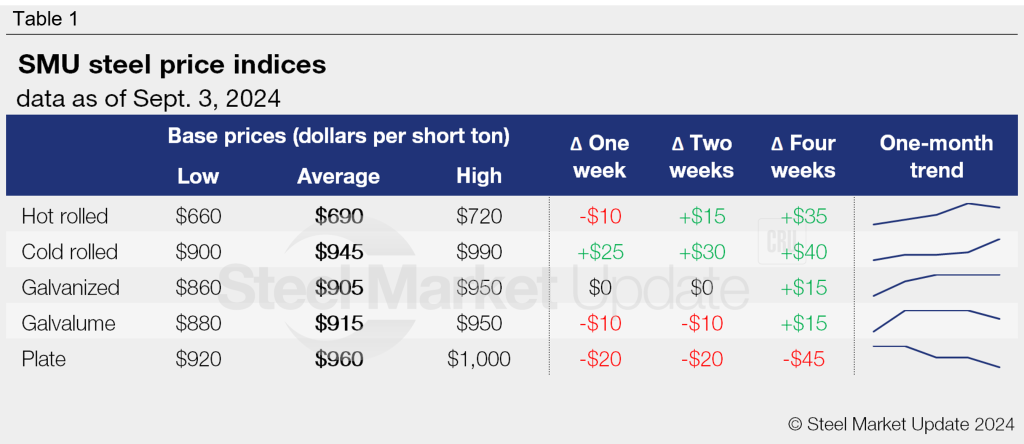

SMU price ranges: Sheet mixed, plate down

Written by Brett Linton

SMU’s steel price indices were mixed this week as the market waited for direction coming out of the Labor Day holiday.

SMU indices moved higher on cold rolled products, while galvanized prices were flat. Our indices for plate, hot rolled, and Galvalume all edged lower.

Buyers continued to report mediocre demand. But that was offset in part by planned mill outages this fall.

Hot-rolled steel prices slipped this week for the first time in over a month, declining $10 per short ton (st) from one week prior to $690/st. Cold-rolled (CR) prices moved in the opposite direction, rising $25/st week over week (w/w) to $945/st. CR prices now stand at an eight-week high.

Our galvanized index held steady at an eight-week high of $905/st. Galvalume prices edged $10/st lower w/w to $915/st. Note that on the coated side, there have been increased rumors of a trade case – potentially one targeting multiple countries.

Plate prices fell $20/st this week to $960/st. Plate prices have been trending downward since last November.

SMU’s sheet price momentum indicator remains at higher following our Aug. 6 adjustment. Our plate price momentum indicator remains at lower.

Hot-rolled coil

The SMU price range is $660-720/st, averaging $690/st FOB mill, east of the Rockies. Our entire range shifted lower by $10/st w/w. Our price momentum indicator for HR remains at higher, meaning we expect prices to increase over the next 30 days.

Hot rolled lead times range from 3-7 weeks, averaging 5.2 weeks as of our Aug. 28 market survey.

Cold-rolled coil

The SMU price range is $900–990/st, averaging $945/st FOB mill, east of the Rockies. The lower end of our range is up $20/st w/w, while the top end is up $30/st w/w. Our overall average is up $25/st w/w. Our price momentum indicator for CR remains at higher, meaning we expect prices to increase over the next 30 days.

Cold rolled lead times range from 5-9 weeks, averaging 7.0 weeks through our latest survey.

Galvanized coil

The SMU price range is $860–950/st, averaging $905/st FOB mill, east of the Rockies. Our range is unchanged w/w. Our price momentum indicator for galvanized remains at higher, meaning we expect prices to increase over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $957–1,047/st, averaging $1,002/st FOB mill, east of the Rockies.

Galvanized lead times range from 6-9 weeks, averaging 7.3 weeks through our latest survey.

Galvalume coil

The SMU price range is $880–950/st, averaging $915/st FOB mill, east of the Rockies. The lower end of our range is up $10/st w/w, while the top end is down $30/st w/w. Our overall average is down $10/st w/w. Our price momentum indicator for Galvalume remains at higher, meaning we expect prices to increase over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,174–1,244/st, averaging $1,209/st FOB mill, east of the Rockies.

Galvalume lead times range from 7-9 weeks, averaging 7.4 weeks through our latest survey.

Plate

The SMU price range is $920–1,000/st, averaging $960/st FOB mill. The lower end of our range is unchanged w/w, while the top end is down $40/st w/w. Our overall average is down $20/st w/w. Our price momentum indicator for plate remains at lower, meaning we expect prices to decline over the next 30 days.

Plate lead times range from 3-5 weeks, averaging 4.2 weeks through our latest survey.

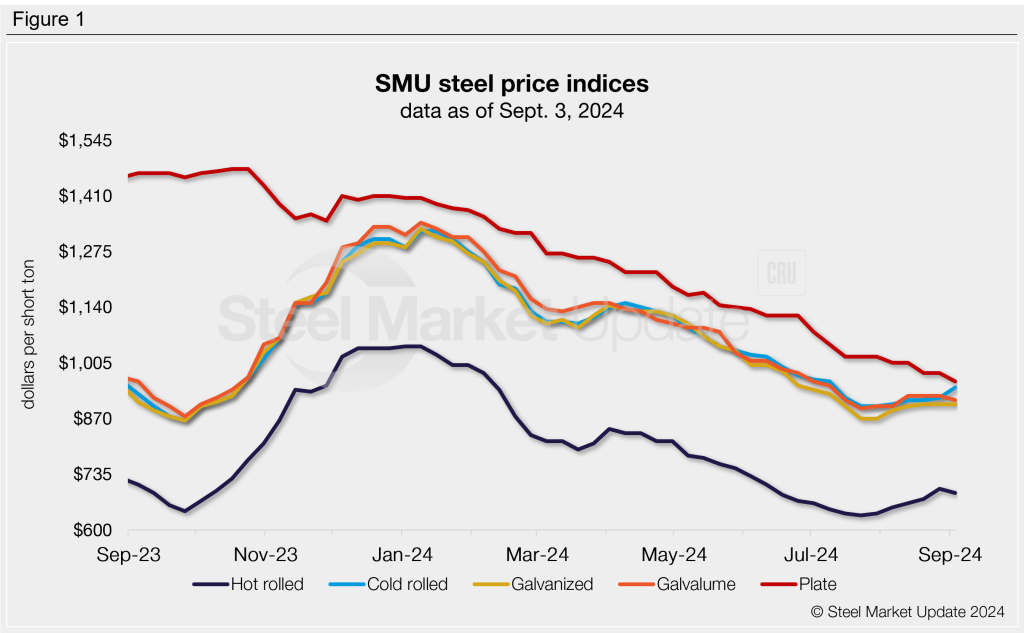

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.