Analysis

July 30, 2024

Final thoughts

Written by Michael Cowden

What a difference a week makes! SMU has shifted its sheet momentum indicators from “lower” to “neutral.” And we’ll be on the lookout for evidence of higher prices in the weeks ahead.

Momentum shifts

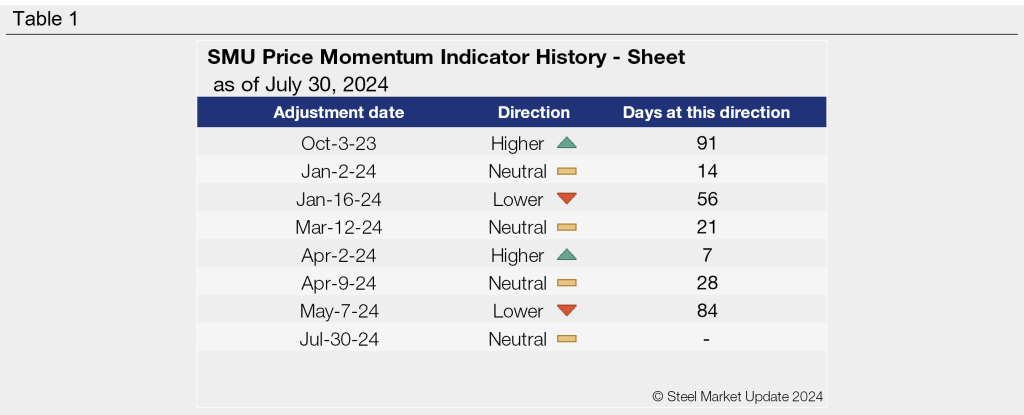

Why is this a big deal? Because our sheet momentum indicators have been at “lower” since early May. The month before that, they were at “neutral.” In fact, we’ve been at neutral or lower for almost all of 2024, as you can see in the table below.

The exception was a week at “higher” in early April. The brief trip to higher started after Cliffs announced it would seek $900 per short ton (st) for HR. It ended when Nucor shortly thereafter said it was seeking $830/st for HR, $70/st below Cliffs, when it published its first weekly spot price. (You can follow the timeline with SMU’s steel mill price announcement calendar.)

HR prices stabilize

As far as prices go, the discussion seems to have shifted from whether we’re at a bottom to how high prices might increase from here. Will Nucor go up another $25/st next week? Could another mill announce an increase in the interim?

I don’t think many folks are predicting a return to rapid-fire increases of $100/st or more that we’ve seen in recent years. But smaller increases from one week to the next… those could add up.

Our ranges haven’t changed significantly yet. It’s too early for that. We’re still seeing some pricing around $600/st. In fact, the bottom end of our range ($600-680/st) is down $10/st vs. a week ago.

That’s probably to be expected. We often see bigger deals done at lower numbers immediately before and immediately after price increases are announced.

How much upside is there?

We’ve also heard that some mills are telling folks that August scrap might be up – so don’t expect HR prices any lower than what’s available now. Meanwhile, we’re told that some mills – even if they haven’t publicly announced anything – are quietly inching up prices on niche items and on smaller transactions. (Think ~100-300 tons or thereabouts). That’s in part why the higher end of our range is up $20/st from last week.

Finally, we’re hearing that more buyers are keen to place orders, something we haven’t heard in a little while. I’m of the opinion that we’ll probably see prices bottom and rebound. But probably not to the highs we’ve seen in past upcycles.

Because the one consistent trend over the last few years is that while the bottom has been roughly steady, the peaks have been lower. But if I’ve learned anything about the steel market, it’s that it almost has a new trick up its sleeve.

How low can plate go?

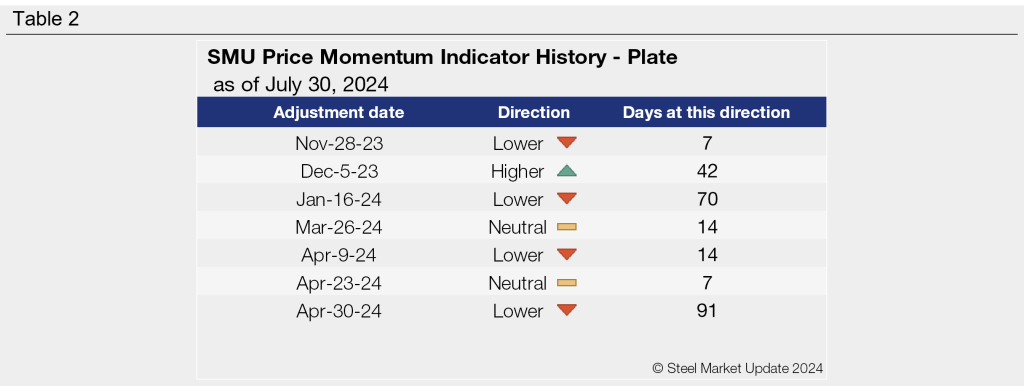

If you’re in the plate market, you might be reading this and questioning whether we’re in the same galaxy. Plate, like sheet, has been neutral or lower almost all year as you can see in this table:

But unlike sheet, there seems to be no indication that momentum will change in plate. Actually, we’ve heard that Nucor might announce another price decrease when it opens its books for September – and that decrease might come any day now.

Yes, SSAB has confirmed that it is pulling forward an outage at its Iowa plate mill. That outage had been scheduled for Q3/Q4 but has since been moved entirely into Q3. We don’t have specific dates. But we’re at the end of July. So it’s safe to assume we’re talking August.

That might tighten up supply on the margins. But the reasons SSAB gave for the outage – that shipments would be significantly lower in the Americas in Q3 – clearly don’t suggest that prices are expected to shoot up.

Meanwhile, we’re also hearing that supply – whether that be prime or secondary material – is weighing on the market as Nucor continues to ramp up its plate mill in Kentucky.

Let’s say sheet has found a stable, post-pandemic floor in the high $500s to mid/low $600s. Where is the floor for plate? And what conditions are necessary for it to find one?

SMU Steel Summit

We’ve heard from some of you that you’re having trouble finding or logging into the desktop version of the networking app for Steel Summit.

If you’ve registered to the event, search your inbox for an email from conferences@crugroup.com with the subject “SMU Steel Summit 2024 – Networking is live, start connecting today.” Scroll down to the subheading that reads “Start your SMU Steel Summit experience now.” Below that you’ll find a link to the app as well as your username and password.

If you have any questions, please reach out to us info@steelmarketupdate.com. And if you haven’t registered yet, you can join the nearly 1,200 that already have here.

We hope to see you on Aug. 26-28 in Atlanta. In the meantime, thanks to all of you for your continued support. All of us at SMU truly appreciate it!