Analysis

July 20, 2024

Final thoughts

Written by Ethan Bernard

They say a picture is worth a thousand words. Well, when you add some commentary from respected peers in the steel industry to those pictures, that may shoot the worth up to five thousand words, at least.

In that spirit, we’ve provided some snapshots from our market survey that closed on July 17, along with some comments from market participants.

We’ve included a few near-term outlooks, and a bit of chatter to help you keep your finger on the pulse of the market. While they might not tell you where the market is going, they can confirm intuitions, or even give you insights that you hadn’t thought of before.

We may be in the summer doldrums, but between what’s happening in the industry and in the world, there’s never a dull moment.

So, in both images and comments, from the near-term prices on HRC and scrap, to lead times and overall demand, here is what people are saying.

Want to share your thoughts as well? Contact info@steelmarketupdate.com to be included in our market questionnaires.

Without further ado, we’ll let the survey speak for itself. (Remember, full survey results are available to Premium subscribers.)

Where do you think HRC prices will be in two months?

“The mills have to be at or below their breakeven.”

“Demand softness due to the election.”

“Mills trying to spark interest think lowering the price is the way.”

“We are thinking prices might dip slightly below $600/ton but then gradually bump up a bit. We don’t expect a crazy spike.”

“It will be a relatively slow upward trend until some degree of inventory rebuilding starts. It won’t be a significant movement but could increase by $100-200/ton.”

“Not done falling. Little pressure on raw material or from demand until after the election.”

“I feel we will hit a bottom within a month, and then pricing will move back up to about where we are at now.”

“I expect prices to start increasing by month’s end.”

“I see no reason for the price to go up.”

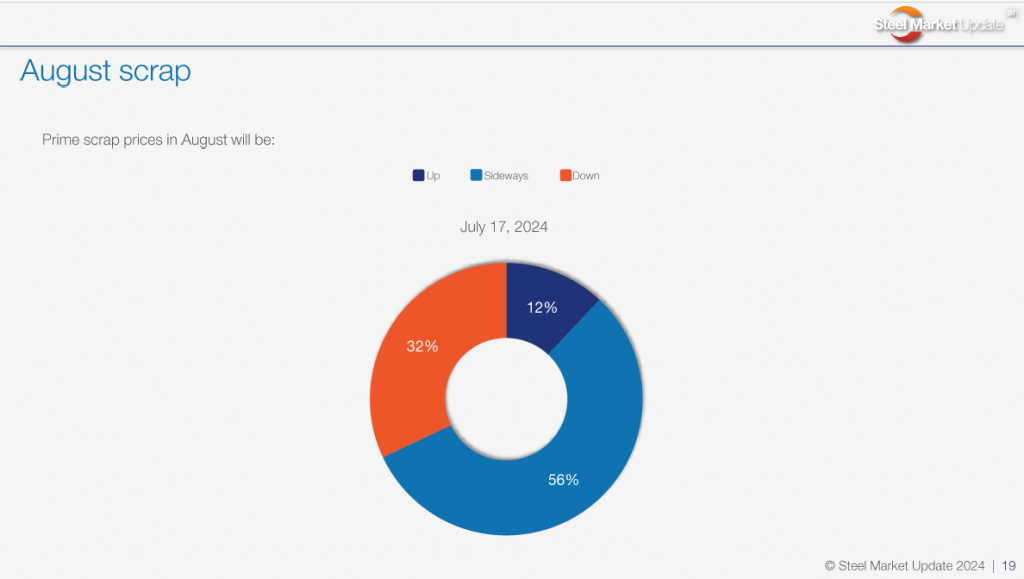

Prime scrap prices in August will be:

“Demand softness due to the election.”

“Exports down and summer doldrums.”

“A total guess here, but most big players we talk to aren’t super bullish for August.”

“Seemed to go a little against the grain in July. Indicates more strength than previously estimated.”

“Iron ore down, steel down, lower Chinese demand.”

“Not large moves up, but coming up off bottom.”

Recall that SMU’s July scrap pricing stands at:

- Busheling at $370-380/gross ton (gt), averaging $375, down $5 from June.

- Shredded at $370-385/gt, averaging $377.50, up $2.50 from June.

- HMS at $300-330/gt, averaging $310, up $5 from June.

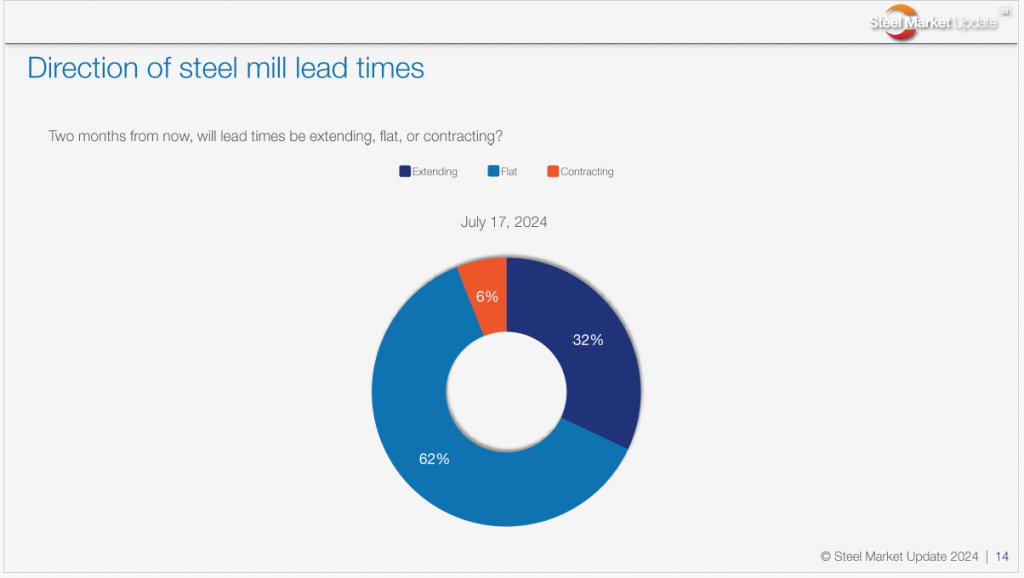

Two months from now, will lead times be extending, flat, or contracting?

“Unless capacity comes offline somewhere (anywhere?), I don’t expect any sort of real stretching out of lead times.”

“Slightly at first and then gaining some momentum.”

“Extended slightly.”

“September they extend slightly on plate – discrete plate.”

“I think they will extend over the next month but then flatten.”

“I don’t think extending lead times will force people to buy at this point.”

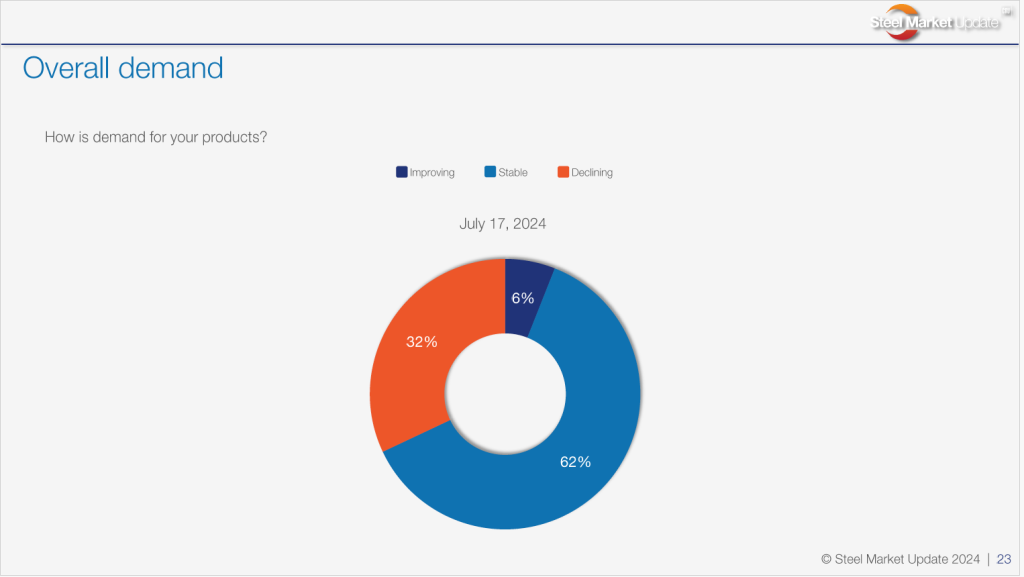

How is demand for your products?

“We are not seeing much new demand these days.”

“Market is slow.”

“Down from better times earlier this year but better than the very slow month of June.”

“Orders have increased over the past few weeks of construction-related products.”

“Usage hasn’t changed, only price.”

Steel Summit 2024

If you thought graphs and commentary gave you a leg up, imagine how much you could glean from attending North America’s preeminent flat-rolled steel event? Of course we’re talking about SMU’s Steel Summit 2024.

From amazing panels with industry experts, to networking opportunities with a who’s who of the steel world, if you haven’t reserved a spot yet, time is counting down. Nearly 1,100 people have registered to attend so far, and more are signing up every day. We look forward to seeing you at the Georgia International Convention Center (GICC) in Atlanta on Aug. 26-28!