Mexico

July 16, 2024

SMU price ranges: HR falls to 19-month low, hopes of a bottom rise

Written by Brett Linton & Michael Cowden

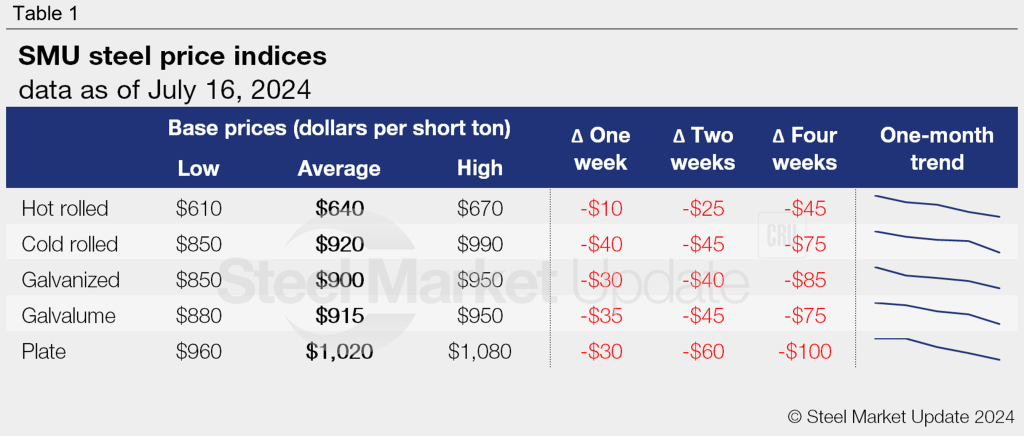

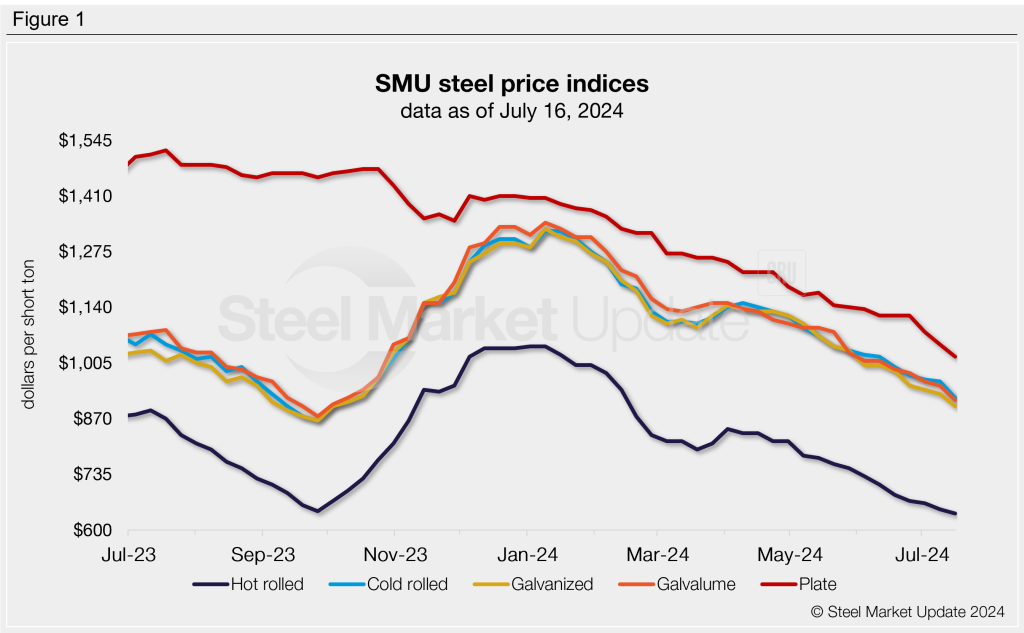

SMU’s hot-rolled coil price fell to $640 per short ton (st) on average on Tuesday. That’s down $10/st from last week and marks the lowest point for HR prices since December 2022, according to our pricing archives.

SMU’s HR price is now $5/st below 2023’s low of $645/st, which occurred against the backdrop of a United Auto Workers (UAW) union strike.

The low end of our range ($610/st) characterizes purchases from larger spot buyers. The higher end of our range ($670/st) represents those from smaller buyers.

We confirmed some purchases slightly below the low end of our range. But the tonnages or terms involved mean they might not be “repeatable” for most consumers.

Some industry participants think the market might be nearing a bottom, especially with certain mills potentially at or below breakeven costs on such low-priced deals. They also pointed to flat scrap prices, the pace of HR declines slowing, and production issues at some domestic mills.

Substrate issues at certain facilities might also be playing a role. Case in point: The labor situation at ArcelorMittal Mexico – an important slab supplier to the US –has dragged on for longer than expected.

All eyes are now on lead times, which some market participants think are primed to flatten out and extend after mostly falling since late March/early April.

But while declines in HR might have slowed, prices for tandem products appear to be catching up with the steeper declines seen in hot band earlier this summer.

SMU’s price for cold-rolled (CR) coil fell to $920/st on average this week, down $40/st from last week. Galvanized base prices tumbled $30/st to $900/st on average. And Galvalume base prices dropped $35/st to $915/st on average.

Plate prices, meanwhile, continued to plunge following Nucor’s $125/ton price cut on July 1. SMU’s plate price now stands at $1,020/st on average, down $30/st from a week ago.

While there are increased hopes that a sheet market bottom is near, SMU’s momentum indicators remain pointed lower until we see clearer evidence of a floor. Our plate momentum indicator continue to point lower as well.

Hot-rolled coil

The SMU price range is $610-670/st, averaging $640/st FOB mill, east of the Rockies. Our range is down $10/st w/w across the board. Our price momentum indicator for HR remains at lower, meaning we expect prices to decline over the next 30 days.

Hot rolled lead times range from 3-6 weeks, averaging 4.7 weeks as of our July 3 market survey. We will published updated lead times later this week in our Thursday issue.

Cold-rolled coil

The SMU price range is $850–990/st, averaging $920/st FOB mill, east of the Rockies. The lower end of our range is down $70/st w/w, while the top end is down $10/st. Our overall average is down $40/st w/w. Our price momentum indicator for CR remains at lower, meaning we expect prices to decline over the next 30 days.

Cold rolled lead times range from 4-9 weeks, averaging 6.5 weeks through our latest survey.

Galvanized coil

The SMU price range is $850–950/st, averaging $900/st FOB mill, east of the Rockies. Our range is down $30/st w/w across the board. Our price momentum indicator for galvanized remains at lower, meaning we expect prices to decline over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $947–1,047/st, averaging $997/st FOB mill, east of the Rockies.

Galvanized lead times range from 4-9 weeks, averaging 6.6 weeks through our latest survey.

Galvalume coil

The SMU price range is $880–950/st, averaging $915/st FOB mill, east of the Rockies. The lower end of our range is down $40/st w/w, while the top end is down $30/st. Our overall average is down $35/st w/w. Our price momentum indicator for Galvalume remains at lower, meaning we expect prices to decline over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,174–1,244/st, averaging $1,209/st FOB mill, east of the Rockies.

Galvalume lead times range from 6-8 weeks, averaging 6.8 weeks through our latest survey.

Plate

The SMU price range is $960–1,080/st, averaging $1,020/st FOB mill. The lower end of our range is down $20/st w/w, while the top end is down $40/st. Our overall average is down $30/st w/w. Our price momentum indicator for plate remains at lower, meaning we expect prices to decline over the next 30 days.

Plate lead times range from 3-6 weeks, averaging 4.6 weeks through our latest survey.

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

Brett Linton

Read more from Brett Linton