Analysis

July 11, 2024

Final thoughts

Written by Brett Linton & Ethan Bernard

In the Middle Ages, it is said scholars used to debate how many angels could dance on the head of a pin. Was that pin made of stainless? Definitely not, as stainless steel wasn’t invented until the 20th century. Still, there are many metal questions where the answers are not so clear cut. Some require a bit of number crunching. On the positive side, they are a lot less theoretical than the movement habits of supernatural creatures. Luckily, we have some pretty great number crunchers over here at SMU. So we’ve taken some time to supply you with a few handy-dandy production figures for 2024 presented in a unique way.

Be prepared, this is the kind of info that you can use to impress at a party. Just be sure it’s a party related to the steel industry, or the people there have at least a passing interest in metal. If not, the results can be brutal. We’ve been there.

In the first five months of the year, US mills have produced ~36 million short tons (st) of finished steel, according to the latest figures released by the American Iron and Steel Institute (AISI). Figure 1 puts that into perspective.

That’s an average of 86.8 Golden Gate Bridges worth of steel produced in our country each month! (We made that calculation using some cool data from the Golden Gate Bridge, Highway, and Transportation District.)

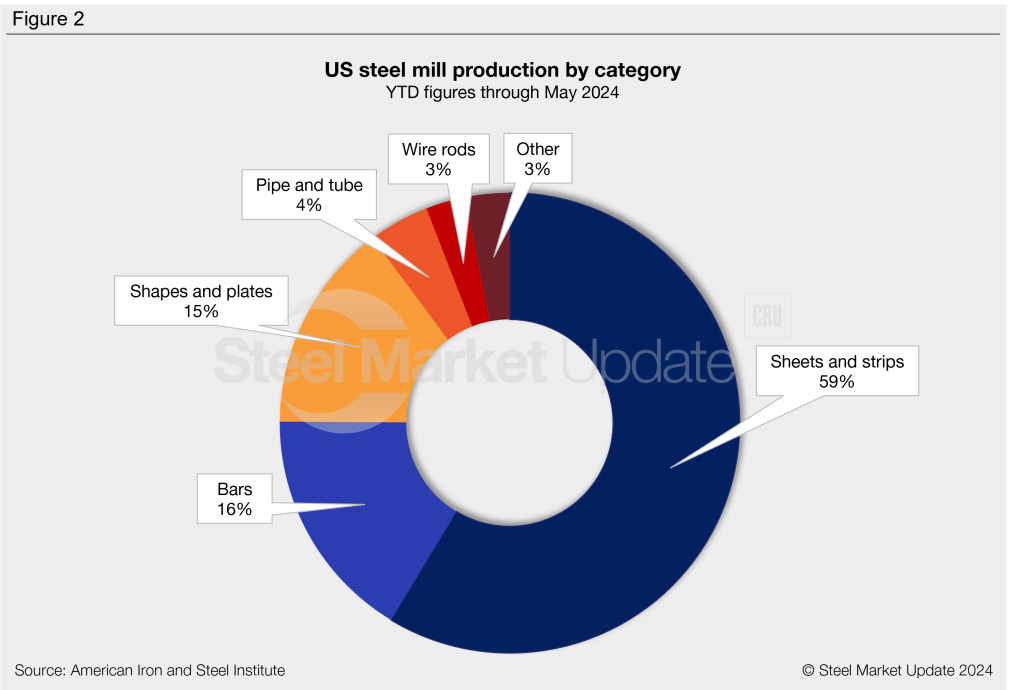

Breaking production down by product type, the largest category is flat-rolled sheet and strip totaling 21.5 million st. Second up is bar products at 6.0 million st, followed by shapes and plates at 5.4 million st, pipe and tube at 1.6 million st, and wire rod at 1.0 million st.

Looking into the flat rolled and plate products that SMU tracks, we see that US mills have produced nearly 9.2 million st of hot-rolled sheet this year through May. Galvanized sheet and strip production comes in second at 6.7 million st. This is followed by 4.2 million st of cold rolled and 1.1 million tons of other metallic coated products.

On the plate side, 2.0 million st of cut-to-length plate has been produced vs. 860,000 st of plates in coils.

Year-to-date production of those sheet and plate products total up to just over 24 million st, or 66% of all steel produced by the domestic mills.

That is the equivalent weight of 66 Empire State Buildings, 265,000 Boeing 737s, or 8.2 million Ford F-150s.

Like this kind of data, at least as far as the production figures? Well, Premium members should be on the lookout for our upcoming steel production analysis, back by popular demand in a future issue of SMU. We can’t wait to bring it to you.

Steel Summit 2024

To continue with the theme, have you ever wondered how many steel industry professionals could fit inside a hotel bar in Atlanta? If so, you’re in luck. There’s still time to register for SMU’s Steel Summit 2024 Aug. 26-28, the country’s preeminent flat-rolled steel event here. Hope to see you soon!

Brett Linton

Read more from Brett Linton