Analysis

July 9, 2024

Final thoughts

Written by David Schollaert

Flat-rolled steel prices have been largely falling since the beginning of the year. Even after a slight bump in early April when mills tried to halt the downtrend, the decrease resumed.

We’re now at the lowest level since last September and trending lower. But in many ways, it’s no surprise because other indicators have also been pointing in the same direction for some time.

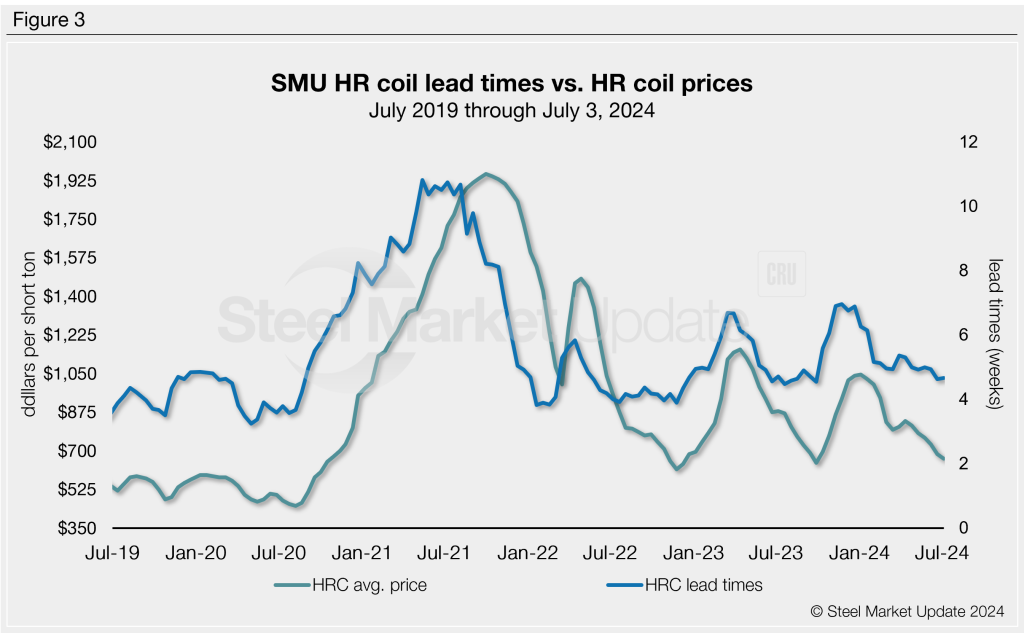

Lead times have been contracting since the beginning of the year and have been below the five-week mark for hot-rolled (HR) coil since May. Indicators have been signaling towards lower levels as we work through the summer doldrums.

Mills remain willing to negotiate lower prices, and early reports seem to indicate that scrap might settle even lower in July. Add to that a low Buyers’ Sentiment reading that rivals levels not seen since the Covid-19 pandemic.

Hot-rolled coil prices are now $650 per short ton (st) on average. That’s down $195/st from a recent high of $845/st in early April but nearly $400/st lower since January. Tandem products have followed a similar trend. Cold rolled, galvanized and Galvalume all fell again this week. Plate also dropped on the back of Nucor’s $125/st price-cut late last week.

When will prices bottom? A solid number of you (nearly 85% in last week’s survey results) expect it will happen between July and August. We don’t do forecasts at SMU. So I figured I’d instead highlight some of the other data we’ve been looking at.

Steel demand index

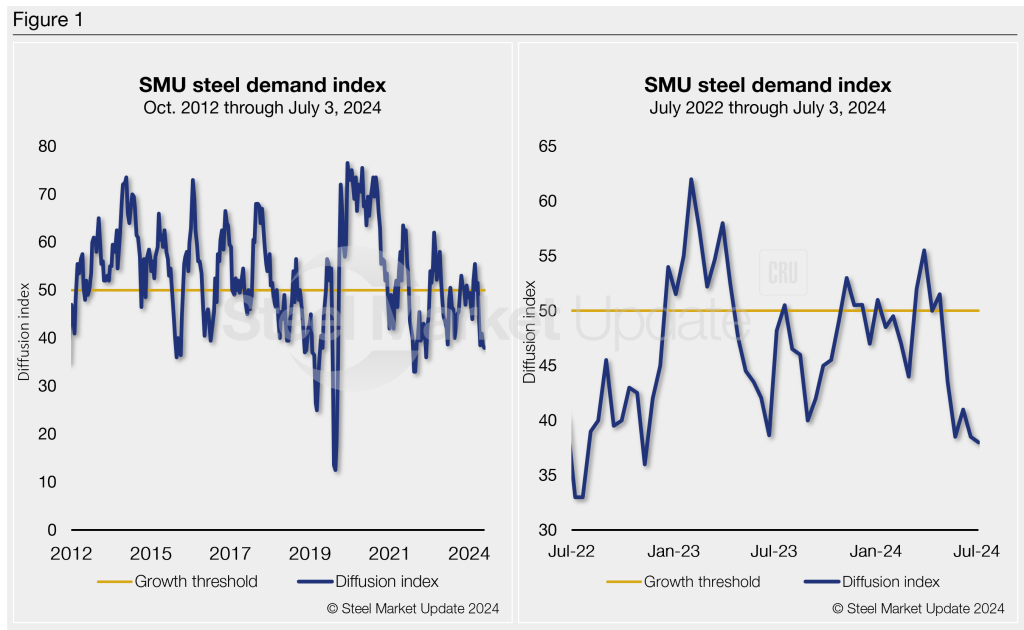

SMU’s Steel Demand Index has been in contraction territory since early May. The index – now at 38 – is down a half point from a reading in late June and at its lowest mark since July 2022.

The index, which compares lead times and demand, is a diffusion index derived from the market surveys we conduct every two weeks. It has historically preceded lead times, which is notable given that lead times are often seen as a leading indicator of steel price moves.

An index score above 50 indicates rising demand, and a score below 50 suggests declining demand. Detailed side by side in Figure 1 are historic data and the latest Steel Demand Index.

Our index has been in contraction territory for the better part of the past year. The index has had some small bumps into growth, but they’ve all been short-lived and only on the heels of repeated mill price hikes. Generally speaking, it has been down more often than not over the last year.

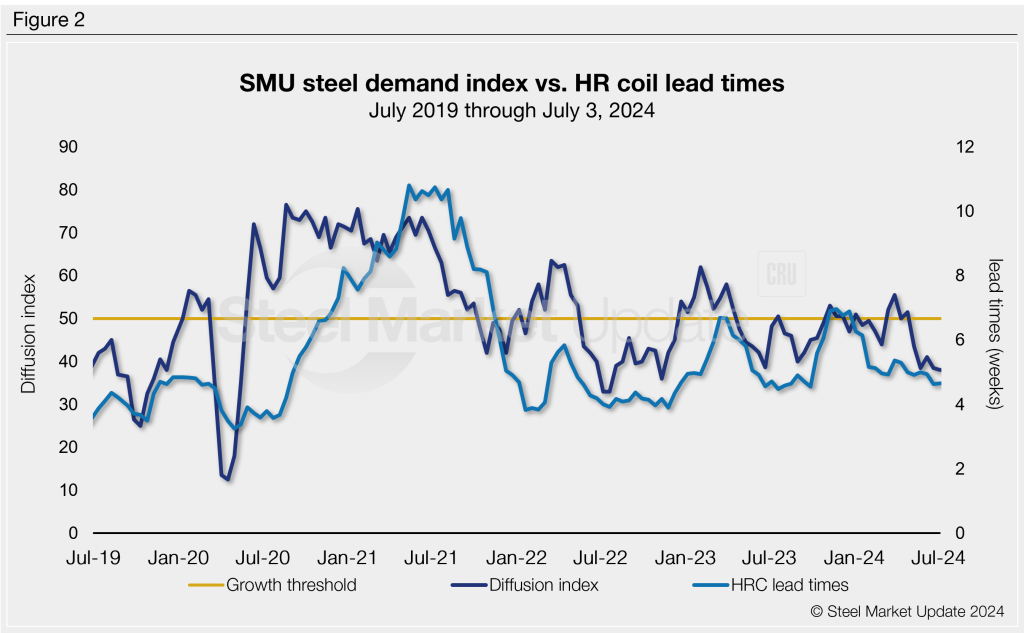

Though many of you are familiar with SMU’s demand diffusion index, it’s important to note that it has for years preceded moves in steel mill lead times (Figure 2). And SMU’s lead times have themselves been a leading indicator for flat-rolled steel prices, particularly HRC (Figure 3).

What to watch for

Lead times should remain a focus and something to keep an eye on. Nucor noted in its HR coil spot price letter yesterday that its lead times are ranging between three to five weeks, and other mills are still hovering at four weeks. With dialed-down demand and little notice of additional outages or downtime, lead times could move lower.

And don’t forget that back in the spring we saw a number of weeklong maintenance programs and outages at EAF and integrated mills alike that had little to no impact on prices or lead times.

The main driver remains demand, which has been lax, a point highlighted by the fact that sources are concerned there’s ample supply and limited interest in restocking.

So how will demand fare as we open Q3 and begin the trek toward contract negotiations come August? Will less-than-stellar demand further impact pricing and lead times? Let me know what you think!

Community Chat

The next SMU Community Chat will be this Wednesday, July 10, at 11 am ET (10 am CT) with veteran investment bankers Vince Pappalardo, managing director and principal at Browns Gibbon Lang & Co. (BGL), and Andy Pappas, managing director at BMO Financial Group.

We’ll talk about how to craft an artful deal, whether that means selling your business or buying another. In addition to M&A, we’ll also talk about lending, finance, and how to prepare your business for whatever lies ahead.

The webinar is free to attend. You can register here.

SMU Steel Summit

There are less than two months to go before the start of the 2024 SMU Steel Summit, and it’s again shaping up to be the can’t-miss flat-rolled steel event of the year!

Our always popular Fireside Chats include conversations this year with Barry Schneider of SDI, Daniel Needham of Nucor, Dave Stickler of Hybar, Alan Kestenbaum of Stelco, and Barry Zekelman of Zekelman Industries.

Other compelling panels and keynote speakers, include:

- Service Center panel with Pam Heglund, Geoff Gilmore, and Thad Solomon

- Equity Analyst panel with Josh Spoores, Timna Tanners, Curt Woodworth, and Alex Hacking

- Keynotes from Michael Smerconish, Dr. Anirban Basu, and Dr. Alan Beaulieu

- Automotive panel with Alan Amici, Dan Bowerson, Dean Kanelos, and Michael Davenport

So, ensure you connect with industry leaders forging the future of the flat-rolled steel market by joining nearly 1,000 steel industry leaders – and counting – from Aug. 26-28 in Atlanta.

You can learn more about the Summit and our agenda here. And you can register here.

We look forward to seeing you in Atlanta!

And as always, your business is truly appreciated by all of us at Steel Market Update.