CRU

June 28, 2024

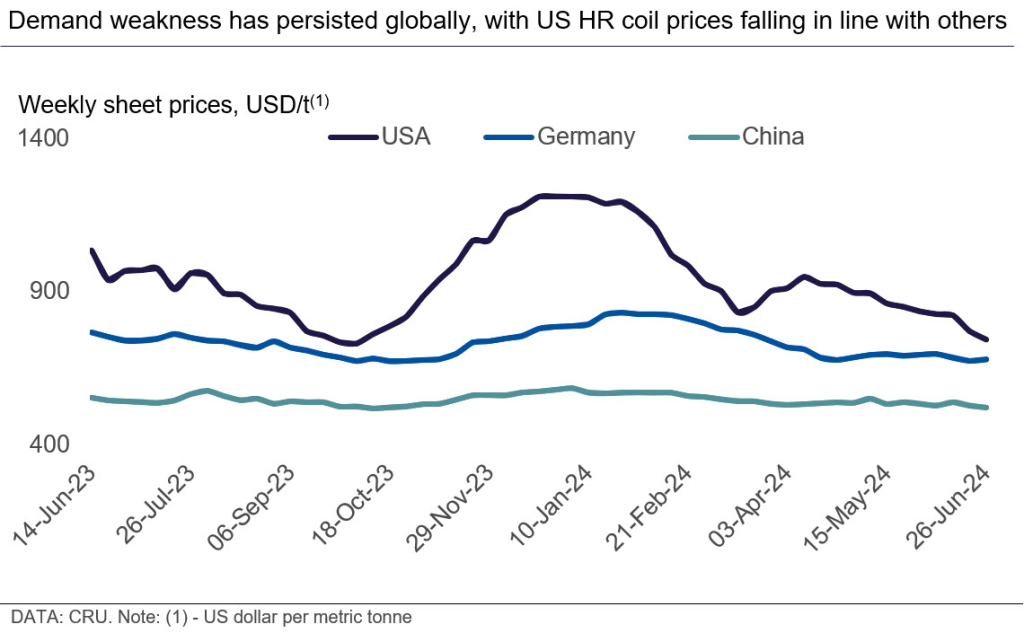

CRU: Sheet demand weakness abounds globally, US HR coil prices near those elsewhere

Written by Ryan McKinley

Low global sheet demand continued to weigh on prices around the world this week. In the US, mills were forced to remain aggressive to secure orders during this period of demand weakness. And compounded by recent new capacity ramp-ups, has forced US hot rolled (HR) coil prices down closer to levels seen in offshore markets.

European demand weakness has thwarted mill efforts to increase prices, and market participants do not see this trend ending in the near term. In Asia, falling Chinese domestic and export prices pressured tags elsewhere in the region lower week on week (w/w).

United States

HR coil prices in the US fell this week by $25/ short ton (st) w/w to $674/st. Cold rolled (CR) coil prices fell by $24/st to $1,023/st, while hot-dipped galvanized (HDG) coil base prices were down by $43/st at $941/st.

We have seen a slowdown in spot activity this week, while the high end of our range fell for HR coil.

Mills have had to remain aggressive with offering discounts in an environment where supply is too high relative to demand. Some market participants have reported extremely short lead times recently for HR coil, and that mills need to compete with one another if they want to place spot HR coil volumes.

Downstream product prices remain elevated relative to those for HR coil because of somewhat tighter availability, but they nevertheless are on the decline. Overall, the possibility for a price increase over the near term appears scant, with the current market situation likely to extend through July and likely into August.

We note that while prices are well on their way to multi-year lows, average costs for producers remain well above break-even, meaning that those with the lowest costs can drive prices further still.

Europe

European sheet prices remained rangebound this week. Market participants are not overly confident that there will be any improvements in demand over the near term. German and Italian HR coil were both assessed at €633 per metric ton, up by €4/mt and down by €2/mt, respectively.

While some mills communicated their intentions to raise prices for HR coil in early June, the latest offers were met with resistance from buyers as end-use demand remained subdued. According to our contacts, some mills are now willing to reconsider prices and are offering discounts for large volumes as they are eager to secure orders.

Interest in imports from Asia was low due to uncompetitive offers. Asian HR coil imports were heard at around €590-600/mt, which is around €30-40/mt lower than domestic European HR coil prices. In addition, uncertainties regarding the new changes in safeguard measures have led some producers in countries such as Egypt to stop quoting HR coil for Europe. As a result, most customers have chosen to purchase material from domestic producers.

China

Domestic Chinese sheet prices fell by RMB50-70/mtt w/w, mainly due to seasonally weak demand during summer. Bearish sentiment dragged down futures prices while buyers purchased only on an as-needed basis, resulting in fewer transactions this week. High temperatures and rainfall, especially in the south, disrupted both demand and supply. With these market dynamics at play, sellers have focused on liquidating inventory, showing greater flexibility in price negotiations. On the supply side, production remains elevated despite rumours of crude steel production controls.

Asia

Prices of imported sheet products in Asia continued to fall this week because of limited buying interest in the market.

Traders offered HR coil SAE1006 rerolling material at ~$535/mt CFR Vietnam, while official offers from Chinese mills stood at ~$545-547/mt CFR Vietnam. However, buyers remain reluctant to purchase because they are still holding a lot of inventory at a time when domestic sales are very slow. According to market contacts in Vietnam, domestic mills are still receiving a good level of export orders even though prices have trended lower for downstream products.

For pipe making and commercial grade HR coil from China, offers were heard at $515-518/mt CFR Vietnam.

CRU assessed HR coil at $535/mt CFR Far East, a decrease of $5/mt w/w. CR coil and HDG coil prices were both down by $10/mt w/w at $670/mt and $690/mt, respectively. Notably, the last time the market saw this level of HR coil price was around November 2022.

India

Indian sheet prices were unchanged w/w due to subdued spot market activity. Most buyers had sufficient stocks and refrained from making fresh purchases until mills announce fresh prices for July output. Several contacts also suggested that the market continues to await more clarity on the policy stance of the newly formed government, which is to be announced with the new government budget in late July.

Exports were also slow to revive last week as buyers in the Middle East came back after the Eid Holidays with much lower price bids. This was because of abundant availability of Chinese offers. Meanwhile, fresh European enquiries stayed discouraging for exporters. The latest assessed Indian HR coil export price was unchanged w/w at $560/mt FOB.

To learn more about CRU’s services, visit www.crugroup.com