Market Data

June 20, 2024

SMU survey: Lead times remain short, HR and plate at 8-month lows

Written by Brett Linton

Steel mill lead times are near some of the shortest levels seen in months, according to our latest market survey. Service centers and manufacturers continue to report short to normal lead times for all sheet and plate products tracked by SMU.

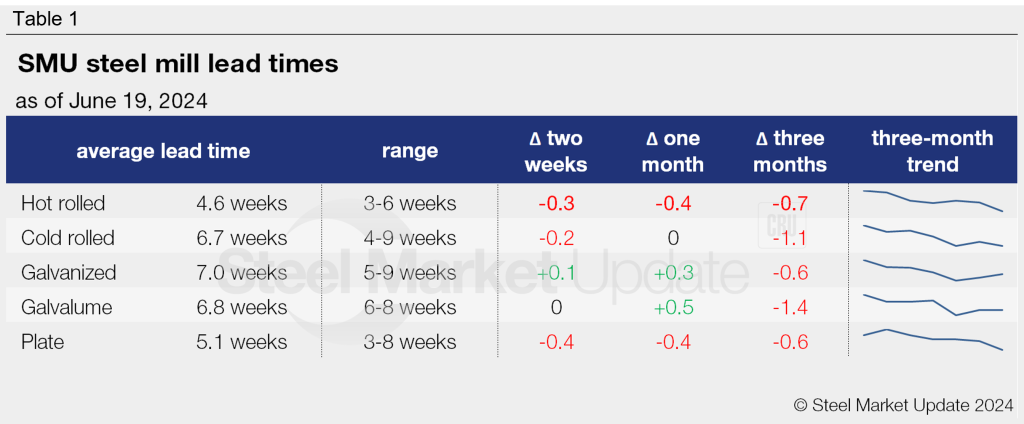

This week we saw reductions in hot rolled and plate lead times, both declining to lows not seen since September/October of last year. Cold rolled production times eased back down to levels seen one month ago. Lead times on galvanized inched up from the beginning of month, while Galvalume held stable.

Table 1 below details current lead times.

Survey results

The majority of service centers and manufacturing companies we surveyed this week categorized current production times as shorter than normal (54%) or normal (44%). Only 2% responded that lead times were extremely short.

Looking through their crystal balls, 25% of this week’s respondents expect lead times will extend two months from now (up from 19% earlier this month). 63% feel production times will remain stable (down from 67% previously), while 12% expect them to contract (vs. 14% previously).

Here’s what respondents are saying:

“Lead times might hit their lowest level in June/July, and then stay flat until some catalyst ignites the market.”

“Most buyers will have jumped back in at this point, striking deals to set them up for the balance of the year.”

“Lead times are already short and unless something gets taken offline, things will stay bleak.”

“Utilization rates appear to be decreasing to keep them fairly stable.”

“Mills will need to pull this lever.”

“Extending ever so slightly as usage picks up after the summer slowdown.”

“Demand is not down enough for the mills to contract capacity.”

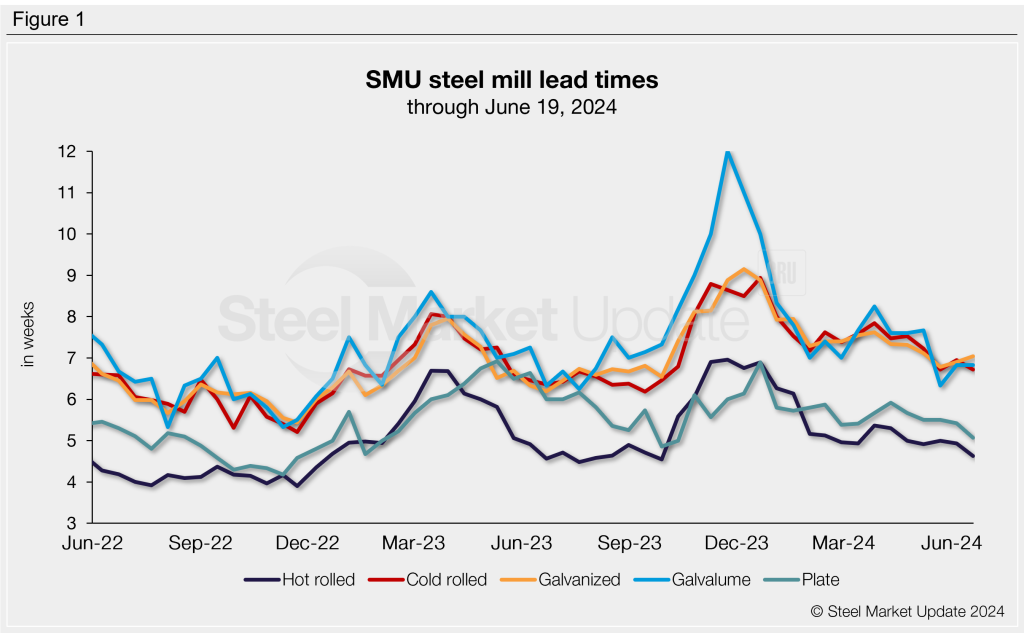

Figure 1 below tracks lead times for each product over the past two years.

3MMA lead times

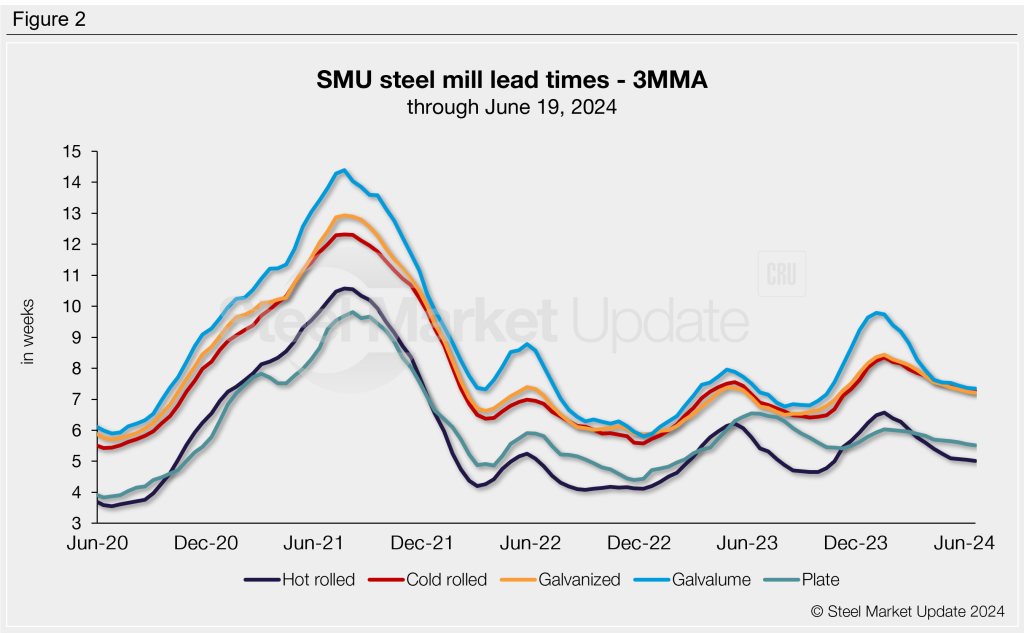

Looking at the three-month moving averages (3MMA) of lead times can smooth out the variability seen in our biweekly readings. Lead times for our sheet and plate products slightly decreased on a 3MMA basis, reaching their lowest levels in seven months.

The hot rolled 3MMA is now down to 5.01 weeks, cold rolled at 7.25 weeks, galvanized at 7.21 weeks, Galvalume at 7.35 weeks, and plate at 5.52 weeks.

Figure 2 highlights how lead times have been trending over the past four years.

There will be no SMU newsletter on Thursday, July 4, because of the Independence Day holiday, so look for our next lead time report in the Sunday, July 7, newsletter.

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis survey. SMU measures lead times as the time it takes from when an order is placed with the mill to when it is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our steel mill lead times data, visit our website. If you’d like to participate in our survey, contact us at info@steelmarketupdate.com.