Community Events

May 20, 2024

SMU Community Chat: McKinley shares insights into CRU, US sheet market

Written by Laura Miller

The CRU US Midwest hot-rolled (HR) coil index is a dominant and established price benchmark in the US. Many steel-buying contracts are linked to ‘the CRU,’ as it’s commonly called. But how does it work?

CRU Senior Analyst Ryan McKinley joined SMU Managing Editor Michael Cowden for a discussion on this topic and more, including CRU’s forecast for steel sheet prices in the US, on SMU’s Community Chat last week.

The CRU

McKinley is one of three analysts on the CRU steel analysis team in North America, led by Principal Analyst Josh Spoores, that works to develop and analyze the weekly CRU price. While Prices Lead Estelle Tran interacts and maintains relationships with data providers, McKinley’s role is to vet the data that comes in. In fact, “to get rid of even the perception of bias,” he doesn’t even know who the data providers are.

When vetting the data, he sees an alphanumeric ‘person,’ their transactional price inputs, and the weight of those transactions. CRU only accepts actual transactions, not bids or quotes, that occured in the past week and can be verified. McKinley must ensure all the data is valid and then use it to find the weekly price reflective of the market. CRU releases the price every Wednesday.

What’s considered in a forecast?

McKinley explained some of the key indicators he looks at when developing a forecast.

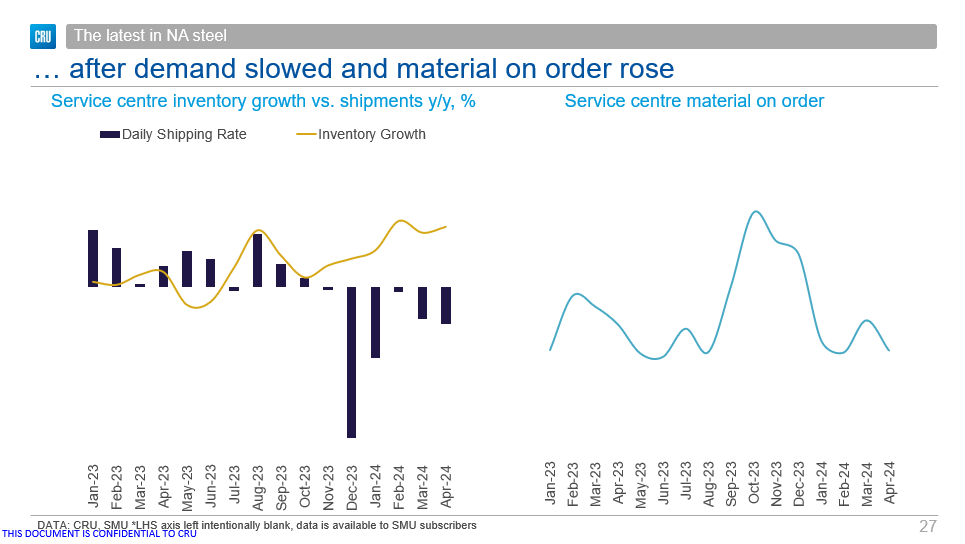

SMU’s Service Center Inventories (SCI) report provides key information “that can be really insightful on especially a more short term basis,” according to McKinley. The daily shipping rates in January’s report indicate a weaker demand picture, and April data points to a continuation in weak demand, he said. With that demand weakness, there’s also been an inventory build and a decline material on order, he pointed out (see chart below).

Imports, lead times, and production outages are some of the other metrics McKinley’s team keeps a sharp eye on.

McKinley is also the editor of CRU’s Steel Sheet Monitor, which gives him valuable insight into global markets. Given the protective nature of the US market, he said it’s important to watch what’s going on in other markets, as “nothing happens in a vacuum.”

Broadly speaking on current markets, he highlighted weakness in Asia and an uptick in apparent demand in Europe. However, he thinks that uptick will be short lived, as much of it is “coming from general restocking from the service centers and not really actual induced demand.”

Forecast

McKinley sees “a clear downward trend in the metrics” affecting his current forecast for steel prices. He foresees weaker pricing in June and July, and said it will get interesting when another restocking cycle needs to occur.

The restocking cycles of the last three years have been particularly intense, with prices shooting up in a month or two and then crashing back down. McKinley sees a couple of things potentially preventing that now — namely, excess supply and weaker demand.

The November elections are creating business uncertainty in the back half of the year and that is one potential wildcard he is keeping his eye on. Once those are over, and especially if inflation and interest rates start to come down, which will provide a boost to infrastructure, “then we start to see an acceleration in pricing and more demand,” he predicted.

McKinley believes 2024 “will be a bit of a reset year in terms of what pricing does, but there’s a pretty strong demand outlook for the remainder of the forecast period.”

He noted that it’s important to keep in mind that steel production in North America is growing and outpacing the growth in apparent consumption. He predicts a “much better-balanced market than we’ve seen in the past,” with increased domestic output competing with imports and “making the region close to neutral in terms of being a net importer.”

CRU’s latest forecast is for US prices to fall in 2024 for a third consecutive year, but then rise slightly thereafter.

To hear the entire conversation with McKinley and to see his full presentation, including his pricing forecasts for HR, CR, and galvanized coil through 2026, subscribers can access a replay on our website.

If you are interested in becoming a data provider for the CRU or SMU’s SCI, please contact estelle.tran@crugroup.com for more information.

And don’t forget to tune in to our next Community Chat on May 29 at 11 a.m. ET to hear the latest on the steel futures markets from Spencer Johnson, head of ferrous trading at StoneX. You can register here.