CRU

April 26, 2024

CRU: Size matters – BHP’s bid to be the global mining behemoth

Written by CRU

If successful in its overtures to Anglo American, BHP will create the world’s largest diversified miner by a country mile. The rationale for this merger is scale and in mining, size matters.

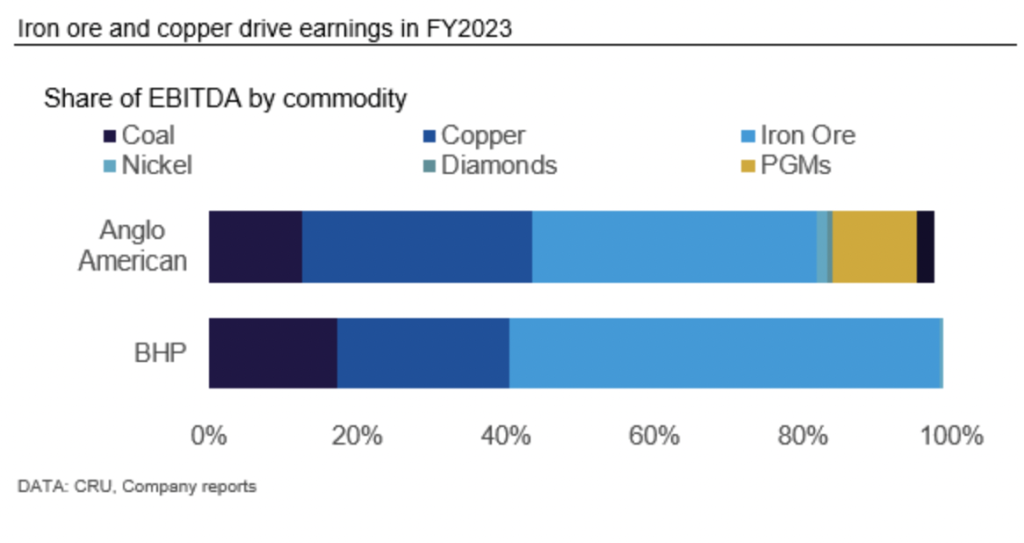

BHP has put forward an unsolicited, conditional offer to acquire Anglo American, potentially creating a mega mining company. In what would be one of the largest value mining deals ever, BHP has made an all-share offer valuing Anglo American at £31.1 billion (USD$38.8 billion). Both companies are significant producers of copper, iron ore, metallurgical coal, and nickel, while both are also developing large projects in the fertilizer industry.

Alignment of BHP and Anglo portfolios create scale

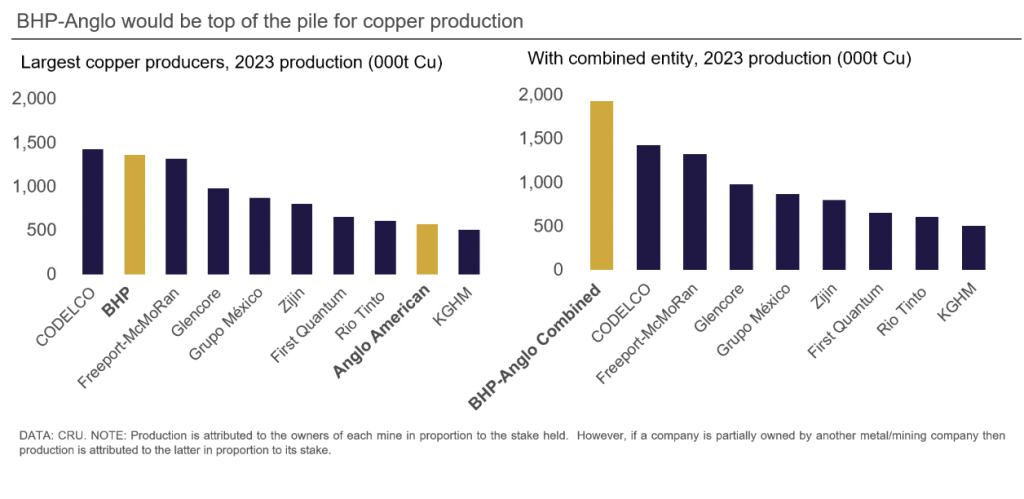

The combination of BHP and Anglo would create a mining company that is the world’s largest copper producer, the world’s largest met coal exporter, and although the merged company would be only be the second largest iron ore exporter in volume terms, it would surpass Rio Tinto as the world’s largest lump producer by taking a market share of just over 40%. This would add Anglo American’s highly regarded pellet feed product to BHP’s portfolio; a prized type of iron ore as steel mills shift away from traditional blast furnace production.

It’s a buy-not-build copper play

With equity attributable production of 1.36 million metric tons (mt) of copper, BHP is placed a fraction behind Chile’s Codelco as the world’s second largest producer of mined copper in 2023. Combining the two companies’ output creates an entity with production of over 1.9 million mt of copper (based on CRU’s 2023 production estimates) – 35% more copper than the next largest player.

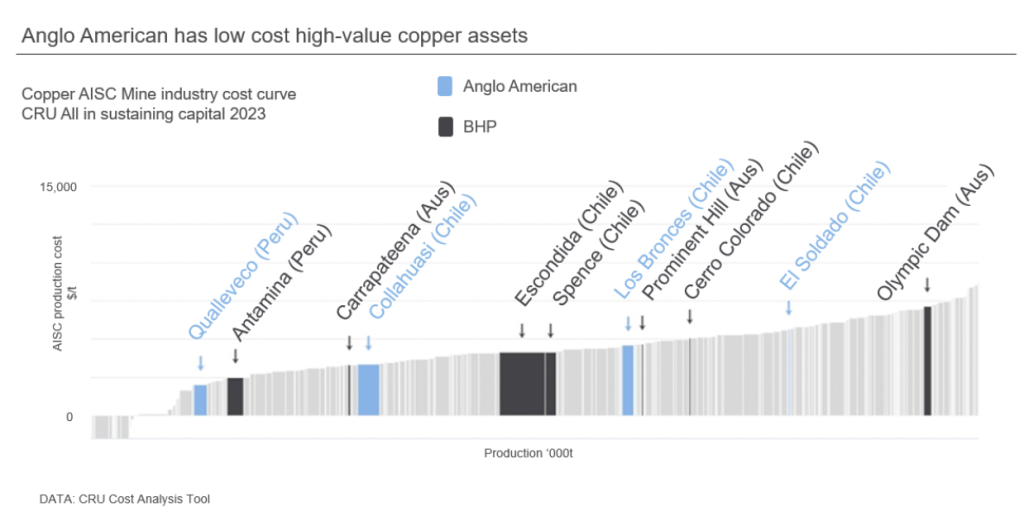

Both companies’ portfolios are weighted heavily towards operations in Latin America, most notably in Chile and Anglo American also operates the Quellaveco mine in Peru. BHP is the manager of the world’s largest copper-producing mines, Escondida, while Anglo American holds a 44% stake in the Collahuasi joint venture, the world’s third largest copper mine by copper units and second largest by contained copper resources.

From a cost standpoint, CRU assess Anglo to be more competitively positioned, in the first quartile, on an All-in Sustaining Cost basis, while BHP sits just above the median, in the third quartile.

Noting the comments of Bold Bataar of Rio Tinto at CRU’s World Copper Conference in Santiago last week, stating a tactical preference to develop projects in-house, this draws clear lines of distinction between Rio Tinto and BHP within the buy vs. build debate.

Rio Tinto No. 1 in iron ore but not all iron ore is equal

BHP is the world’s third largest iron ore producer with close to 290 million mt of annual production in Pilbara, Western Australia. Most of the production is medium-grade ore (60-63% Fe), which is shipped to its customers in East Asia. With the ramp-up of the new South Flank mine, which started operation in 2021, BHP is also becoming a key supplier of lump.

An acquisition of Anglo American would diversify BHP’s iron ore operations, not only geographically but also from a quality perspective. BHP’s Australian operations are not optimal from a decarbonization perspective, and this acquisition would add Anglo American’s highly regarded pellet feed product to its portfolio. This is a type of iron ore that will be in high demand as steel mills shift away from traditional blast furnace production. Another development is that it would make BHP surpass Rio Tinto as the world’s largest lump producer by taking a market share of just over 40%.

According to CRU’s analysis, BHP’s iron ore market share is 18% for global iron ore exports and 35% for lump. Anglo American has iron ore operations in South Africa and Brazil and produce a combined 60 million mt per year (mt/y) of iron ore. Kumba is the company’s South African operations, an important supplier of high-quality lump. The company produces nearly 40 million mt/y, a number that has fallen steadily from a peak of nearly 50 million mt nearly 10 years ago. The main constraint is the rail transportation in South Africa, which has affected most mining companies in the country. Anglo American also owns the Minas-Rio mine in Brazil, which produces just over 20 million mt/y of high-quality pellet feed.

Scale and synergies – it makes sense for met coal

BHP and Anglo American are two of the three largest exporters of metallurgical coal in the traded market, the third being Teck Resources. These three companies supply around half the world’s seaborne hard coking coal (HCC).

An acquisition of Anglo American would add scale to BHP’s existing premium hard coking coal operations in Queensland’s Bowen basin. Most BHP and Anglo coking coal mines are located adjacent, with access to the same Goonyella rail system and port infrastructure at Hay Point terminal and Dalrymple Bay Coal Terminal (DBCT). Synergies could be found across mine infrastructure, logistics, and marketing if the two operations were combined. The combined entity would have production capacity exceeding 70 million mt/y, reminiscent of the scale commanded by BHP prior to its BMC and Blackwater/Daunia divestments over the past three years. Only now the proportion of benchmark quality premium HCC would be much higher, yielding significant leverage to BHP in the traded met. coal market. The combined entity would account for 35% of hard coking coal supply in the seaborne market.

BHP, with its operations in Queensland, is the world’s largest metallurgical coal exporter with just over 50 million mt of exports in 2023, close to a 20% market share. The company operates Peak Downs, Goonyella Riverside and Saraji. These mines are referenced in most coking coal trade, forming the basis of price and coal quality benchmarks. The company has just completed the sale of its lower-quality assets to Whitehaven and Stanmore coal as they shift focus exclusively on higher-quality coking coal, where they now have a 25% market share.

Anglo American is also an important supplier of metallurgical coal and has made little change to its product portfolio over the past few years. Anglo has had safety-related challenges at its key coking coal mines Moranbah North and Grosvenor, leading to lower production in recent years.

All eyes on the fertilizer prize – BHP/Anglo projects

Neither BHP nor Anglo American have operational assets in the fertilizer space, but both have ambitious projects to build out large scale capacity for potassium bearing fertilizers.

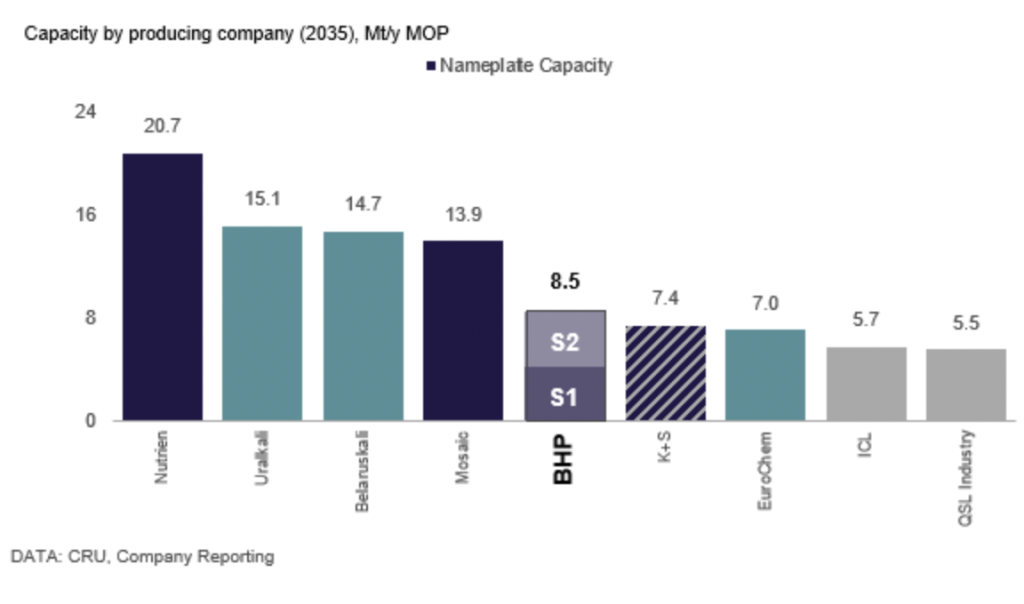

A combined BHP-Anglo American could be a large potash market player by the end of the decade. The Jansen project in Canada will be the centerpiece of BHP’s potash portfolio. However, despite the significant capital already injected into the Woodsmith polyhalite project, there will likely be less certainty and more scrutiny over its fit in a combined company.

BHP is constructing its Jansen potash ‘mega mine’ in two phases, with a planned total capacity of 8.5 million mt/y by 2029. This will make it the single largest MOP (Potassium Chloride) facility in the world.

Anglo American is constructing the world’s largest polyhalite mine at Woodsmith, in the north of England. This mine, with operation planned to begin in 2027, is designed to have a capacity of 13 million mt/y polyhalite ore. By raw output this will make it the largest mine for potassium bearing products in the world. However, polyhalite is low-grade, with the mine having K2O (Potassium Oxide) equivalent of only 1.8 million mt/y, vs. Jansen’s 5.1 million mt/y K2O. Both projects will contribute to a spate of capacity additions globally, supressing the long term outlook for prices.

Anglo American has a history with fertilizers, having jointly owned the Boulby potash (MOP) mine with Imperial Chemical Industries until it was acquired in 2002 by ICL. Anglo American acquired the northern England based Woodsmith polyhalite project for £405 million from Sirius Minerals for in early 2020. So far nearly $4 billion has been spent, with plans to spend around $1 billion dollars per year until 2027. BHP’s Jansen potash mine in Saskatchewan, Canada, calls for similarly large figures, having invested $4.5 billion in pre- Jansen stage 1 investments, allocating $5.7 billion for Stage 1 in August 2021, and in October of 2023 allocating a further $4.9 billion for Stage 2, for a total planned spend of $15.1 billion.

Will it happen? Could it happen?

Historical precedent tells us industry transformative M&A like this can happen and do happen but we are in the early stages of the bid process and there are many potential outcomes. Anglo’s share price has been lagging its peers of late, largely on the back of being weighed down by the poor performance of nickel and PGM prices. Time will tell what Anglo’s shareholders make of the all-share offer valuing Anglo American at £31.1 bn (USD$38.8 billion). If they pull it off, BHP might make the deal of the decade in mining space.

Learn more about CRU’s services at www.crugroup.com.