Market Data

April 25, 2024

SMU survey: HR, plate lead times slip as CR extends

Written by Ethan Bernard

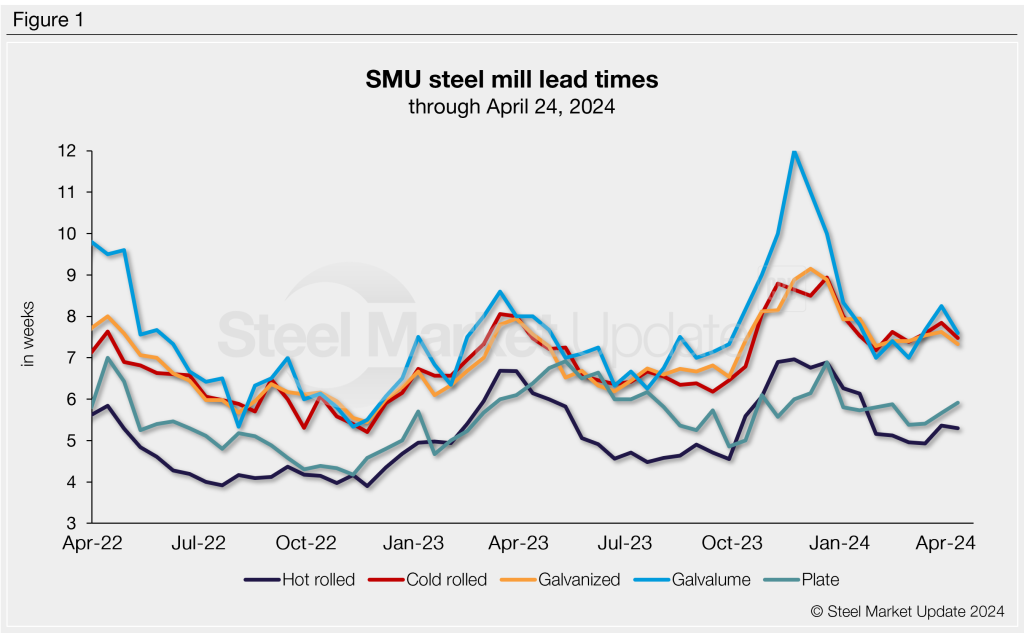

Hot-rolled coil and plate lead times contracted this week, with most other products remaining flat, according to SMU’s most recent survey data.

Cold-rolled products, however, saw lead times extend 0.1 weeks to an average of 7.5 weeks vs. two weeks earlier. Hot rolled and plate lead times both contracted 0.3 weeks from our last market check.

Table 1 below details current lead times. It displays the change from two weeks ago, a month ago, and three months earlier. It also shows the three-month trend.

Survey results

This week, 11% of survey respondents thought lead times would be extending two months from now, 70% thought they would be flat, and 19% expected them to contract.

Here’s what respondents are saying:

“Along with pricing bottoming before two months, lead times will come back up.”

“Lead times are flat or adjusting down now. In two months, still flat.”

“New normal.”

“We are expecting more domestic capacity (post-outages) and more imports.”

“Some outages will keep lead times flat. If not for the outages, lead times would be very short. Can still get quick responses from the mini-mills today.”

“In the midst of contraction.”

Figure 1 below tracks lead times for each product since April 2022.

3MMA lead times

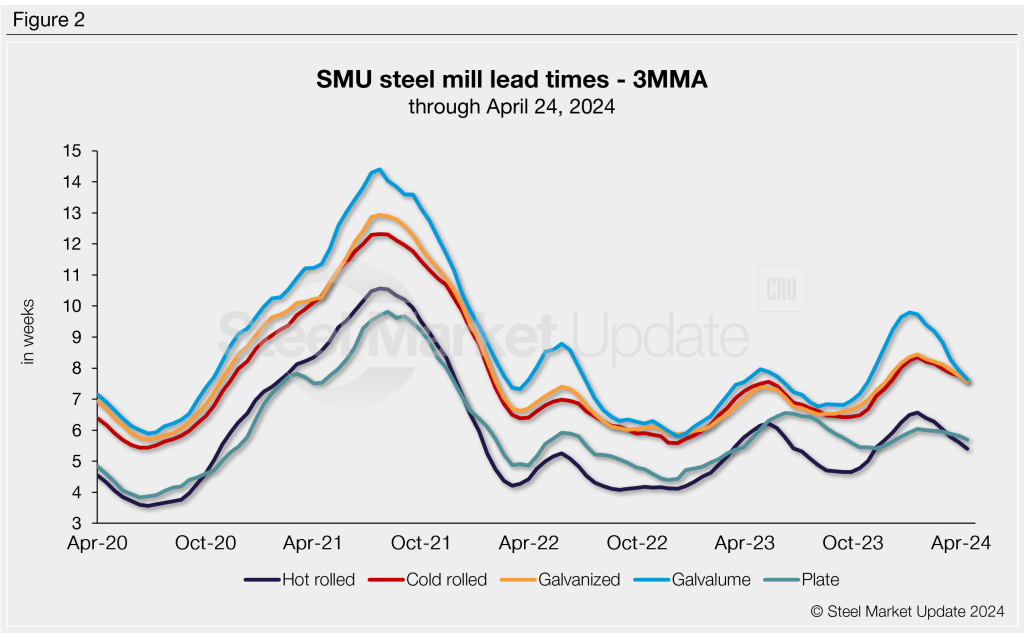

Looking at the three-month moving averages (3MMA) of lead times can smooth out the variability seen in our biweekly readings.

On a 3MMA basis, lead times contracted slightly for all products SMU surveys: with hot rolled at 5.25 weeks, cold rolled 7.52 weeks, galvanized 7.48 weeks, Galvalume 7.54 weeks, and plate at 5.68 weeks.

Figure 2 graphs the 3MMA for each product back to April 2020.

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis survey. SMU measures lead times as the time it takes from when an order is placed with the mill to when it is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our steel mill lead times data, visit our website. If you’d like to participate in our survey, contact us at info@steelmarketupdate.com.