Analysis

April 9, 2024

Final thoughts

Written by Michael Cowden

Nucor made waves in the sheet market when it announced on Friday that it would begin publishing a weekly hot-rolled (HR) coil price.

The Charlotte, N.C.-based steelmaker arguably made even bigger waves on Monday when it posted its first weekly HR number: $830 per short ton.

That’s $70/st lower than the $900/st HR price Cliffs announced in late March. It’s also lower than prices in the mid-$800s that other mills were (less publicly) seeking.

What was the impact on steel markets?

At times on Monday, it felt like Nucor’s announcement had totally eclipsed just about all other steel news.

An immediate impact was on futures markets. Here is where things stood with CME HR futures on Monday afternoon, following Nucor’s $830/st announcement:

The consensus had been that HR prices would continue to inch upward on steady demand, a raft of mill outages, and additional mill price announcements – even if the gains wouldn’t be as steep as some predicted in March.

Many in the market expected a Nucor announcement last week. Namely, a price increase. A published weekly HR price, and one at $830/st, wasn’t the announcement that was expected.

The result: The move at least temporarily took upward momentum out of the sheet market. SMU has adjusted its sheet price momentum indicators from upward to neutral to reflect that.

What the market is saying

“I am perplexed at what was accomplished by their $830. We found ourselves scratching our heads on Monday,” one mill source said. “We averaged more than that last week, which was also the best spot volume week in a little while.”

Another industry executive echoed that sentiment. He said his company had been selling HR for less than Cliffs but more than Nucor. That was not a problem as recently as Friday, he said.

“Since Nucor’s announcement, everything has changed. It really had a massive impact,” he said. “Now everyone believes the price is going down, not up.” But he questioned whether Nucor’s price would have as big an impact over the longer term.

A service center executive said that Nucor’s “Monday sticker price” has been, at least this week, a useful bargaining chip. “If another mill says $840, then I have the Nucor sticker price to come back and negotiate with,” he said.

That roughly dovetails with other sources, who said Nucor’s price would likely become a key reference point, among others, over time – as is already the case with its published plate prices.

A few suggested Nucor’s price could replace indices like those published by CRU, SMU, and others. But Nucor has publicly said that it does not intend to compete with the indices.

Preliminary survey results

So what do folks in the broader SMU community have to say?

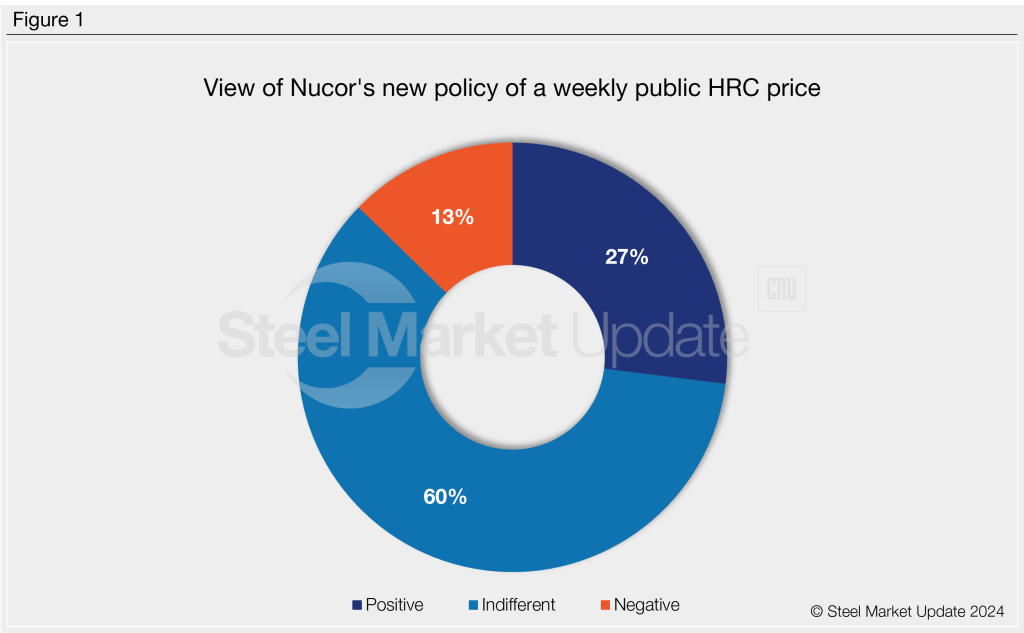

About 61% were indifferent to news of Nucor’s weekly HR price. Approximately 27% saw it as a positive development. And roughly 13% saw it in a negative light.

Here is what some of them had to say.

Positive

- “We believe that this move is mutually beneficial and will help many others.”

- “I like that a mill is going to publish their general spot number.”

- “Should bring more transparency to the market.”

Indifferent

- “It will depend on how honest they will be in publishing pricing. It takes a few cycles of publishing to realize if the rates are genuine.”

- “Wishful thinking!”

- “Too soon to tell. The bottom line is the deal we make, not the published number.”

Negative

- “I think it will create more speculation.”

- “The mills haven’t made much of a secret that they don’t care for indices. But to go at it alone is an interesting play. We shall see.”

Have your say!

The survey results above are preliminary. We won’t have complete data posted until Friday. So make sure you take part in this week’s SMU steel market survey.

For those who have already responded, thanks! For those who have yet to, keep an eye on your inbox for an invitation to participate in this week’s survey. And for those who do not participate, ping us at info@steelmarketupdate.com to learn how to.

Community Chat on Wednesday at 11 a.m. ET

Don’t forget to join us for the next SMU Community Chat on Wednesday, April 10, at 11 a.m. ET with Anton Posner, CEO of Mercury Resources.

The live webinar is free. You can register here. A recording of the webinar and the slide deck will be available only for SMU members.

We’ll talk about military tensions on the Red Sea, the drought on the Panama Canal, and the collapse of the Francis Scott Key Bridge in Baltimore – and what it all means for steel and scrap.

We’ll also talk about inland truck, rail, and barge issues. How are volumes and business there? And we’ll take your questions too, so think of some good ones to bring to the Q&A on Wednesday.

Thank you for your continued interest in SMU!