Analysis

March 28, 2024

February imports ease from seven-month high

Written by Brett Linton

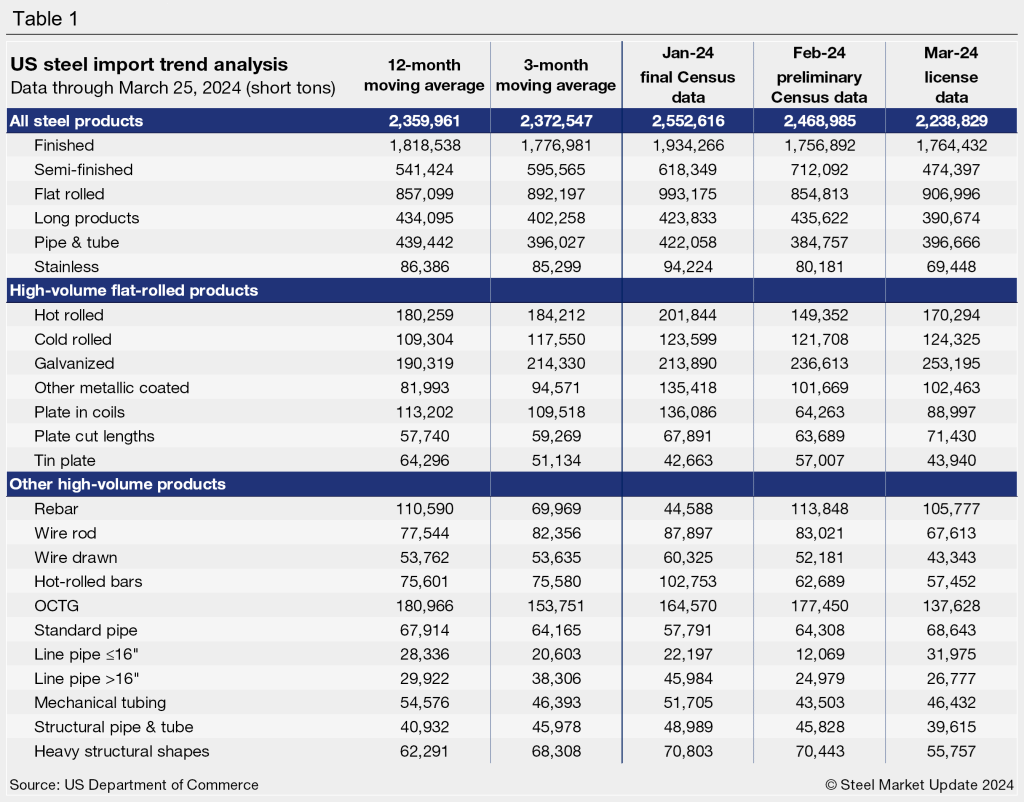

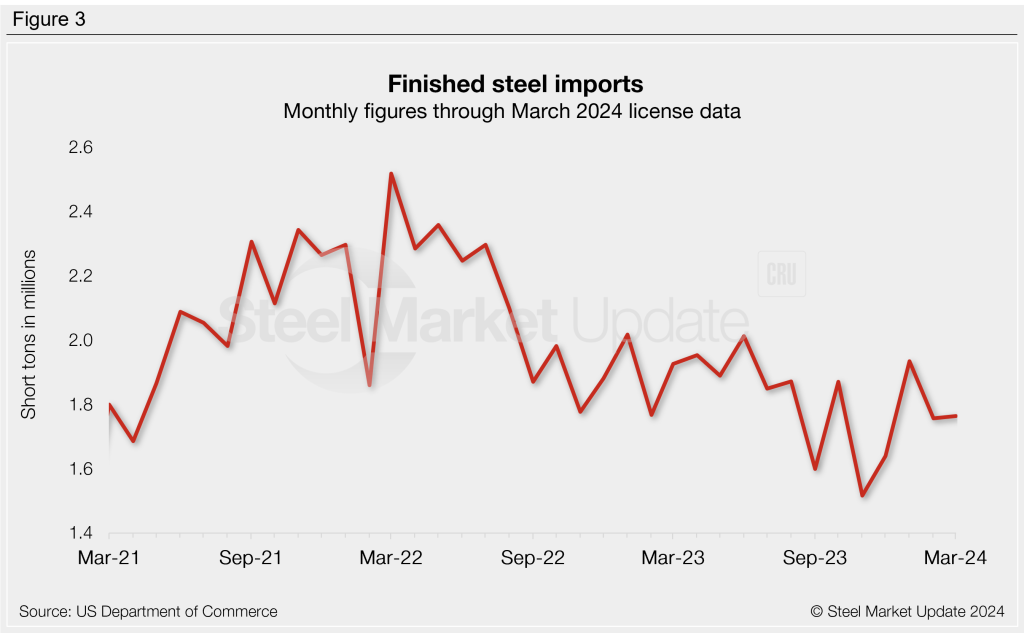

After reaching a seven-month high in January, steel imports fell back 3% in February, according to preliminary Census data released earlier this week. Though down month on month (m/m), February imports were strong compared to levels seen over the past few months, with the second-highest rate recorded since June 2023.

The US Commerce Department’s preliminary count shows 2.47 million short tons (st) of steel products entered the country last month. February levels were down from 2.55 million st in the first month of the year, but up from 2.10 million st in December 2023.

March import licenses through March 25 totaled 2.24 million st, down 9% from February. (Note that license data is still being collected so March levels could fluctuate from here).

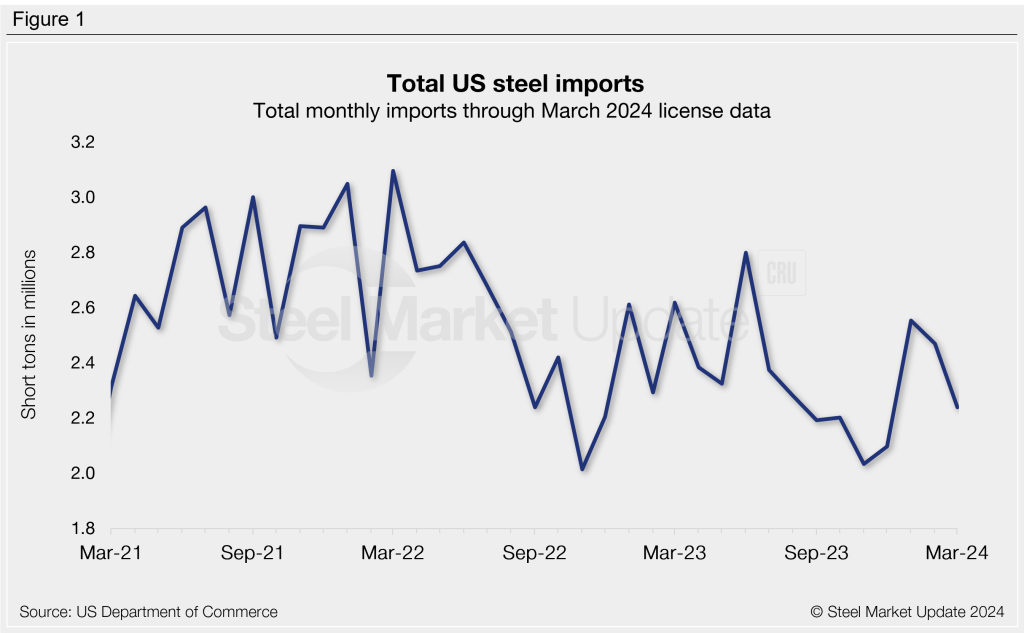

Imports as a 3MMA

Looking at imports on a three-month moving average (3MMA) basis can smooth out the variability in monthly readings. On a 3MMA basis, imports through preliminary February data rose to a six-month high of 2.37 million st.

March’s 3MMA through the 25th of the month was 2.42 million st. Figure 2 shows the strong rally after imports slowed in the latter part of 2023.

Semi-finished and finished steel

Recall imports of semi-finished steel had rallied 36% higher from December to January. Levels carried higher into February, jumping another 15% to 712,092 st. March licenses currently report 474,397 st of semi-finished material coming into the country, potentially down 33% from February levels.

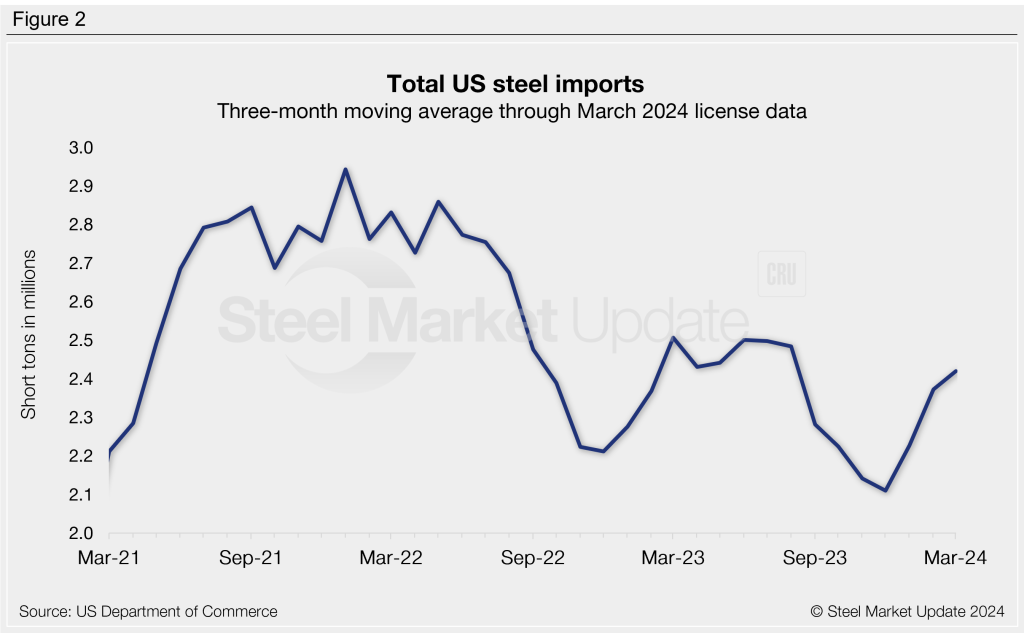

Meanwhile, finished steel imports eased 9% in February to 1.76 million st. Finished imports had risen 18% m/m in January. The latest March tally is at 1.76 million st, in line with February figures.

The American Iron and Steel Institute (AISI) estimated the finished steel import market share to be 21% in February, down from 22% in January.

Flat-rolled steel

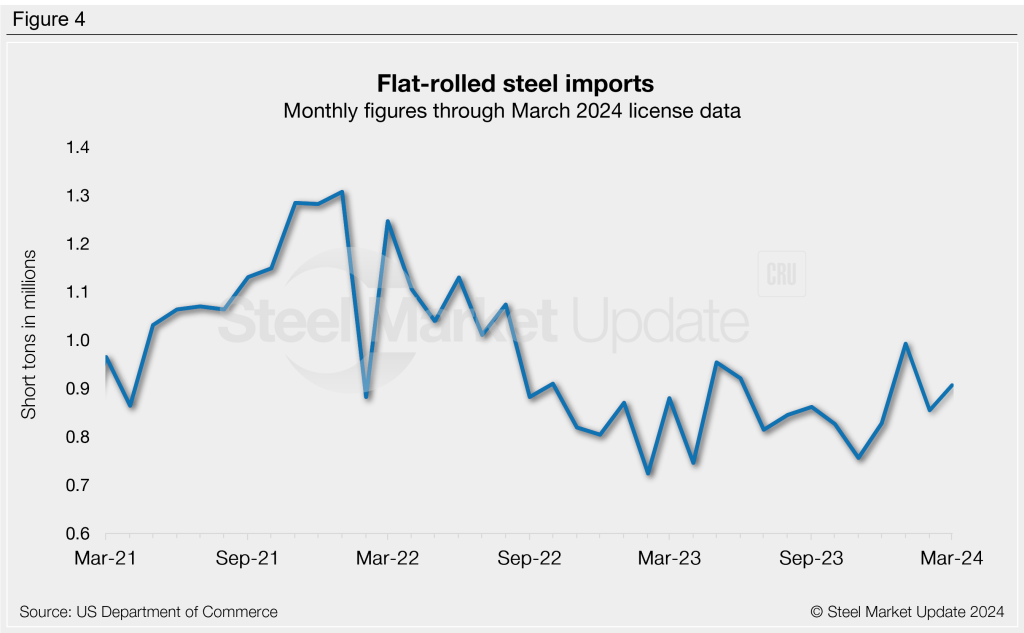

After falling to a seven-month low in November, flat-rolled steel imports jumped in December and again in January to reach a 17-month high of 993,175 st. Imports slipped 14% m/m into February to 854,813 st but are still in line with levels seen over the last year and a half. March licenses are currently up 6% m/m to 906,996 st.

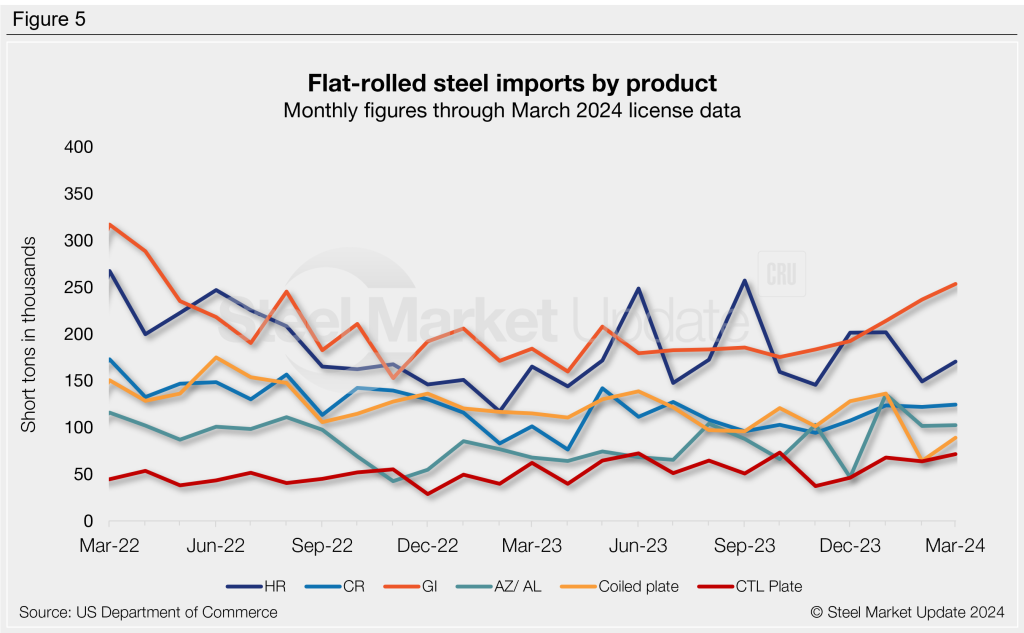

Figure 5 shows flat rolled imports of popular products. Most products declined from January to February, aside from galvanized (+11%). The largest monthly drop was seen in plate in coils (-53%), followed by hot-rolled coils (-26%) and other metallic coated (-25%). March licenses show a rebound across the board, with notable recoveries in plate in coils (+38%), hot rolled (+14%), and plate cut lengths (+12%).

Pipe & tube

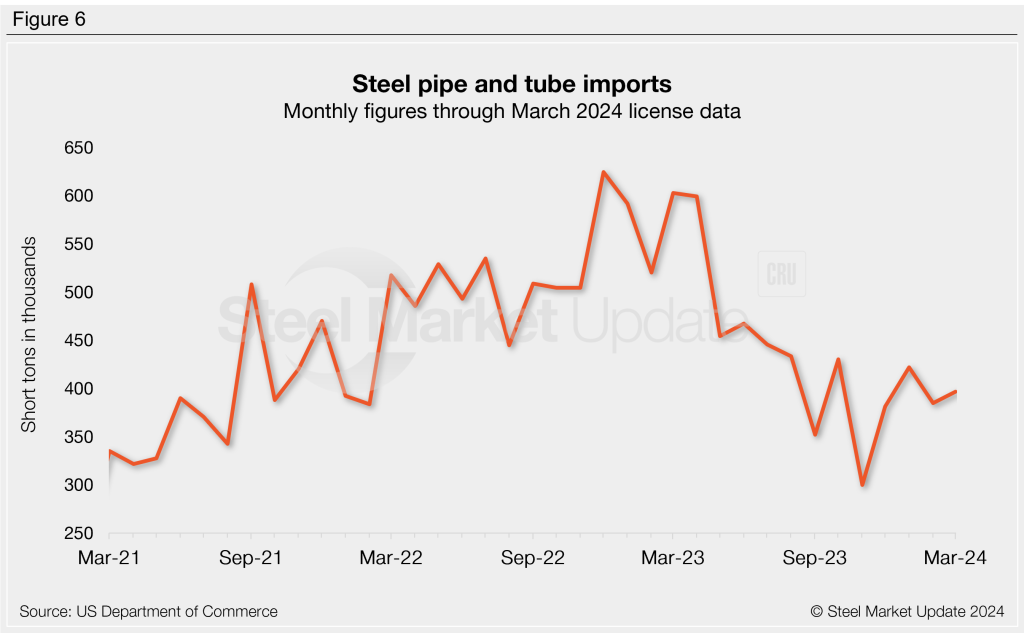

February’s preliminary count of pipe and tube imports eased 9% m/m to 422,058 st. March levels are at 396,666 st through the latest license data, up 3% m/m. Pipe and tube imports have been substantially lower over the last few months compared to years prior.

Imports by product

The chart below provides further detail into imports by product, highlighting high-volume steel products.