Market Data

March 27, 2024

HR vs CR price gap continues to increase

Written by Brett Linton

The dollar premium cold-rolled coil (CR) carries over hot-rolled coil (HR) continues to expand according to our latest check of the market. The spread between these two products is now up to $305 per short ton (st), one of the highest weekly deltas seen over the last 17 months.

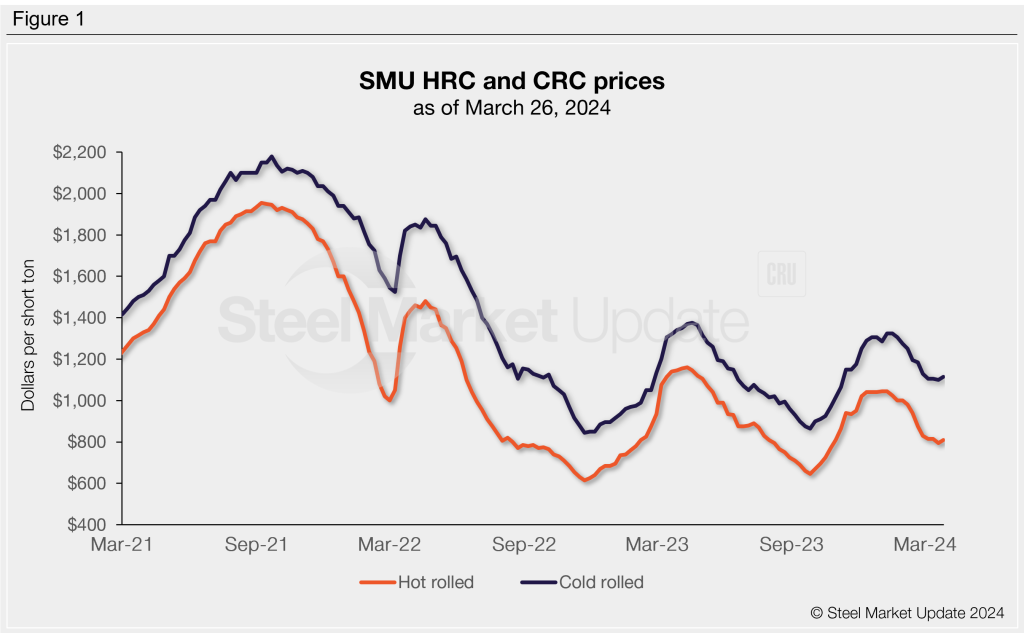

Figure 1 below shows SMU’s average HR and CR base prices as of March 26.

SMU’s HR price reversed course this week and rose to $810/st, the first week-on-week (w/w) increase in 11 weeks. HR prices are now $235/st lower than the highs seen at the start of the year, having fallen by an average of $20 each week of 2024.

Cold rolled prices inched up to $1,115/st this week, also the first w/w increase seen in 11 weeks. CR are down $210 from their early January peak. The average weekly decline in CRC prices in 2024 is slightly less than HRC at $14/st.

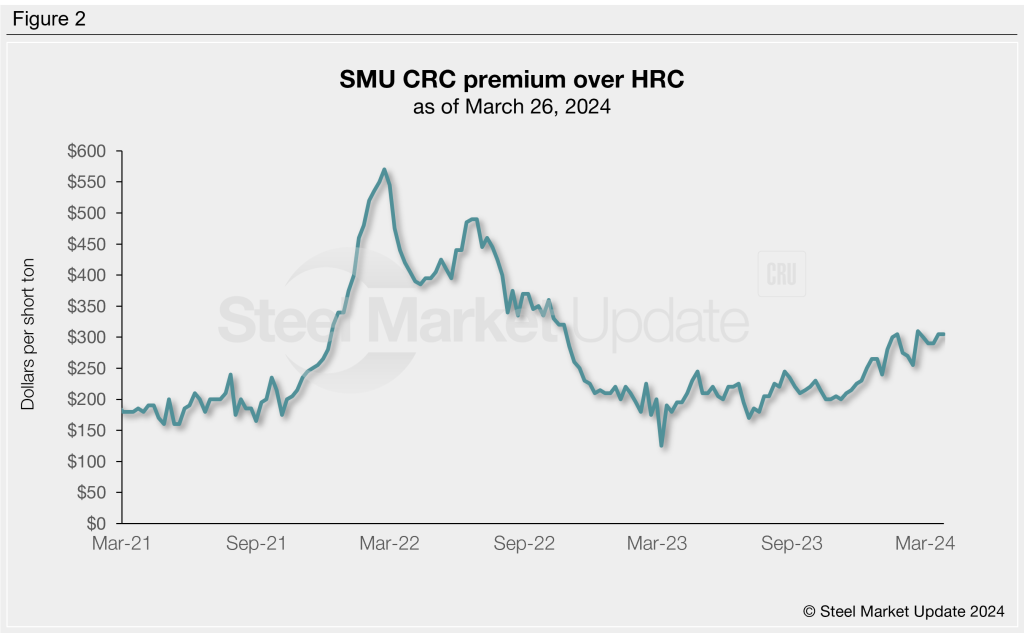

As Figure 2 shows, the latest HR vs. CR price spread is $305/st as of March 26, having been in the $290-305/st range for the last month. The average price spread throughout 2024 is now up to $287/st. Prior to the last two months, we have not seen spreads this high since Oct. 2022.

Back in early 2022, CRC’s premium over HRC peaked at $570/st, a record high. Throughout the second half of that year, the spread slipped lower and returned to typical levels by year end. We saw relatively stable spreads last year, averaging $210/st across 2023. In December 2023, the delta began widening again and has continued to do so since.

In our early March update on HR vs CR prices, we posed the question: Are sub-$200/st premiums now a thing of the past? Over the past two and a half years, we have only seen twelve weeks where the price spreads were beneath that threshold.

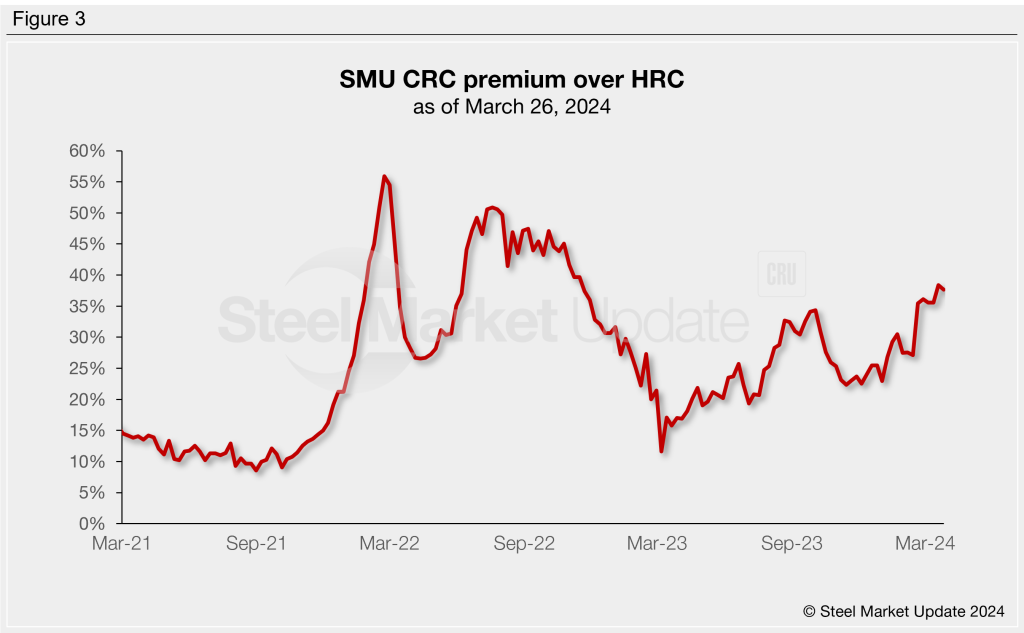

Figure 3 displays the spread from a different perspective, graphing the cold rolled premium over hot rolled as a percentage of the HR price.

While cold rolled’s percentage premium over hot rolled took a dive in late 2022 through early 2023, the premium recovered throughout the year to peak at 34% in October 2023. After briefly easing through the final months of 2023, the spread jumped back up in February and now stands at a 16-month high of 38% as of March 26.

You can chart historical HRC and CRC prices using SMU’s interactive pricing tool on our website.