Market Data

March 14, 2024

SMU survey: Steel mill lead times stabilize following months of declines

Written by Brett Linton

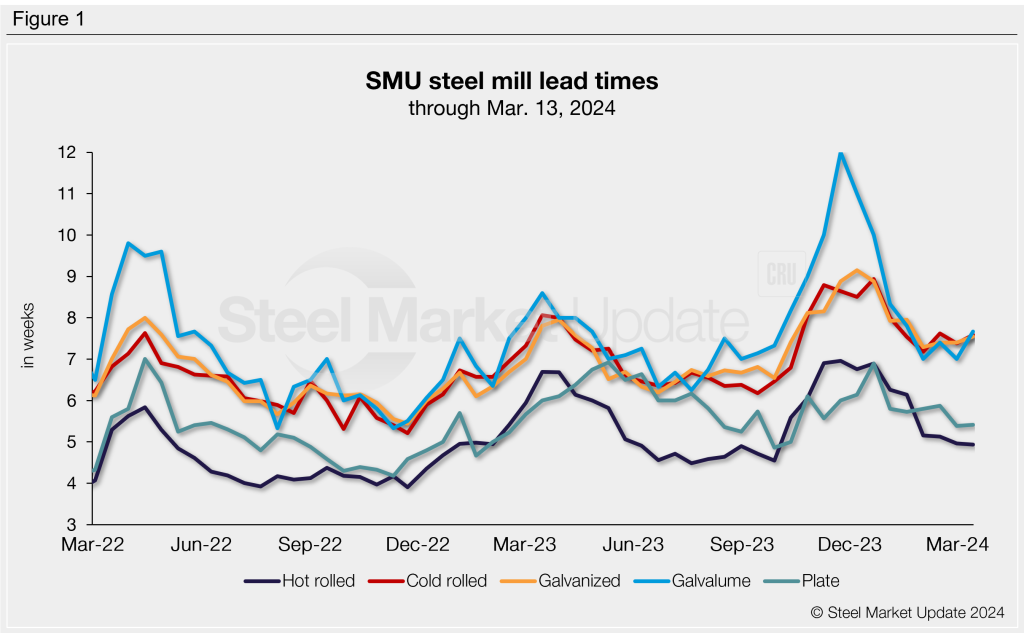

Steel mill lead times were flat to slightly up, according to our market survey this week. Mill production times were stable for hot-rolled and plate products, and marginally higher for cold-rolled and coated. This is the first time in three months where we have not seen an overall reduction in lead times. Could this be an inflection point, or just a pause brought on by recent mill price increase announcements?

Lead times by product

In our latest market check, steel buyers reported hot-rolled sheet lead times between 3 and 7 weeks. The average lead time is now 4.9 weeks, in line with late February levels. This is down 0.2 weeks from one month prior and 1.3 weeks shorter than levels seen at the start of the year. Prior to late-February, the last time we saw hot rolled lead times shorter than 5 weeks was in September 2023.

Buyers of cold-rolled and galvanized sheet reported lead-times ranging from 5 to 10 weeks, with both averaging 7.6 weeks through our latest data. Lead times for both products are down 0.5 weeks from the beginning of the year and have hovered in the 7-8 week range on average since January.

Buyers reported Galvalume lead times between 6 and 10 weeks, with this week’s average rising from 7.0 to 7.7 weeks. Like other tandem mill products, average Galvalume production times have hovered between 7-8 weeks throughout the year. Recall that Galvalume lead times had peaked at 12 weeks last November.

Steel buyers reported plate lead times ranging from 4 to 7 weeks. The average lead time is 5.4 weeks, unchanged from late-February. Average plate lead times have been in the 5-6 week range since January. This remains one of the shortest plate lead times recorded since October of last year.

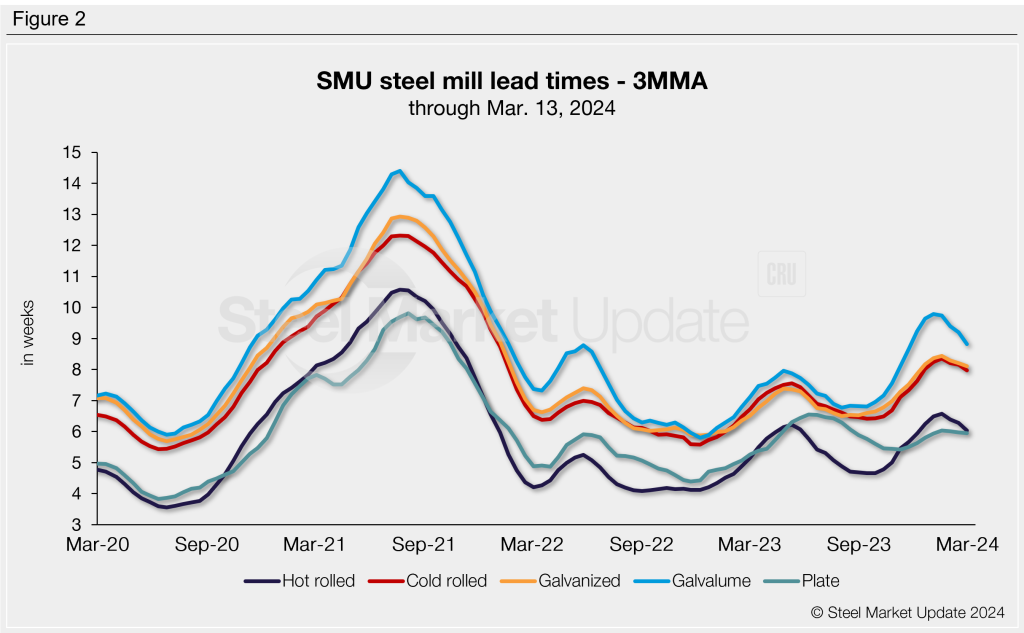

3MMA lead times

Looking at lead times on a three-month moving average (3MMA) can smooth out the variability seen in our biweekly measurements. On a 3MMA basis, lead times for all products declined between 0.1-0.5 weeks compared to our previous update and have been contracting over the past two months.

The 3MMA for hot rolled shrunk by one quarter of a week from late-February, now at 5.8 weeks. Cold rolled and galvanized both eased to just under 8 weeks. Galvalume declined by half of a week to 8.3 weeks. Plate’s lead time shortened by 0.1 weeks to 5.9 weeks, having been relatively flat since December.

SMU’s survey results

This week, 53% of surveyed buyers predict lead times will be flat two months from now, down from a rate of 63% in late-February. Meanwhile, 32% expect lead times to be extending in two months, up from 20% two weeks ago. Those expecting lead times to contract slightly declined from 17% to 15%.

Here’s what a few of our survey respondents had to say about lead times:

“Just don’t see enough demand to let market take off.”

“Mills will have to keep supply short.”

“Seasonal auto shutdowns and their concern about inventory will temper demand.”

“Imports will slow lowering supply.”

“We will be looking past automotive model-year change over and mills will begin planning further out.”

“Seasonal upturn but they will be shorter than normal until then.”

SMU will next update lead times on Thursday, Mar. 28.

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis survey. SMU measures lead times as the time it takes from when an order is placed with the mill to when it is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our steel mill lead times data, visit our website. If you’d like to participate in our survey, contact us at info@steelmarketupdate.com.