Market Data

March 5, 2024

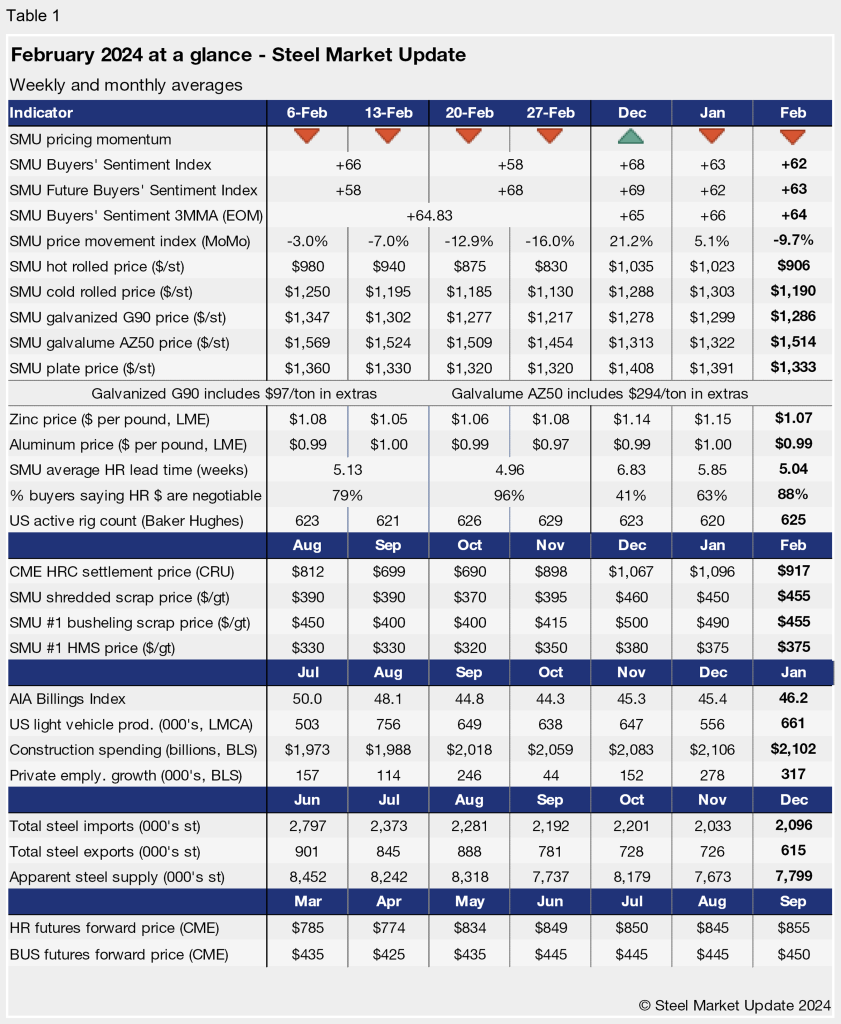

SMU's February at a glance

Written by Brett Linton

Steel prices continued to ease lower throughout February, following a loss of upwards momentum in the middle of January.

The SMU Price Momentum Indicator for sheet products remained at Lower since its mid-January adjustment from Neutral. Like sheet, the Price Momentum Indicator on plate remained at Lower all through February.

We saw hot-rolled coil (HRC) tags start the month around $980 per short ton (st), slipping $40-65 per st each week through month’s end. By the end of February, HRC prices eased 15% from the beginning of the month to $830 per ton. Tandem products saw smaller declines in this period, falling 10%. Plate prices saw the softest decline in February, easing 7%.

Raw material prices were stable to down across the month. Busheling scrap prices declined for the second consecutive month, slipping $35 from January. Shred and HMS scrap prices were relatively flat. Read our recent outlook on the March scrap market here. LME zinc spot prices eased in the first half of the month, while aluminum prices held mostly stable. You can view and chart multiple products in greater detail using our interactive pricing tool here.

The SMU Steel Buyers’ Sentiment Index remained positive but eased to an eight-week low at the end of the month. Future Buyers’ Sentiment moved in the opposite direction, rising to a near-six-month high last week.

Hot rolled lead times averaged 5 weeks in February, easing lower throughout the month. Lead times for each product we track are nearing lows last seen in September of last year. SMU expects lead times to potentially dip further due to reduced demand. A history of HRC lead times can be found in our interactive pricing tool as well.

About 96% of HRC buyers reported that mills were willing to negotiate on prices through late-February. Buyers have reported more mill willingness to negotiate each month since December.

Key indicators of steel demand continue to show some signs of weakness overall, with most nowhere near the bullish levels seen in recent years.

See the chart below for other key metrics for February: