Analysis

February 16, 2024

Steel market chatter this week

Written by Laura Miller

When will steel prices bottom? Where will steel and scrap prices be in the coming months? Are you actively buying steel? Will your company meet its forecast?

You all had a lot to say in this week’s survey about what’s going on in the market right now and where we’re headed.

In your own words, with minimal editing, here’s what some of you in the SMU community shared with us this week, as well as some of the slides from this week’s steel buyers’ survey.

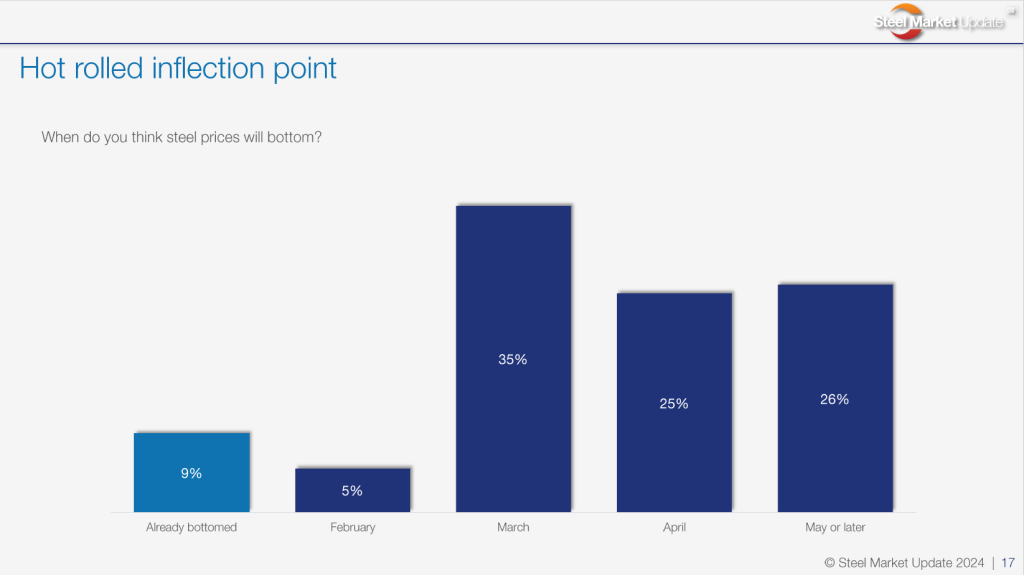

When do you think sheet prices will bottom, and why?

March

“Demand is OK; inventories are fairly lean. Pricing won’t go down forever.”

“It will depend on how quickly prices drop, but I see a mid-late March bottom.”

“March is the month where lead times stall and hit their lowest point and allows a few more weeks of buyers pushing prices lower than they should probably go.”

“I think we have much more room for falling prices.”

April

“Some mills have a backlog of orders, but others are showing signs of holes in the order book. It will take some time for the bottom of the market to be realized.”

“Offshore pricing is still much better than domestic, and supply is good at service centers.”

“They will bottom when European imports stop coming in.”

“Lead times are contracting, and steel service centers seem to be destocking after ordering a large amount in Q4.”

“I feel we will see a slower decline than the increase late last year, getting down into the low $800s.”

May or later

“We are expecting to see a few months’ worth of slides here. I don’t think it outlandish to call for sub-$800/ton HRC as Q2 rolls around.”

“Hot rolled is falling at a faster pace than cold rolled or coated, and I expect this to continue.”

“Forward curve is bearish.”

Hot-rolled coil prices averaged $980 per ton in our last market survey. Where will prices be in two months?

$1,000-1,049 per ton

“Good demand fundamentals will pull prices higher by April.”

$950-999

“It won’t change that quickly.”

$900-949 per ton

“I would think in two months, prices are back up a bit.”

$850-899 per ton

“Word on the street is that large transactions are already happening below this.”

“Mills will hit the market with increases as the bottom overcorrects.”

“Economy is still sluggish, and the election cycle will get more dramatic.”

“Oversupply, and demand is not as strong as forecasted.”

$799 per ton or lower

“Nothing to stop it.”

“The peak was $55/cwt ($1,100/ton) in late December. The low point was $33/cwt ($660/ton) in early October. Hope springs eternal this time of the year, but it won’t hold. The cycle will prevail.”

“The last few market bottoms have occurred when the HRC to #1 busheling spread went below $300/ton. Scrap is at $480, so I expect it to get into the $700s.”

“Mills cannot help themselves but try to grab market share.”

“Prices will drop and will have to settle into a new price normality, as demand is not enough to sustain high prices.”

“If we get $20-30/ton drops, we’ll be below $800/ton in late March/early April. Crazy, but we’ll probably get there.”

“Futures trading at $780/ton today for April”

“Imports coming into Gulf Coast.”

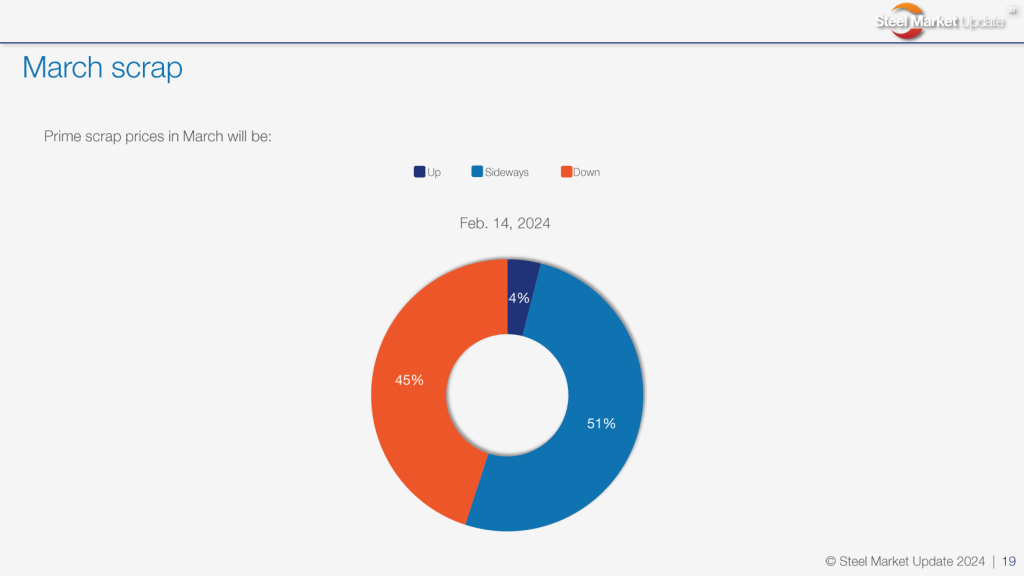

Prime scrap prices in March will be:

Down

“Quite a bit of confusion out there on scrap, but it seems far less bullish at the moment.”

“Scrap prices have already started to drop.”

“Weather allows more flow into the yards.”

“Seems like everyone is pointing to pressure on scrap with coil prices falling.”

“Down slightly. Follow the forward curve and continued soft demand in China.”

“Collection improves, and numbers soften slightly.”

“Lower buying activity and lower service center inventories.”

Sideways

“Roller coaster.”

“Stable scrap demand.”

“Demand is climbing, but availability should be, too.”

“February is down, which is a departure from historical trends, so March will somewhat correct this by staying flat.”

“Transition will occur from export to domestic use.”

Up

“More demand as EAF capacity increases, also more demand for infrastructure poles, scrap for rebar, etc.”

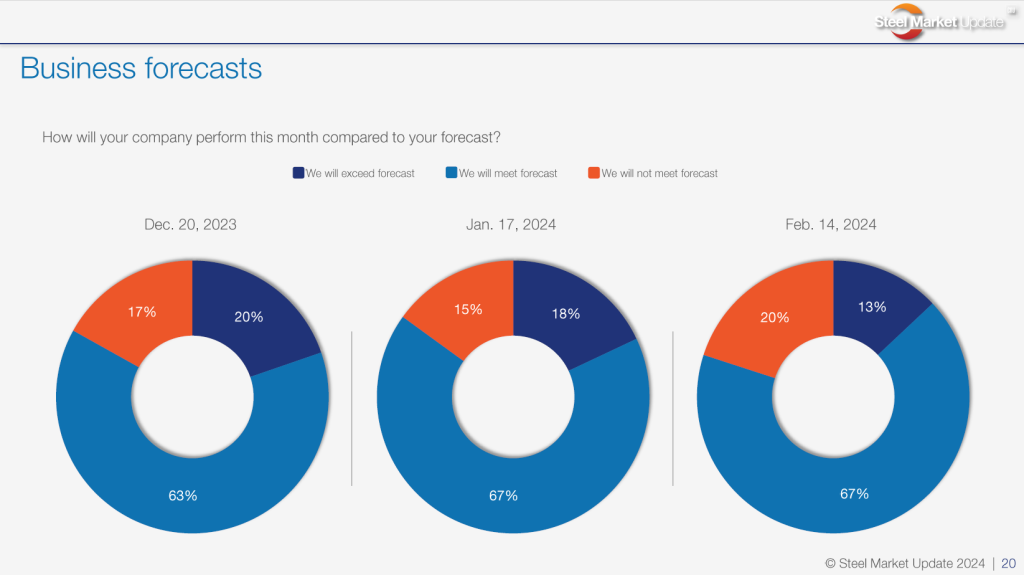

How will your company perform this month compared to your forecast?

We will exceed forecast

“A couple large orders booked in Q4 are shipping this month.”

“We’ll be the exception and will exceed forecast. Most market respondents will be flat or slightly down from last year.”

We will meet forecast

“We are having issues placing orders, as buyers continue to push for lower prices.”

“We’re continuing to steal market share, so our business is meeting or exceeding forecasts.”

We will not meet forecast

“Have seen quite a bit of slowdown in February vs. January.”

“Seeing margin compression.”

“Customer forecasts keep falling, and we are reacting, but this will continue to reduce how much we are buying.”

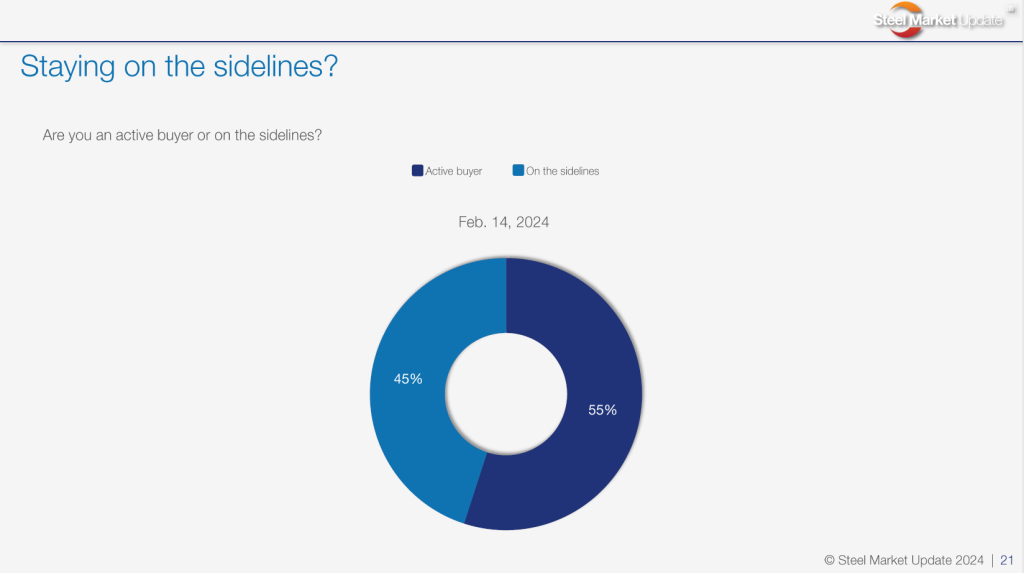

Are you an active buyer or on the sidelines, and why?

On the sidelines

“We are buying what we need but minimizing quantity.”

“Already contracted late last year and don’t need additional tonnage.”

“But very close to being a buyer as quickly as prices have come down.”

“Only buying what we can sell back to back.”

“We’re ‘on the sidelines’ from a mill perspective, but we’re beating up all of the steel service centers pretty good right now.”

Active buyer

“Pricing has moved down, and offshore pricing is still lower than domestic.”

“Active, but only buying what we need for orders. We are working on reducing inventory.”

“Only buying what we will consume. We are depleting inventory.”

“Only for sold work, no speculation.”

“We maintain inventory, so we’re constantly buying smaller amounts.”

Thank you to everyone who participates in our surveys!

Do you not yet take part in our surveys but care to share your views as well? Contact david@steelmarketupdate.com to be included in our questionnaires.