Market Data

February 15, 2024

SMU survey: Steel mill lead times largely stable

Written by Laura Miller

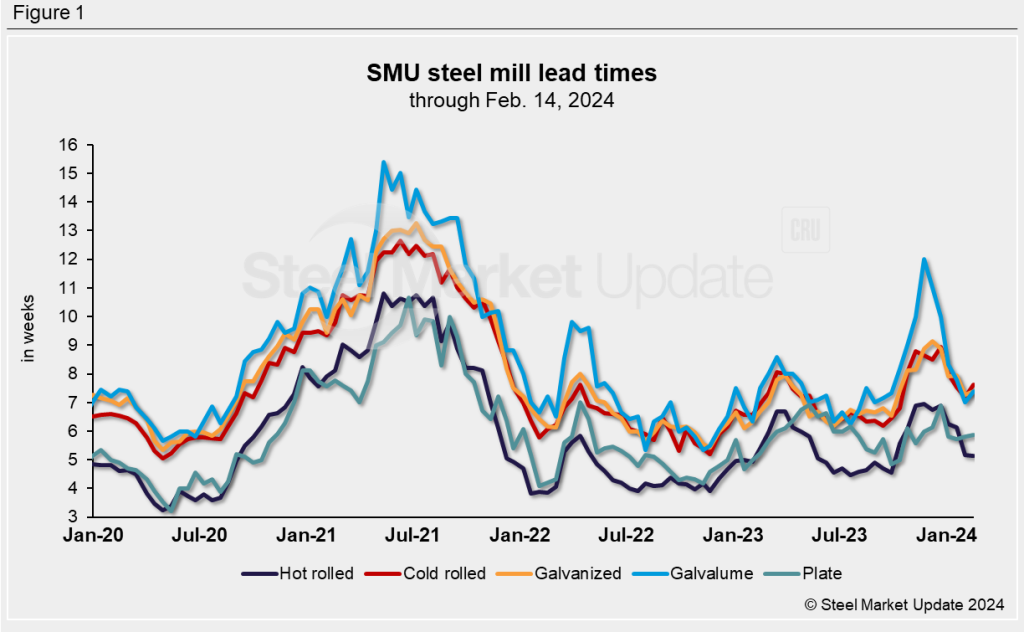

Mill lead times for flat-rolled steel were mostly stable over the past two weeks. With several mills slow to come out of outages and upgrades, cold rolled and coated lead times have been holding up a bit better than hot rolled.

Mill lead times this week

In this week’s market survey, buyers reported lead times for hot-rolled sheet from 3 to 7 weeks. The average of 5.13 weeks was comparable to the 5.16-week lead time reported two weeks ago. Since the start of the year, HRC lead times have contracted by 1.13 weeks.

Buyers of cold-rolled sheet this week reported a lead-time range of 6 to 10 weeks, with the average of 7.62 weeks extending by 0.44 weeks from two weeks earlier. At the start of the year, CRC lead times were on average 8.00 weeks.

Galvanized sheet lead times were again reported by buyers this week to be between 5 and 10 weeks. The average of 7.40 weeks extended by 0.11 weeks from our Jan. 31 market check. Galvanized lead times are now just 0.53 weeks shorter than at the start of 2024.

Buyers reported lead times for Galvalume ranging from 6 to 10 weeks. This week’s average of 7.40 weeks is unchanged from two weeks ago. Galvalume lead times have come down by almost a week since the start of the year and are down from 12.00 weeks in late November.

Lead times for steel plate have held steady since the start of the year. Buyers said plate lead times are now between 3.5 and 8 weeks. The average of 5.88 weeks is comparable to the 5.80-week lead time seen at both the start and end of January.

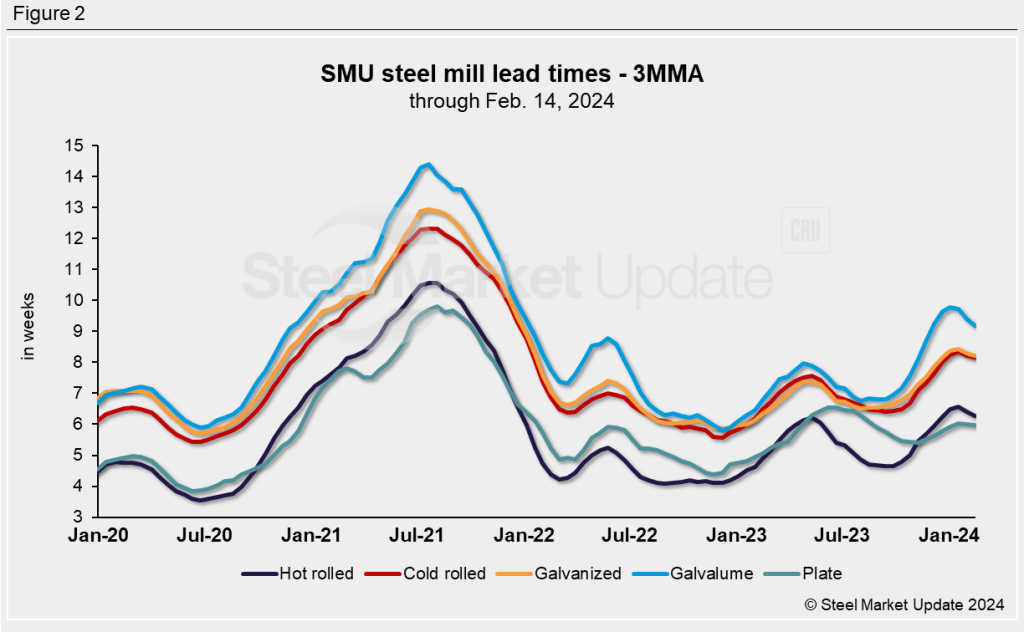

3MMA lead times

To smooth out the variability in SMU’s biweekly readings, we can consider lead times on a three-month moving average (3MMA) basis.

Hot rolled’s 3MMA lead time was 6.49 weeks at the start of the year before bumping up to 6.57 weeks during the week of Jan. 17. It has since contracted for two consecutive market checks, coming in at 6.27 weeks.

The 3MMA lead times for cold rolled and galvanized have been above 8.00 weeks since our Dec. 21 check of the market. There’s been some movement in the averages, but they are largely steady, at 8.15 weeks for cold rolled and 8.20 weeks for galvanized.

We calculated Galvalume’s 3MMA lead time this week to be 9.19 weeks, the shortest it’s been since the end of November.

Plate’s 3MMA lead time has been between 5 and 6 weeks since September and has been steady since the start of 2024, registering 5.98 weeks this week.

SMU’s survey results

More buyers in this week’s survey (56% vs 55% two weeks ago) said they think lead times will be flat two months from now. Those expecting a contraction in lead times fell to 31% (from 33%). Still, 12% foresee extending lead times two months out.

Here’s what a few of our survey respondents had to say about lead times:

“We’re already seeing domestic lead times slip, and we aren’t even seeing the waves of imports yet.”

“Summer changeover and shutdowns should be impacting lead times in two months.”

“As we hit bottom and mills book deals, they will push lead times back up.”

“Mills will be forced to act to try and stop the freefall.”

“March is the month where lead times stall and hit their lowest point and allows a few more weeks of buyers pushing prices lower than they should probably go.”

“HR is relatively short. HDG is tight and long.”

SMU will next update lead times on Thursday, Feb. 29.

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis survey. SMU measures lead times as the time it takes from when an order is placed with the mill to when it is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our steel mill lead times data, visit our website. If you’d like to participate in our survey, contact us at info@steelmarketupdate.com.