Market Data

February 1, 2024

SMU survey: Sheet mill lead times pull back significantly

Written by Laura Miller

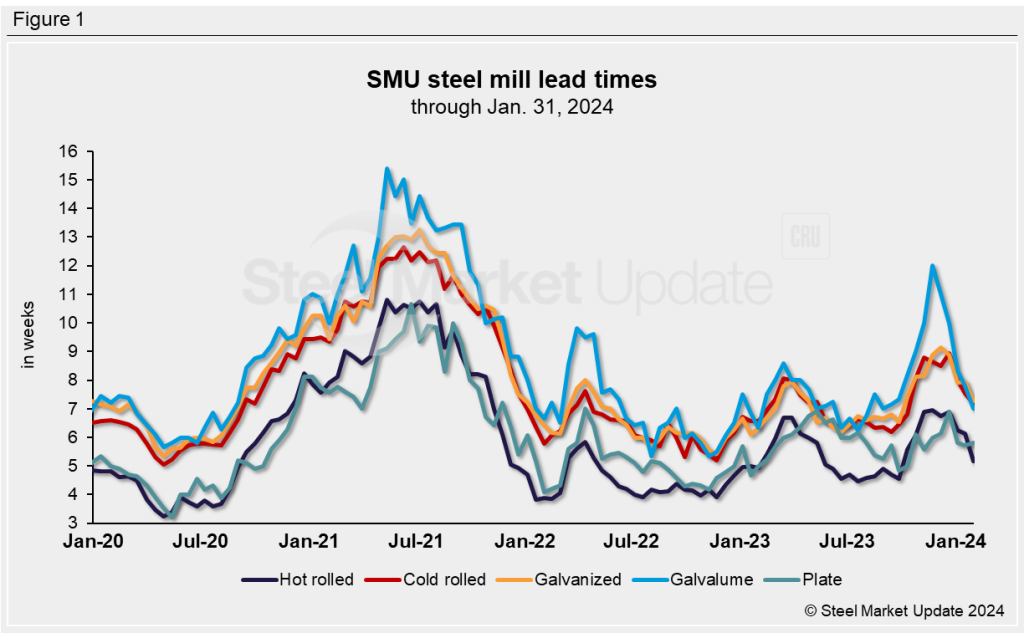

Steel mill lead times for sheet products saw substantial declines over the past two weeks, while plate production times held steady during January.

In SMU’s check of the market this week, hot-rolled coil (HRC) lead times contracted by a week from our Jan. 17 market check. Meanwhile, manufacturing times for cold-rolled and coated products are holding up slightly better.

Mill lead times this week

HRC lead times were reported by buyers in SMU’s survey this week to be between 3 and 8 weeks. The average of 5.16 weeks contracted by 0.98 weeks from two weeks prior. We haven’t seen a lead time for HR this low since late September when HR prices hit their low for last year.

Buyers reported lead times for cold-rolled sheet ranging from 6 to 9 weeks, with an average of 7.18 weeks. This week’s average is 0.35 weeks shorter than two weeks earlier and is the lowest CRC lead time since mid-October.

Buyers of galvanized sheet this week reported a lead-time range of 5 to 10 weeks. The average of 7.29 weeks contracted by 0.66 weeks from 7.95 weeks two weeks ago. This is also the shortest galv lead time since mid-October.

In this week’s market check, we calculated the lead time for Galvalume to be 7.40 weeks, a decline of 0.40 weeks from the Jan. 17 market check. Galvalume lead times have been steadily falling since reaching a recent peak of 12.00 weeks at the end of November.

Note that our data for Galvalume is more volatile due to the smaller sample and market size. This week, we averaged in the average lead time reported two weeks earlier due to fewer inputs. If you are a buyer of Galvalume and would like to share your lead time and pricing data with SMU, please contact david@steelmarketupdate.com.

In this week’s market check, buyers reported lead times for plate from 4 to 7 weeks. The average of 5.80 weeks was comparable to the 5.73-week lead time reported two weeks prior. Plate lead times have been holding steady since the start of 2024 after rising to a recent peak of 6.89 weeks during the week of Christmas.

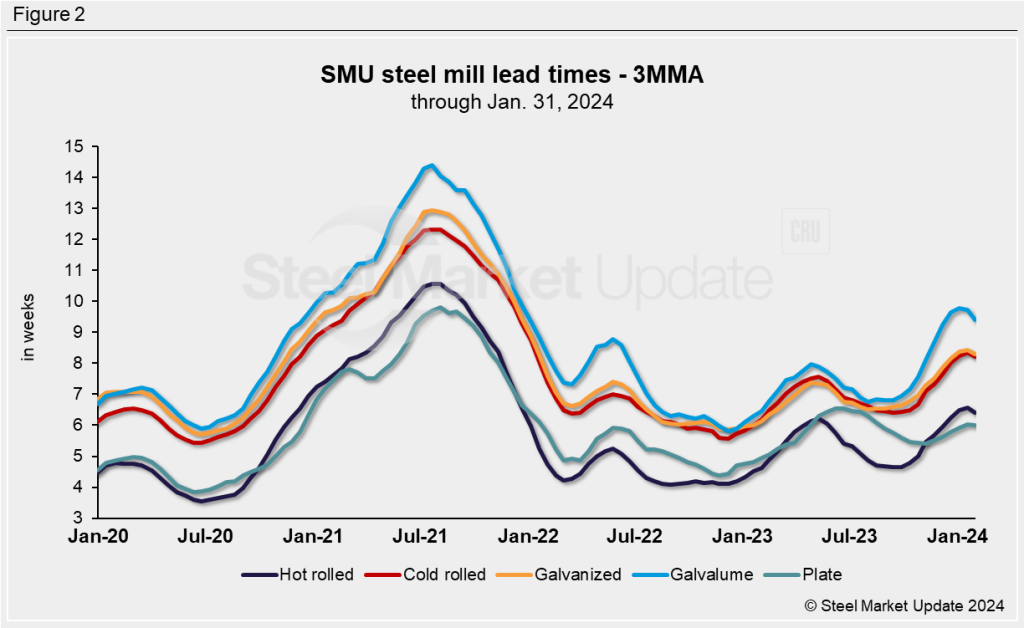

3MMA lead times

We can look at the three-month moving averages (3MMA) of lead times to smooth out the variability in SMU’s biweekly readings.

The 3MMAs for all flat-rolled products tracked by SMU declined across the board this week.

Plate’s 3MMA saw the smallest decline, from 6.03 weeks two weeks prior to 6.00 weeks this week.

Galvalume’s 3MMA saw the largest decline, falling by 0.34 weeks to an average of 9.39 weeks.

HRC, CRC, and galvanized lead times on a 3MMA basis were shorter by 0.18, 0.15, and 0.14 weeks, respectively.

SMU’s survey results

In this week’s survey, we asked buyers if they think lead times will be extending, flat, or contracting two months from now. The number of buyers anticipating flat lead times rose from 45% in our last survey to more than 55% this week. Still, 33% expect contracting lead times (down from 42%), and only 12% foresee extending lead times.

Here are a few comments from survey respondents:

“We’re already seeing domestic mills getting antsy and that is before imports start showing up. A troubling sign, no doubt.” – Buyer predicting contracting lead times

“Already starting to see the trend.” – Buyer predicting contracting lead times

“I think they contract before then, and then flatten out.” – Buyer predicting flat lead times

“I assume lead times will drastically decrease in the next few weeks.” – Buyer who thinks current lead times are slightly longer than normal

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis survey. SMU measures lead times as the time it takes from when an order is placed with the mill to when it is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our steel mill lead times data, visit our website. If you’d like to participate in our survey, contact us at info@steelmarketupdate.com.