Market Data

January 16, 2024

December service center shipments and inventories report

Written by Estelle Tran

Editor’s note: Steel Market Update is pleased to share this Premium content with Executive members. For information on how to upgrade to a Premium-level subscription, contact info@steelmarketupdate.com.

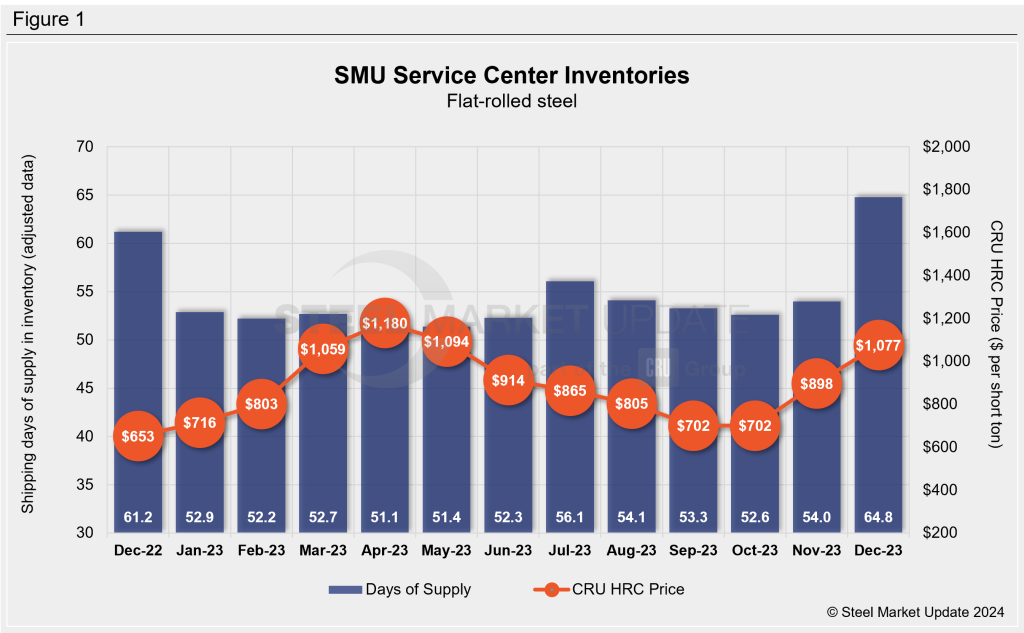

Flat Rolled = 64.8 Shipping Days of Supply

Plate = 66.4 Shipping Days of Supply

Flat rolled

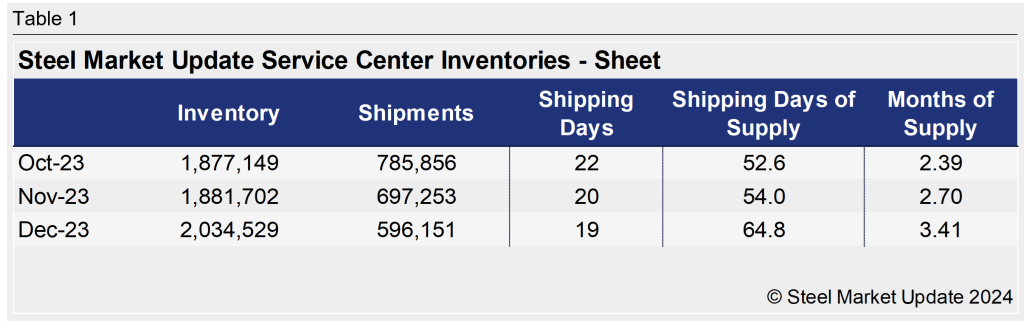

US service center flat-rolled steel inventories surged in December with the seasonal slowdown in shipments. At the end of December, service centers carried 64.8 shipping days of supply, according to adjusted SMU data, up from 54 days in November. In terms of months on hand, service centers carried 3.41 months of flat-rolled steel supply at the end of December, up from 2.7 months in November. Inventories at the end of December were up year on year as well from 61.2 shipping days of supply and 3.06 months in December 2022.

December had 19 shipping days, compared to 20 in November. The number of shipping days reported by service centers varied from 16 to 22 days with 19 as the average. The variation in shipping days as well as seasonal demand slowdown around the winter holidays helps to explain the spike in December inventories.

While inventories rose in December, the amount of flat-rolled steel on order also remained high. Service centers shipping days of supply on order at the end of December were up from November and December 2022.

The total amount of flat-rolled steel on order peaked in October, as service centers bought large volumes ahead of mill price increases. Flat-rolled steel as a percentage of inventory on order in December was down vs. November. The elevated level of material on order reflects longer lead times, orders spanning multiple months, and imports, but they are still significantly higher than they were in December 2022.

Recently, mill lead times have started to edge back in. In the latest SMU survey published on Jan. 4, mill lead times for hot-rolled coil (HRC) were at 6.26 weeks, compared to 6.76 weeks a month earlier.

The elevated inventories and high level of material on order have allowed service centers to sit on the sidelines to start the year. This has put pressure on prices, which flattened in early January.

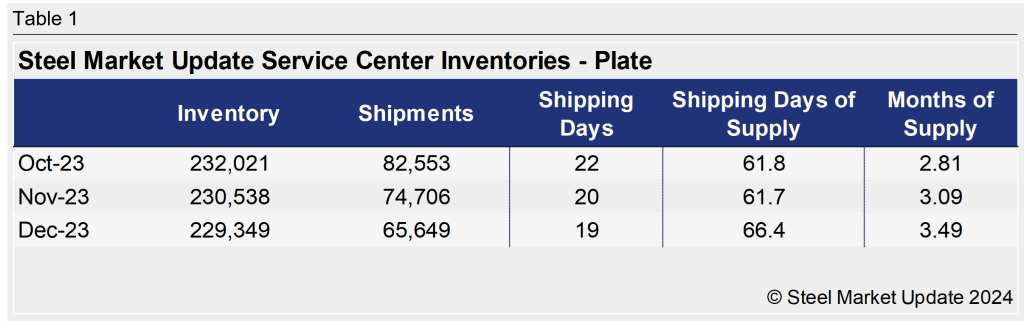

Plate

US service center plate inventories edged down slightly by the end of December, but with the lower daily shipping rate, the volume represented more supply. At the end of December, service centers carried 66.4 shipping days of plate supply, according to adjusted SMU data. This was up from 61.7 shipping days of supply in November.

In terms of months on hand, service centers carried 3.49 shipping months of plate supply in December, up from 3.09 in November. Material on hand was higher than in December 2022, when service centers carried 57.3 shipping days of supply or the equivalent of 2.87 months of supply.

Market contacts said in December and early January they were still reducing inventory to align with slower demand, and the plate market appears to be more balanced than sheet.

Service centers boosted their material on order at the end of December, pushing shipping days of supply up vs. shipping days of supply in November. Plate as a percentage of inventory on order at the end of December was up vs. November. Some of this reflects imports as well as some domestic material purchased at lower levels.

Mill lead times have been relatively steady around 6 weeks. The latest SMU survey pegged plate mill lead times at 5.8 weeks, down from 6.14 weeks in early December.